Report Overview

In need of comprehensive data for uses of molded fiber in packaging?

-

Molded fiber is one of the highest growth materials in packaging due to the increasing importance of sustainability.

Learn more here…

This study examines the US market for molded fiber packaging,  which is defined as rigid packaging formed from fibrous materials using wet or dry processes. Nonpackaging products – such as nursery pots and bedpans – are also covered. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2032. Annual data is provided for 2018-2026. Also provided is an analysis of key industry players.

which is defined as rigid packaging formed from fibrous materials using wet or dry processes. Nonpackaging products – such as nursery pots and bedpans – are also covered. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2032. Annual data is provided for 2018-2026. Also provided is an analysis of key industry players.

Featuring 143 tables and 45 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

The US market for molded fiber packaging continues to see strong growth attributable to an increased focus on sustainability initiatives, technological improvements, new product introductions, and longer-running market trends all combining to increase market size and breadth. Demand for molded fiber packaging is forecast to rise 7.8% annually to $3.0 billion in 2027, with real growth of 8.2% yearly to 2.46 billion units. Gains will be supported by multiple factors:

- Molded fiber will continue to benefit from its image of sustainability, being recyclable, compostable, biodegradable, and increasingly made from agricultural waste.

- Performance and aesthetic improvements will boost demand, particularly for packaging of higher end products such as cosmetics and electronics.

- Developments in coatings and additives will increases the number of applications for molded fiber, including high-temperature and oily products.

- Advances in manufacturing and tooling processes will continue to lower the cost of molded fiber production, especially for those sourced from alternative fibers.

- New products are being introduced to the market, such as molded fiber beverage bottles.

Molded Fiber Continues to Take Share from Conventional Plastic- & Paper-Based Packaging

Owing to its favorable sustainability profile and increasing cost competitiveness, molded fiber packaging is expected to keep taking share from conventional plastic and foam iterations. In addition to being recyclable, molded fiber is compostable and biodegradable. It is also increasingly made of nonwood fiber sources that enhance its sustainability profile.

Nonwood Fibers Expected to See Especially Strong Growth Due to Increasing Availability

Though molded wood pulp products are expected to see strong growth going forward, products sourced from alternative fibers – including sugarcane, wheat straw, bamboo, and various grasses – are expected to see the largest gains due their superior renewability and image of sustainability, as they are not sourced from trees – as well as improved aesthetics and increasing cost competitiveness. Wheat straw, for example, is often chosen for its darker shade compared to other materials. Recent manufacturing advances allow these fibers to be molded into wider varieties of shapes and forms, increasing the number of applications in which they can be used.

Foodservice Molded Fiber Products to Continue to Post Largest Gains

Foodservice is by far the largest market for molded fiber packaging and serviceware. Over the past decade, sustainability has become increasingly important for both high-profile foodservice outlets and smaller restaurants wishing to appeal to younger clientele. Gains will benefit from continued growth of existing molded fiber products – including dinnerware, clamshells, and two-piece containers – and the penetration of new ones like cups, lids, and cutlery. Gains will also be supported by improvements in coatings and additives used with molded fiber packaging, thereby allowing use with a wider variety of foods and beverages. Local bans on EPS packaging and restaurants’ continued focus on delivery and carryout services, which are more packaging intensive, will both support growth.

Historical Market Trends

At the highest level, demand for molded fiber packaging is driven by trends in its primary markets – foodservice and food, and increasingly retail and nonfood – which is an indicator of the number of potential packaging applications. In turn, growth in these markets is dependent on multiple macroeconomic and demographic factors; they include:

- Trends in food consumption and the mix of food eaten at home versus away from home

- The health of the overall economy and levels of disposable income, which impact the ability of consumers to spend on restaurants, as well as sustainably packaged products, which tend to be higher cost

- Changes in the population mix, especially in terms of age cohorts (such as young adults) who are likely to eat out more often and be more environmentally conscious

Beyond these basic macroeconomic indicators, other factors that can impact molded fiber packaging demand include:

- The share of total restaurant orders that are provided via drive-thru, curbside pickup, carryout, or delivery services, as these are more likely to be packaged in two-piece containers and clamshells, two of the largest molded fiber products

- Social factors such as health concerns, as restaurants focused on healthy foods are more likely to use sustainable packaging

- Sustainability initiatives, which impact the overall level of packaging used as well as the types of products and materials used

- Regulations, especially restrictions on specific materials or types of disposables

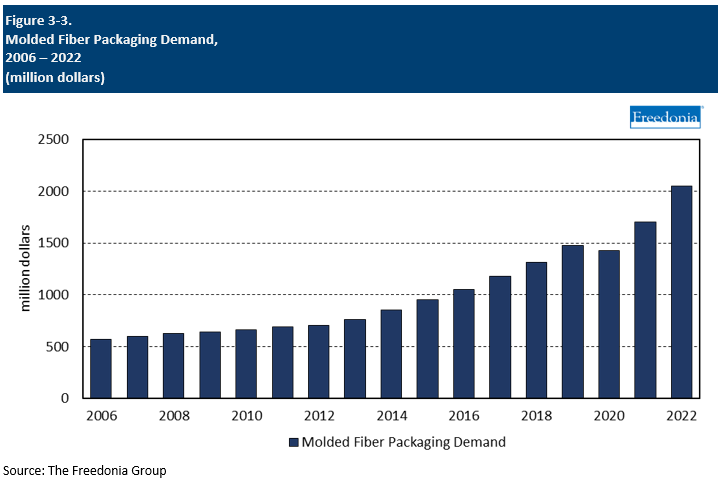

From roughly 2012 to 2020, molded fiber products experienced strong real growth in the range of around 9-11% per year, reflecting a general shift toward the increasing importance of sustainability – particularly among younger people – and improvements in the performance and aesthetic of molded fiber packaging.

Following the pandemic, the foodservice industry recovered with an increased focus on takeout and delivery options. Additionally, businesses were able reinitiate sustainability efforts as supply chain issues began to subside.

These factors strongly increased real demand of molded fiber products in 2021 and 2022. Furthermore, high inflation in 2021 and 2022 further propped up increases in value demand.

Molded Fiber Supply & Demand

Demand Overview

Manufacturers of food products and consumer and industrial packaged goods are increasingly implementing strategies to improve their environmental footprints, as commitments to eco-friendliness are important to many of their customers. In addition to packaging reduction strategies, a key means of improving sustainability has been the use of more environmentally friendly materials, such as molded fiber.

In addition to trends favoring molded fiber packaging’s excellent environmental profile, key factors supporting strong demand increases include:

- The development of molded fiber products that are more competitive with plastic alternatives in terms of cost, performance, and aesthetics

- Backlash against single-use plastic products manufactured from expanded polystyrene (EPS) foam, as well as bans on certain EPS foodservice products in a growing number of cities

- Increasing domestic manufacturing capacity for molded fiber, which will help make prices more competitive

- Healthy growth in several key applications for molded fiber, including foodservice and food packaging

- Research and development of new applications for molded fiber, specifically in nonfood packaging markets

- Improvements in coatings and additives for molded fiber, increasing the breadth of applications with which it can be used

Nonetheless, a few variables are expected to constrain growth to some degree, including:

- Ongoing elevated prices for some molded fiber packaging products, compared to competitive materials such as conventional plastic and corrugated paper

- Concerns about the presence of per- and polyfluoroalkyl substances (PFAS) – used in molded fiber packaging for water and grease resistance – as these chemicals can potentially pose health concerns and do not biodegrade

- Generally modest increases in the domestic production of eggs, fruit, and vegetables – chief markets for traditional molded wood pulp packaging

Trade Balance

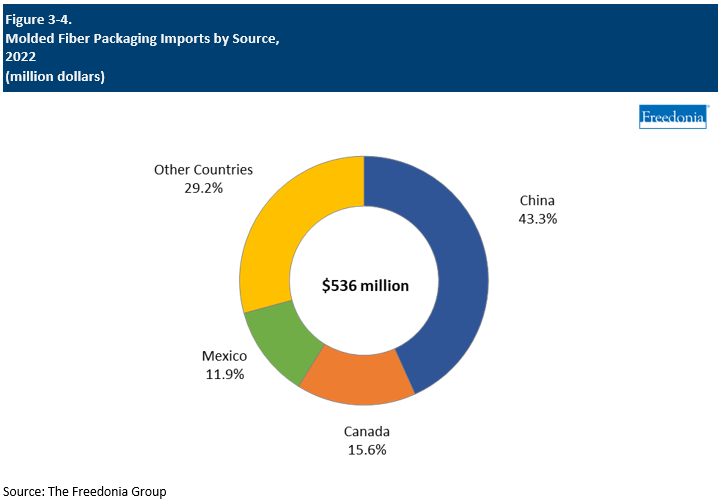

International trade is an important part of the molded fiber packaging industry, particularly in the foodservice segment.

Manufacturers in Asia are a major source of molded fiber foodservice products that are sold to customers in the US. Unlike suppliers in Asia, domestic molded fiber producers are typically focused on manufacturing food and protective packaging.

Asia – particularly China – is a key source for molded fiber products made from bagasse, the pulpy residue leftover from processing sugarcane crops.

- Supplies of bagasse are high in countries with large sugar production industries – including China, Brazil, Thailand, and Vietnam.

- Production of food packaging items made from bagasse has expanded quickly in these countries, largely due to growing global demand for environmentally friendly foodservice disposables.

Numerous foodservice packaging suppliers operating in the US purchase molded fiber products from Asian manufacturers, then resell them via private label to domestic customers. Sales of these imported products are included in demand totals as well as in company market share estimates for the purposes of this study.

The majority of US production is for domestic use, with a small amount exported, primarily to Canada and Mexico. Historically, much of these exports were for protective packaging and commodity food packaging products such as egg cartons and trays. However, as the US increasingly adopts newer dry pulp technology and domestic production expands to include a wider breadth of products, exports are forecast to increase significantly.