Report Overview

Featuring 109 tables and 82 figures – now available in Excel and Powerpoint! Learn More

Demand for shelf-stable food packaging is forecast to increase 2.4% annually to $9.6 billion in 2026. The food market is challenging for packaging suppliers due to the vast number of applications where packaging must not only meet specific performance criteria but also be cost effective and in line with changing sustainability goals and consumer preferences. This especially applies to shelf-stable packaging because it tends to be more costly, the type of processing and packaging used depends on the application, and consumers’ views regarding the nutrition of shelf-stable food remain in flux. Trends in the shelf-stable food packaging market include:

Demand for shelf-stable food packaging is forecast to increase 2.4% annually to $9.6 billion in 2026. The food market is challenging for packaging suppliers due to the vast number of applications where packaging must not only meet specific performance criteria but also be cost effective and in line with changing sustainability goals and consumer preferences. This especially applies to shelf-stable packaging because it tends to be more costly, the type of processing and packaging used depends on the application, and consumers’ views regarding the nutrition of shelf-stable food remain in flux. Trends in the shelf-stable food packaging market include:

- Flexible packaging continues to gradually take market share from rigid types based on cost and sustainability advantages.

- Paperboard will remain the fastest growing material for shelf-stable packaging due to growing use of aseptic and retort carton packaging.

- Despite innovations in the field of shelf-stable food and packaging, frozen and especially fresh foods continue to see faster growth as consumers increasingly prefer minimally processed, preservative-free foods due to both taste and nutrition concerns.

Aseptic Processing Continues to Take Share from Retort Cans & Hot Fill

Aseptic processing affords multiple benefits over more traditional thermal processing methods such as retort cans and hot fill containers. The most important advantage of aseptic processing is shorter heating times, which minimize the impact of thermal processing on flavor, texture, and nutrition. Aseptic processing is not only important for organic foods and items such as baby formula and protein shakes, it can boost the perception of preserved foods overall. Pouches will see the fastest growth among aseptic packaging formats due to their lower weight and material usage, as well as the popularity of aseptically processed condiments.

Paperboard Cartons Remain the Fastest Growing Shelf-Stable Packaging Format

Aseptic and retort cartons have superior barrier properties and offer a lightweight, resealable way to package shelf-stable food. Soups, juices, and milk are established markets used with cartons; however, cartons are increasingly used with a variety of shelf-stable liquid applications – such as processed vegetables and sauces. This is due to their premium and sustainable image, bolstered by their large billboard space, simple shape, and consumers’ perceived image of paperboard as more environmentally friendly than plastic.

Sustainability Concerns Continue to Drive Innovation

Sustainability is an issue for all food packaging, but especially for shelf-stable packaging products such as pouches and cartons, which are often made of composite materials and can be difficult to recycle. These issues are driving the development of improved barrier materials that are more easily recycled. Food waste also remains a primary concern among consumers and producers, leading to the increasing usage of high evacuation rate shelf-stable formats such as pouches and bag-in-box, as well as resealable options – such as bottles and cartons – as opposed to traditional cans.

Historical Trends

Shifts in demand for food packaging from year to year are determined by a number of factors, primarily related to the production and marketing of food products. These activities in turn are influenced by:

- demographic trends such as age, average household size, and levels of disposable income

- consumer spending on food and the balance between at-home and away-from-home meals

- food preferences (e.g., demand for enhanced convenience or for organic products)

- restaurant and other foodservice industry trends

In addition, a number of competitive variables determine the mix of packaging types used and their cost, including:

- raw material and conversion costs

- changes in the mix of foods being packaged, particularly in terms of food format (canned, dried, frozen, fresh)

- trends in packaging size and format, such as shifts toward smaller single-serving packages, family-size units, or multipacks

- the proportion of food that is sold via retail channels versus foodservice establishments

- environmental and regulatory factors, including trends such as source reduction, the use of recycled content, and recyclability

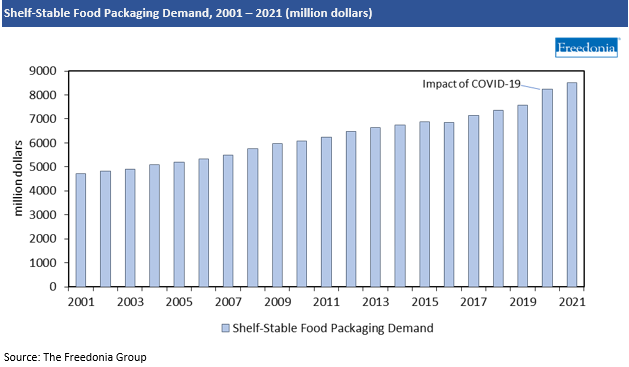

Demand growth for shelf-stable packaging in 2020 increased due to a shift in the product mix toward more packaging-intensive retail foods as consumers cooked and ate more at home. However, even more robust gains were restrained by declining sales of foodservice packaging due to the extensive disruption in the foodservice industry caused by the COVID-19 pandemic. This was followed by a return to historical growth rates in 2021 as consumers reverted to their normal shopping habits and restaurant revenues rebounded.

Shelf-Stable Food Packaging Technologies Overview

Shelf-stable foods compete with fresh, dried, and frozen foods, and packaging has played an important role in consumer perceptions of the different types of foods available. Fresh foods, including produce, meat, seafood, dairy, and fresh prepared foods, account for the largest share of food packaging demand on an annual basis and also are seeing some of the best growth opportunities.

For the purposes of this report, shelf-stable foods include wet or liquid foods that undergo a thermal process through which the food product and its container are sterilized, rendering the contents shelf-stable for a long period of time (generally six months to five years but sometimes longer). There are three main types of shelf-stable technologies:

- retort processing

- hot fill processing

- aseptic processing