Report Overview

Featuring 78 tables and 52 figures – now available in Excel and Powerpoint! Learn More

This study covers the United States consumer market for water treatment systems primarily designed to decrease the amount of contaminants and minerals in households’ water. Systems purchased by consumers for personal use outside of the home (e.g., during leisure activities, pleasure, work, or school) are also considered, as are consumables, such as replacement filters, membranes, and salt.

Refrigerator water filters and pitchers are excluded because these systems are originally sold to equipment manufacturers and only the replacement units are sold to consumers.

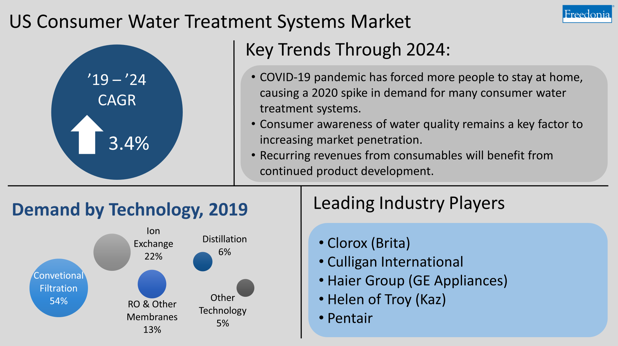

Historical data for 2009, 2014, and 2019 and forecasts to 2024 and 2029 are provided for consumer water treatment systems demand both in units and in current dollars (which are not adjusted to account for inflation).

Key breakouts for consumer water treatment systems include technology, system, and region.

Technologies include:

- conventional filtration (adsorptive or mechanical filtration media or the combination of the two)

- ion exchange

- reverse osmosis and other membranes (e.g., ultrafiltration, microfiltration)

- distillation

- other technologies

- magnetic and deionizing

- ultraviolet disinfection

- ozone treatment

- atmospheric disinfection

The technology under which a particular product is classified is determined by the highest level of treatment in that system. For instance, if a product includes both conventional filtration and reverse osmosis, it is labeled as a reverse osmosis system because that technology removes the most contaminants.

Types of systems include:

- whole-house

- point-of-entry (POE) water purification

- water conditioners (e.g., conventional, or salt-based; exchange tank systems, magnetic, template assisted crystallization)

- point-of-use (POU)

- under-the-sink

- countertop

- faucet-mounted

- flow-through

- other POU systems (e.g., atmospheric, showerhead, water bottles, filter straws)

The main designation for systems is the point at which treatment occurs, entry or use. Point-of-entry treatment is defined as treatment at the location where water enters the household for the first time, prior to being dispersed to the home’s faucets. Point-of-use treatment is defined as treatment at the point where water will be consumed or used for other purposes.

Consumables are also included in this study:

- replacement water filters

- water softener salt

- replacement membranes (e.g., spiral-wound, hollow-fiber, plate and frame, large tube)

Demand for consumer water treatment systems is also segmented by the following US geographic regions: Northeast, Midwest, South, and West.

Impact on the Consumer Water Treatment Industry

The COVID-19 pandemic forced many consumers to spend more time at home and change their water consumption patterns, causing the amount of water drawn through consumer taps rather than those at business and commercial establishments to increase.

According to The Freedonia Group National Online Consumer Survey conducted November-December 2020, 52% of those who were employed full- or part-time reported working at home or otherwise away from their typical workplace because of the pandemic. Because of the pandemic, people were also staying home for other reasons:

- 75% reported doing less leisure travel

- 75% said they were much less likely to eat at a restaurant

- 82% said they were much less likely to go to public or social gatherings

Reductions in dining out, travel, and entertainment spending – combined with government stimulus programs – freed up cash for consumers and allowed them to divert those funds to home projects or products to improve their homes, like consumer water treatment systems. In fact, 39% of respondents to The Freedonia Group National Online Consumer Survey conducted November – December 2020 reported that they were currently undertaking home improvement projects because of the pandemic.

The market for consumer water treatment systems saw strong gains in 2020, growing 8.2% from 2019 to just under $1.6 billion. POU systems drove gains as they cost less on average – making them readily available to most consumers – and are easier to install and/or use, particularly flow-through and faucet-mounted systems.

Whole-house systems also saw strong growth, rising 5.5% in 2020. The housing market – including new housing completions and existing home sales – performed better than expected, which spurred adoption of these products. Whole-house systems are often installed during or immediately after home construction or a home sale.

Among technologies, the majority of gains in 2020 were from conventional filtration, which is used in all product types. Gains for conventional filtration particularly benefited from strong sales for entry-level systems such as flow-through and faucet-mounted products in 2020. Reverse osmosis and other membrane-based consumer water treatment systems grew the fastest of any technology from 2019 to 2020, expanding over 12%.

Demand for POU systems will remain elevated in 2021, while whole-house systems are forecast to grow through 2021, spurred by faster gains in housing completions and existing home sales. The latter has benefited from historically low interest rates in 2020, a trend that is expected to continue through at least the beginning of 2021.

A major competitor to consumer water treatment systems, bottled water, did not see a large increase in demand in 2020. Many consumers were looking for a longer-term solution to providing higher quality water so that they did not need to shop so frequently during the pandemic. In The Freedonia Group National Online Consumer Survey (conducted November-December 2020):

- 65% of respondents reported that they were currently shopping in brick-and-mortar stores less because of the coronavirus pandemic

- 75% reported that they were keeping shopping and browsing time in stores to a minimum.