Report Overview

Get the latest trends in fertilizers.

-

Price gains in the near term will help maintain market size.

-

Increased interest in organic fertilizers will boost value demand.

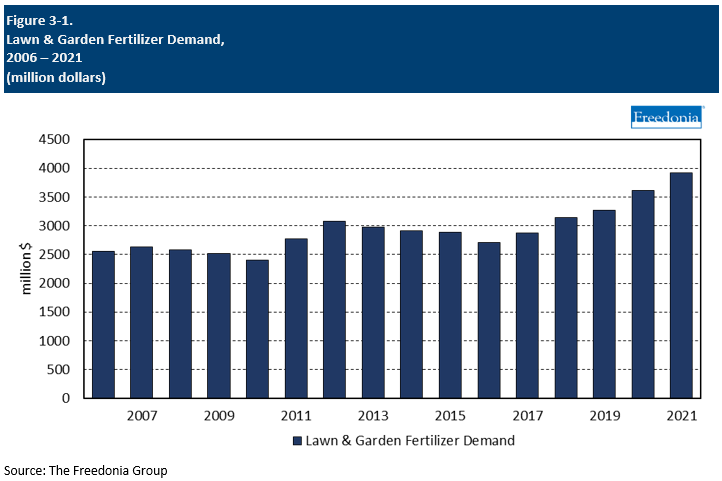

This Freedonia industry study analyzes the $3.9 billion US packaged lawn and garden fertilizer industry. It presents historical demand data (2011, 2016, and 2021) and forecasts (2026 and 2031) by media (dry, liquid), application (lawn and turf, gardens and borders, and other applications), market (residential, golf courses, government and institutional, and commercial and industrial), and end user (consumer, service firms, and other professional users). The study includes year-by-year annual data and consumer survey data. The study also evaluates company market share and competitive analysis on industry competitors including Central Garden & Pet, Nutrien, Scotts Miracle-Gro, and Simplot.

Featuring 44 tables and 10 figures – available in Excel and Powerpoint! Learn More

Demand for lawn and garden fertilizer products is projected to advance less than 1.0% annually to nearly $4.1 billion in 2026. A significant moderation in consumer demand following pandemic-related gains in 2020 and 2021 will restrain growth. Professional end users will drive gains as more consumers return to using professional services for their lawn and garden maintenance.

Nonresidential Markets Will Dominate Advances

The residential market will continue to account for a large majority – about 75% – of fertilizer demand. However, nonresidential markets will be responsible for most of the market gains posted through 2026. While the significant golf course market will grow at a slow rate as the number of courses in the US continues to decline, the government and institutional market will grow at a healthy rate due to an expansion in government spending, including additional investment from the Infrastructure Investment and Jobs Act. Also, the commercial and industrial market will be boosted by the increasing installation of green roofs to improve the eco-friendliness of these structures.

Liquid Formulations Find Increased Favor; New Packaging Supports Dry Formulations

Dry and granular fertilizer formulations will remain the leading format for packaged fertilizer products, but greater advances are anticipated for liquid iterations. This is especially true for ready-to-use products and those that are packaged in easy-use formats – for example, containers with attached sprayers – that eliminate or minimize contact with hazardous or unpleasant chemicals.

Dry fertilizer formats will also benefit from product and packaging format innovations, such as extended time-release fertilizers that make single applications effective for longer periods; improved handling characteristics; and specialized spreaders that are designed to work with packages and eliminate the need to handle dry fertilizers.

Historical Market Trends

Overall, year-to-year fluctuations in demand for lawn and garden consumables such as fertilizers are influenced by a variety of factors, including:

- residential and commercial construction, which generally involves the installation of new lawns and landscaping

- trends in average lot size and maintained areas

- personal incomes and levels of discretionary spending

- the number of people participating in gardening as a hobby

- variability in active ingredient and raw material pricing and availability

- weather patterns and climate change

- a shift in product mix favoring either economy or value-added formulations

- changes in the way living spaces are used and the frequency with which they are used

Weather and climate change continue to play a role in the variability of demand for lawn and garden products. Abnormal storms or longer terms events like droughts can influence the need for certain types of fertilizer products. Additionally, as climates change over time, regions will see more variations in the lawn and garden consumables they require.

In 2020 and 2021, lawn and garden fertilizer demand surged because of increased investment in outdoor projects, particularly in the residential market. As consumers stayed at home more, a greater importance was placed on the areas in and around their homes. Funds typically allocated for entertainment outside the home were used to renovate, upgrade, or maintain their outdoor areas.

Demand by Application (Lawn Care, Gardens, & Other)

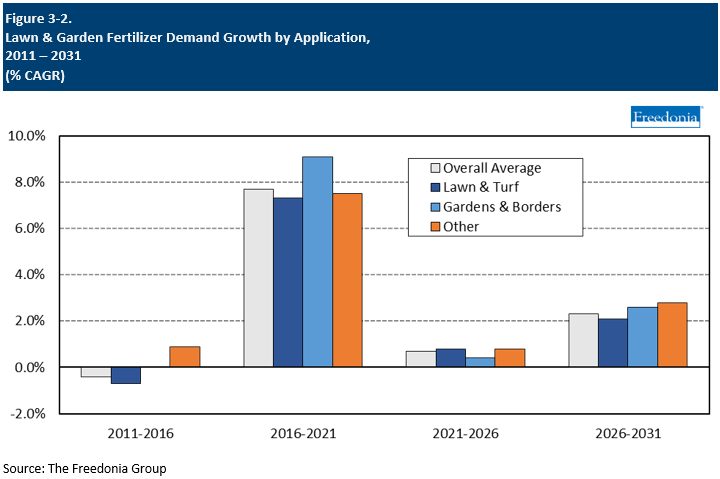

Lawn and turf care continues to dominate lawn and garden fertilizer applications – representing 71% of the market in 2021 – since most residences and many commercial and institutional establishments have lawn spaces that requires care. Each application for fertilizers showed strong gains in the historical period, with gardens and borders showing the fastest growth, supported by the rise in residential gardening trends during the COVID-19 pandemic.

Looking forward through 2026, each application for fertilizers is expected to grow at a relatively similar rate, with demand sustained by:

-

the continued demand for an aesthetically pleasing full and lush yard among homeowners

-

growing availability of specialty products targeted at specific plants such as roses, tomatoes, and fruit trees

-

elevated interest in gardening, particularly food gardening and houseplant care, among millennials

- the aging population, as a greater portion of consumers will be in retirement and able to engage in recreational gardening

Demand by Media (Solid or Liquid)

Fertilizer is available in two basic formats:

- solid or dry (including granules, powders, spikes, and other solids)

- liquids

Going forward, solid fertilizer formulations will continue to dominate, but faster growth will be seen in liquid products; this is particularly true of those that are in ready-to-use formulations and/or come in packaging that improves ease-of-use, such as Ortho liquid fertilizers intended for the Ortho Dial N Spray hose-end sprayer. Liquid fertilizer demand will be particularly promoted by its ease of use in flower or vegetable gardening.

Solid fertilizers account for most of the lawn and garden market, mainly due to their widespread use in the consumer lawn care segment. Solid fertilizer will benefit from product improvements such as:

- extended time release

- ease of use

- improved handling characteristics, such as better flowability

- the emergence of specialized spreaders designed to work with packages that eliminate having to handle fertilizer products directly; examples include Scotts Miracle-Gro’s Snap system

However, solid fertilizers will face significant competition from fertilizer granules included in premixed soil blends; such products are included in the Growing Media category.

Pricing Trends

There is wide variation in the prices for lawn and garden fertilizers. Fertilizer nutrients and other raw materials are relatively inexpensive materials due to market maturity, significant economies of scale, and strong industry competition.

Factors impacting lawn and garden fertilizer pricing overall include:

- patent protection, although this is a much more significant issue for pesticides

- new product introductions

- raw material and commodity costs

- energy costs

All lawn and garden products experienced price volatility in 2021 and 2022; high demand created shortages, and supply chain challenges limited the ability to fulfill downstream orders. Products like fertilizers – which was also influenced by rising tensions in the Ukraine-Russia conflict – saw particularly strong spikes in price. While some of these issues may take time to ease, they will have a diminished impact on price growth going forward.