Report Overview

Featuring 50 tables and 14 figures – available in Excel and Powerpoint! Learn More

This study analyzes US demand for lawn and garden growing media by end user (consumer, professional), market, application (lawn care, gardens and borders, other), and product type.

Market segments include:

- residential

- golf courses

- government and institutional

- commercial and industry

- other, including nurseries, sod farms, and sports venues

Product types include:

- packaged soil

- potting soil

- garden soil

- topsoil

- planting mix

- soil amendments

- compost

- sphagnum peat moss

- perlite

- humus

- manure

- vermiculite

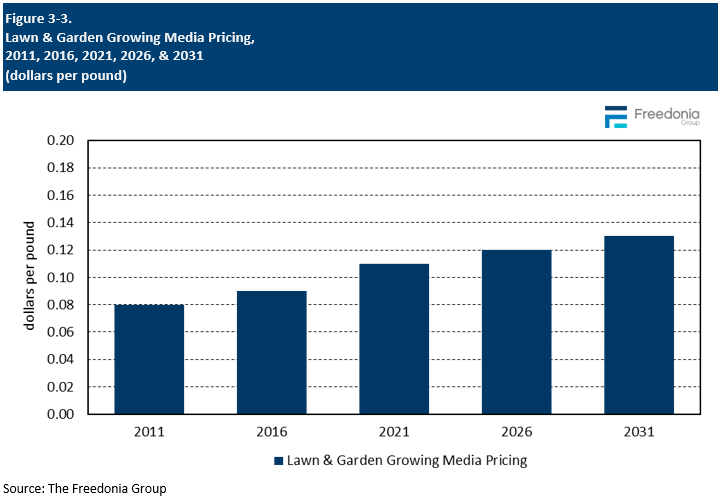

Historical data (2011, 2016, and 2021) and forecasts for 2026 and 2031 are presented for lawn and garden growing media demand in current US dollars (including inflation). Annual data is also provided from 2018 to 2025.

The market for lawn and garden growing media – including packaged potting soil, garden soil, topsoil, compost, peat, perlite, and a variety of niche soil mixes and soil amendments – is expected to grow 1.4% per year through 2026 to $1.5 billion from a high 2021 base. In volume terms, demand will moderate significantly, but remain above pre-pandemic levels. Consumers and business owners became more interested in maintaining and improving outdoor spaces, causing demand to spike in 2020 and remain at record levels in 2021. The challenge going forward is to retain those gardeners and produce products that are effective and easy to apply so that that more consumers will consider using growing media, especially higher value versions, in their lawns and gardens.

Inflationary Trends Impact Lawn & Garden Growing Media Spending

Near-term growth rates for many segments will be challenged by an inflationary environment that has fostered price sensitivity. Consumers are looking for value, not just a low cost. In some cases, gains in value terms in 2022 stemmed from price increases more than sales volume gains. However, interest in value-added versions temporarily slipped as customers found the high prices challenging to their budgets. Price increases were also upheld due to shortages from products such as peat moss, which has been challenged by reduced supplies coming from Canada as wet weather in 2022 limited harvest and extraction for the 2023 season, while regulations make expansions slow and challenging.

Return to DIFM Services Impacts Growing Media Sales

Many US consumers have embraced a DIY ethic for lawn and garden projects. The widespread availability of gardening information – both practical advice from experts and inspirational content from social media influencers on TikTok, Instagram, and other outlets – helps to maintain this trend.

However, use of DIFM landscaping services has grown again as consumers return to pre-pandemic habits. This is particularly important with growing media, which is typically applied seasonally as consumers seek to condition their lawns and establish their garden beds or containers. Increasingly, consumers are relegating these seasonal cleanup tasks to professionals who are more efficient and have the skill and knowledge to select the right growing media and apply them properly. Still, that trend has been somewhat counterbalanced by rising inflation, which has led many consumers to economize and cancel some services. Furthermore, the shortage of professional landscape workers has made such services either too expensive or too unreliable for some homeowners.

Product Innovations Continue to Support Value Gains

Market value gains will be bolstered by an ongoing shift in the product mix toward innovative, value-added products. Key value-added growing media types include pre-blended soil mixes that offer improved performance characteristics, such as moisture retention, added fertilizers or pesticides, and the inclusion of soil amendments, and products that feature improved sustainability.

Historical Market Trends

Overall, year-to-year fluctuations in demand for lawn and garden growing media are influenced by a variety of factors, including:

- personal incomes and levels of discretionary spending

- residential and commercial construction, which generally involves the installation of new lawns and landscaping

- trends in average lot size and maintained areas

- changes in the way living spaces are used and the frequency they are used

- the number of people participating in gardening as a hobby

- weather patterns and climate change

- variability in active ingredient and raw material pricing and availability

- changes in where gardens are planted, urban v. rural and in-ground v. raised beds and containers

- a shift in product mix favoring either economy or value-added formulations

Weather and climate change continue to play a role in the variability of demand for these products. Abnormal storms or longer terms events like droughts can influence the need or replacement for certain types of products or can discourage gardeners from additional investments in their lawn and garden spaces. Additionally, as climates change over time, regions will see more variations in the lawn and garden growing media they require, especially in order to accommodate changes in rainfall amounts and patterns.

In 2020 and 2021, demand for lawn and garden growing media surged because of increased investment in outdoor projects, particularly in the residential market. As consumers stayed at home more, a greater importance was placed on the areas in and around their homes. Funds typically allocated for entertainment outside the home were used to renovate their outdoor areas.

Consumer Market Trends

Demand for lawn and garden growing media for consumer users is expected to decline slightly from a high pandemic-related 2021 base to $847 million in 2026. However, sales will be well above pre-pandemic levels and the 2026 total will represent an increase from the expected low of 2023. Sales will be supported by efforts to retain many of these newer gardeners who picked up the hobby during the pandemic.

Value gains will stem from two main factors: shortages from products such as peat, as well as shifts in the product mix to include higher value products. Key value-added growing media types include pre-blended soil mixes that offer improved performance characteristics, such as moisture retention, added fertilizers or pesticides, and the inclusion of soil amendments.

Soil blends for specific applications – such as those for indoor houseplants or vegetable gardens – will offer some opportunities, as the number of inexperienced gardeners participating in DIY gardening and landscaping increases. These products will also be valued by more experienced home gardeners, who may be willing to pay for more expensive products that increase their efficiency and success.

The trend toward raised bed, container gardening or other above-ground formats as well as potted plants, indoors and out, will also sustain growing media sales. In many cases, these types of gardening, which are suitable for urban areas, at rental properties, and by older gardeners looking spend less time or effort bending over or getting up off the ground, require greater use of packaged soil and soil amendments to make them suitable for raising plants.

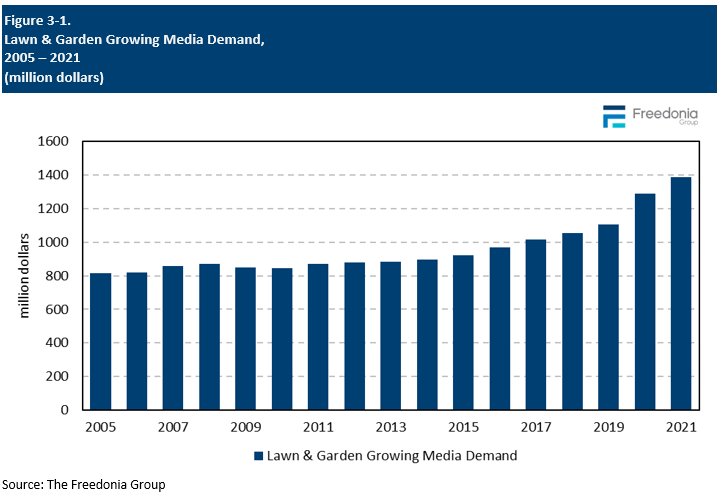

Demand by Application (Lawn Care, Gardens, & Other)

The primary applications for packaged growing media are for gardens and borders, but lawn and turf – as well as potted plants – are also significant outlets. In non-lawn and turf related applications, smaller volumes of soil may be needed. As such, the cost savings of bulk products often do not offset the added convenience of packaged products. However, larger-volume applications (such as the installation of entirely new garden beds or landscaping features) will continue to be dominated by bulk soil sales.

Gains in demand for packaged growing media will be supported by the continued popularity of value-added soil blends marketed for specific purposes (e.g., Miracle-Gro garden soil for vegetables and herbs, or Espoma’s cactus potting soil).

Soil amendments are typically used before the installation of a new lawn and in garden beds and pots before planting. In soils that are less than ideal for growing the desired types of plants, soil amendments can be a less expensive solution than buying topsoil, garden soil, or potting soil.

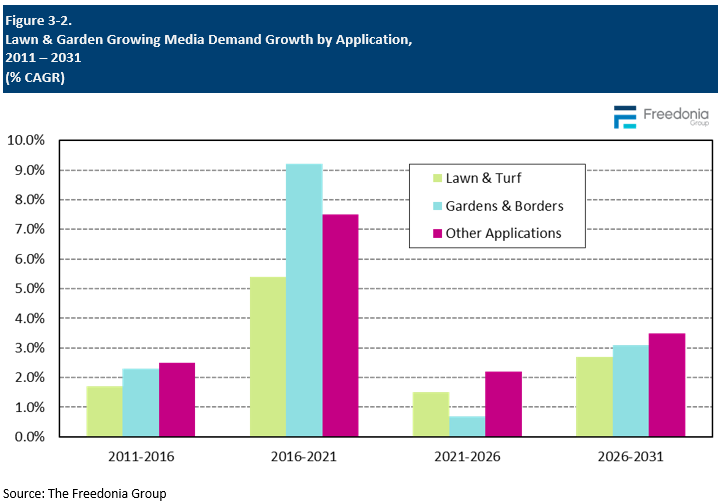

Pricing Trends

Average prices for growing media are forecast to grow 1.8% per year to reach 12 cents per pound in 2026. Lawn and garden growing media prices are generally much lower than prices for more technologically advanced lawn and garden consumables, such as pesticides and seeds with special traits. Traditionally, growing media is considered a commodity – low cost products for which brand differentiation can be challenging.

Still, there are factors influencing pricing fluctuations for growing media, including:

- raw material and commodity costs

- new product introductions

- trends in the product mix

Raw material price fluctuations are key factors impacting lawn and garden growing media pricing. This is particularly so when considering the price of peat, an ingredient in many soil mixes as well as a soil amendments on its own. Not only is it increasingly seen as environmentally problematic, especially where not harvested in a sustainable way, but most peat in the US is shipped from Canada and therefore subject to higher shipping costs and international currency fluctuations. This is not an issue for alternative such as competitive organic soil amendments such as compost and pine bark which are generally sourced locally.

Otherwise, average prices for growing media will be supported as an increasing number of higher value products enter the market. As these products become more widely used, this new product mix will boost average prices.