Report Overview

Featuring 41 tables and 22 figures – now available in Excel and Powerpoint! Learn More

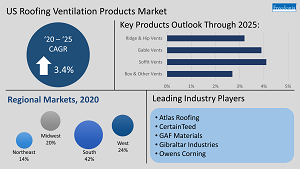

US demand for roofing ventilation products is projected to advance at a 3.4% annual pace to $955 million in 2025. Although housing starts are expected to retreat from their 2021 peak, they will remain elevated during the forecast period. In addition, the large stock of older buildings in the US will provide steady demand for ridge vents, which are being installed during reroofing projects to replace existing box vents and provide better attic ventilation in single-family homes.

Demand will also be supported by rising interest in using roof vents to better control moisture levels and indoor air quality:

- Changes in building codes have reduced the ways in which water vapor can escape through wall cavities, leading builders to increasingly use roof vents to prevent moisture buildups.

- Concerns about maintaining proper air flow inside of structures to minimize the risk of disease transmission will encourage contractors to add roof vents.

Soffit & Gable Vents Will Post the Fastest Market Advances

Demand for soffit and gable vents is expected to expand more quickly than that for ridge vents or box vents. New construction, particularly of single-family homes, accounts for most soffit and gable vent installations, and demand for these products will be boosted by elevated levels of homebuilding in 2025.

Growth in Demand for Intake Vents Will Outpace That for Exhaust Vents

Although exhaust vents will continue to account for a much larger share of the sales in value terms, intake vents will post faster market gains. New construction is responsible for 75% of all intake vent demand, so suppliers will benefit more than exhaust vent providers from a shift in overall roofing ventilation product demand toward new construction.

Efforts to Modernize the Building Stock Are Providing Opportunities for Roof Vents

The market for roof vents is being boosted by ongoing efforts by designers and contractors to bring homes and commercial buildings up to modern standards by adding more vents when they are being remodeled or having their roofs replaced. Proper ventilation has a number of benefits and improves energy efficiency in all US climates. In hot and humid climates, ventilation becomes even more important due to its ability to remove both heat and moisture, which in many cases is even more important to avoid mold growth.

While these factors are important in buildings across the US, they are particularly important in the South, largely because of high levels of construction in the region.

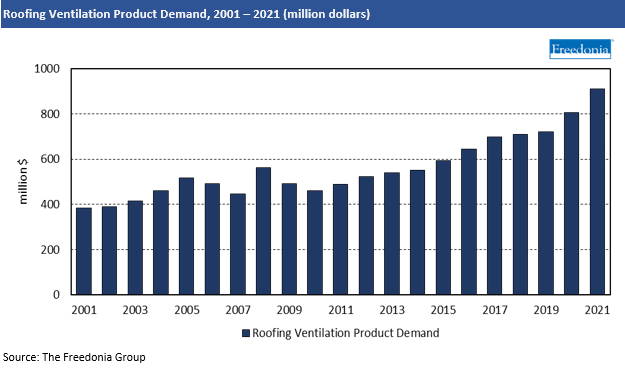

Historical Market Trends

Demand for roofing ventilation products is linked to roofing activity, as most roofing vents are needed only when new roofs are installed or existing roofs are repaired or replaced:

- The large reroofing segment is the key driver of roofing ventilation product demand in the US, as the nation has a large number of homes and businesses with roofs at or near the end of their expected lifespans.

- New roofing demand is tied to housing starts and new commercial and industrial building construction.

A number of other factors have shaped the roofing ventilation product market over the past decade, key among them being:

- storm activity, particularly hurricanes, tornadoes, and hailstorms

- access to credit, as a stringent lending environment can inhibit the ability of homeowners to afford expensive renovation projects such as reroofing

- the buildings being constructed – the types of primary roofing and roofing ventilation products used varies considerably depending on the structure

- changes in the tax code that make home and building owners more likely to undertake roof repair and replacement projects in a given year

Markets Overview

The residential market comprises the much larger share of US roofing ventilation product demand in any given year, particularly reroofing. Indeed, in value terms residential reroofing accounts for more than 80% of all roofing ventilation demand. Residential reroofing dominates demand in this product category due to such factors as:

- Ridge vents are generally integrated into a steep-slope roofing system; thus, as roofing materials are removed, so too are ridge vents, and they must be replaced when new roofing materials are laid down.

- Contractors are increasingly cognizant of the role proper ventilation plays in keeping a home’s moisture levels down and will install more vents to make sure residences have adequate air flows.

Reroofing will continue to account for the larger share of residential roofing ventilation product demand through 2025. However, new housing will see the more rapid growth going forward, supported by builders and contractors installing more roof vents per residence to ensure that a home is better protected against moisture buildup and is more energy efficient.

In the commercial market, new construction will see the faster growth due to the:

- rise in commercial building construction in the aftermath of the COVID-19 pandemic

- efforts of commercial construction professionals to improve structures’ interior moisture control and air quality by installing more vents per structure