Report Overview

Featuring 73 tables and 72 figures – now available in Excel and Powerpoint! Learn More

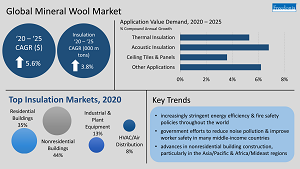

Global demand for mineral wool insulation is forecast to increase 3.8% per year to 10.0 million metric tons valued at $11.0 billion in 2025. Demand for mineral wool used in other applications – including ceiling tiles and such small volume applications as water filtration – is forecast to increase 4.9% per year to $2.4 billion. Going forward, growth in the global mineral wool market will be driven by:

- advances in nonresidential building construction, particularly in the Asia/Pacific and Africa/Mideast regions, and a global rebound in new residential building construction

- increasingly stringent energy efficiency and fire safety policies throughout the world, which often call for greater use of heat-resistant insulation

- the growing use of mineral wool for acoustic insulation to reduce noise pollution and improve worker safety as well as to meet consumer demand for quieter household appliances

- increasing access to air conditioning in developing countries, leading to rising levels of HVAC production and associated mineral wool insulation demand

- growth in high-end industrial equipment production in the US, Germany, Italy, Japan, and South Korea

China & India Drive Global Mineral Wool Insulation Gains

China and India will account for 40% of mineral wool insulation gains globally through 2025, driven by robust expansions of their nonresidential building stocks. In addition, India will see rapid growth in residential building construction from a low base, as the pandemic suppressed construction in 2020. Demand in both countries will also be bolstered by an increasing desire for acoustic insulation to reduce noise transmission in buildings.

The rest of the Asia/Pacific region will account for an additional 15% of global gains, supported by:

- continued production of industrial equipment and high-end motor vehicles, heavy machinery, and appliances in Japan and South Korea

- strong growth in HVAC equipment production, as the Asia/Pacific region will remain the leading regional manufacturer of these products

Ceiling Tiles, Water Filtration, & Hydroponics Are Key Non-Insulation Uses for Mineral Wool

While insulation accounts for the vast majority of mineral wool use, ceiling tiles, water filtration, and hydroponics offer opportunities for mineral wool suppliers:

- Ceiling tiles are often used for soundproofing and fireproofing in nonresidential buildings such as offices and hospitals. Already popular in North America, they are increasingly being used as an alternative to drywall ceilings in China.

- Water filtration is an important application for mineral wool, as demand for potable water is increasing in areas with limited access to sanitation systems and water infrastructure.

- Mineral wool can be used as a medium for hydroponic plants, which allow for crop production in areas with less arable land and limited water sources.

Regional Mineral Wool Insulation Trends

Demand by Region

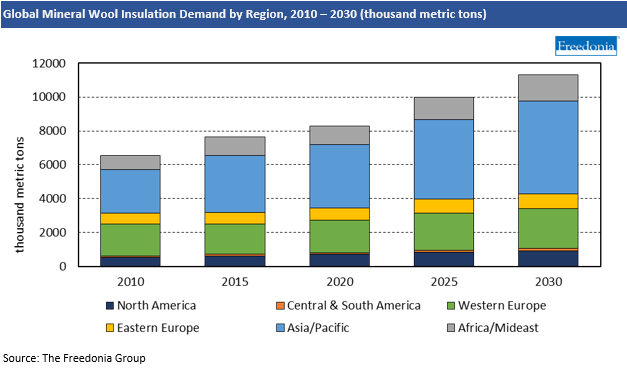

While mineral wool was the most used type of insulation material in volume terms in 2020, it was also the smallest in value terms due to the material’s low price compared to foamed plastic and fiberglass, the other two major insulation materials. While used primarily in building applications due to its flame resistance, high-temperature resistance also supports mineral wool use in industrial applications.

Western Europe is the most intensive consumer of mineral wool, primarily due to the emphasis on fire resistance in many building codes in the region.

Through 2025, demand for mineral wool insulation is projected to rise 3.8% annually to 10.0 million metric tons, totaling $11.0 billion. Market growth will be bolstered by:

- increasingly stringent fire safety policies throughout the world, benefiting suppliers of mineral wool due to its superior fire resistance properties

- its cost effectiveness relative to foamed plastic and fiberglass

- its growing popularity in North America

- advances in manufacturing activity, which supports demand for mineral wool in the industrial sector

- rising interest in developed countries in adding acoustical insulation to interior walls in areas of the home such as bedrooms and home theaters

- increasing construction of high-rise apartments, as flame retardance is an especially high priority in these structures

Healthy absolute volume gains are expected in Western and Eastern Europe, supported by accelerations in building construction activity.

Strong growth in both value and volume terms is projected in the Asia/Pacific and Africa/Mideast regions, as these areas continue to experience solid expansion in nonresidential building construction and industrial equipment production.

Western Europe is the world’s largest producer of mineral wool insulation by a considerable margin, as the region is home to world’s leading producers of these products – ROCKWOOL International, Knauf, Saint-Gobain, and Owens Corning’s Paroc Group division. These companies supply local markets, but also export significant amounts of product to Eastern Europe, Asia, and the United States.