Report Overview

Featuring 131 tables and 72 figures – available in Excel and Powerpoint! Learn More

This US report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

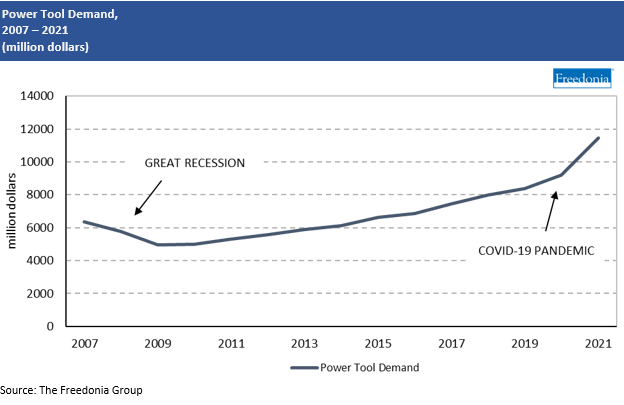

US demand for power tools is expected to decline less than 1.0% per year from a high 2021 base to $11.2 billion in 2026. Sales of power tools to both consumers and professionals surged in 2020 and 2021 as home construction and remodeling projects – both DIY and large professional installations – spiked unexpectedly during the pandemic, causing prices to rise and further boost market value. Though the market will begin to steady in 2022, elevated levels of demand will be sustained by the following factors:

- Product development will encourage new users to adopt power tools and some current consumer and professional users to upgrade their existing tools.

- Users will continue to shift from plug-in electric to higher cost cordless electric power tools.

- Professional market drivers, such as building construction and manufacturing activity, will remain strong overall, despite economic uncertainty.

Cordless Electric Power Tools Increase Market Share as Performance & Innovations Improve

While cordless electric tools are relatively established, they continue to increase their share of the market, boosted by improvements to these tools that allow them to be more user friendly, more functional, and better able to complete a broad range of tasks. Cordless electric power tools increasingly have more powerful and longer lasting batteries that can be used interchangeably with a wide range of products both within the power tools market and outside of it, such as with outdoor power equipment. These power tools also increasingly offer brushless motors and smart features – the latter is particularly helpful for professional settings to monitor tool usage and performance.

Market share gains for cordless electric power tools are also supported by the increasing number of professionals who are upgrading and transitioning away from competitive technologies and new consumers adopting these products as they become homeowners or seek to upgrade and add to their own range of DIY tools.

The Professional Market Remains Key Driver of Power Tools Sales Long-Term

Historically, the professional market has been a stalwart for the industry, occupying the largest share of demand in value terms and outperforming the consumer market. While gains during the pandemic temporarily shifted the industry in favor of consumer markets, professional markets are expected to show better prospects through the forecast. Gains in construction and manufacturing will help businesses adopt and upgrade new power tools to help them perform their tasks more efficiently.

Historical Sales Trends

Power tools are used in construction, industrial, and manufacturing settings to:

- build and repair structures and infrastructure

- produce and maintain automobiles and other vehicles

- manufacture durable goods such as cabinets, furniture, and machinery

Tools are also used for simple household, hobby, and do-it-yourself (DIY) tasks. The outlook in professional key end use sectors contributes directly to the health of the power tools market on a year to year basis. However, their use in repair applications and general tasks insulates the market somewhat from more significant volatility.

At the broadest level, demand for power tools is a reflection of growth in the overall economy. A combination of both consumer and industrial factors supports gains in the power tool industry:

- consumer: spending and trends in consumer behavior towards household projects and hobbies

- construction: new building construction activity and improvement and renovation activity

- automobile: fluctuations in automobile replacement and repair rates and expansion of the motor vehicle base

- industrial: manufacturing shipments and trends in professional tools

However, these trends are not mutually exclusive to these segments of the power tool industry, as home renovation projects can be done by both consumers (DIY) and professionals (DIFM). Another factor is sales of existing homes, which are often dependent on current mortgage rates; such sales can spur consumers to purchase new tools, particularly if they are first time homebuyers. It can also lead to significant investment in the home via professional construction for renovations.

Lastly, product innovation can drive sales of replacements and larger sets of tools. Higher requirements for quality, productivity, and ergonomics, as well as changes in manufacturing methods, can drive spending on power tools.

Historically, market gains have been somewhat limited by competition from rental tools – available at major retail outlets such as Lowe’s and Home Depot – sales or inheritance of used tools, and hand tools. In addition, most consumers do not use power tools on a regular basis, limiting replacement demand for these products.

Market Trends: Professional vs. Consumer Tools

Demand for power tools in the US is forecast to decline less than 1.0% annually from an elevated 2021 base to $11.2 billion in 2026. The market is expected to steady through 2026 following strong gains in 2020 and 2021 during the COVID-19 pandemic. The size of the market will be maintained by price growth, particularly in the near term as inflation has pushed up prices of power tools products.