Report Overview

Wine packaging formats continue to diversify beyond glass bottles and corks.

This Freedonia industry study analyzes the $2.9 billion wine and wine beverage packaging industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027) by product (containers, multipack packaging, and accessories) and material (metal, glass, plastic, paper and paperboard, and niche materials including cork). Annual historical data and forecasts are also provided from 2019 to 2026. Data are given in unit and dollar value.

Featuring 49 tables and 22 figures – available in Excel and Powerpoint! Learn More

Read our Wine Packaging blog!

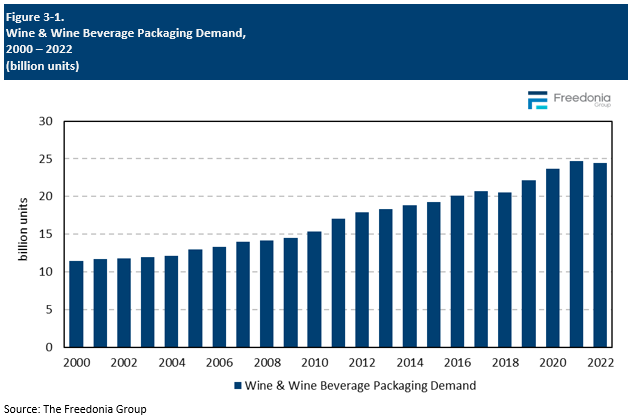

US demand for wine and wine beverage packaging is projected to increase 2.5% per year to $3.3 billion in 2027, with unit demand expected to grow 1.8% annually through the same period. Gains will be boosted by modest growth in wine production, particularly when imported bulk wine packaged domestically is accounted for.

Wine Packaging Expanding Beyond Glass Bottles & Corks

Glass bottles have been the dominant wine container for centuries, and are expected to remain so through the foreseeable future. However, other containers are expanding their footprints by offering specific attributes:

-

Bag-in-box formats, particularly three-liter versions, will benefit from growing acceptance of their use for more than just low-quality and flavored wines; that perception initially hindered their introduction to the market.

-

Aluminum cans – which were initially troubled by a similar association with inferior wines – are also being used for better wines, as well as for light sparkling wines and wine coolers.

-

Aseptic cartons will have an expanded market presence via an array of available sizes, ranging from single servings to 1 liter (larger than traditional 750 milliliter bottles).

A similar diversification of product mix has occurred in closures. At one time, cork dominated. However, metal screw caps and synthetic stoppers have captured larger shares of the closure segment. Closures used with other container types have come to account for more of the market; these range from the fairly simple plastic caps that are used with aseptic cartons, to more sophisticated fitments for dispensing wines from bag-in-box containers.

Sustainability Efforts Influence Wine Packaging Choices

Although glass wine bottles perform admirably, they are heavy (making them expensive to ship) and susceptible to breaking. Moreover, colored glass bottles are generally preferred for performance and aesthetic reasons, but they create complications in recycling. Many wine producers have considered using lighter weight bottles to reduce material consumption and lower shipping costs, but there is an internal conflict within the industry because producers and consumers alike often equate heavier bottles with better wines.

Sustainability considerations have also boosted prospects for other containers. Bag-in-box containers are valued for their ability to hold the equivalent of four glass bottles – or more – at a much lower packaging weight and unit price. Plastic bottles are lighter and can be shipped and recycled relatively easily, while metal cans can be made from aluminum (which is almost infinitely recyclable).

Historical Market Trends

The US wine and wine beverage packaging industry is heavily dependent upon general trends in the production and consumption of wine and associated beverages. Prospects for the wine industry are impacted by a range of variables, many of which are beyond the control of industry participants. These include:

-

macroeconomic shifts, as in levels of consumer spending and disposable income or overall economic growth and inflation

-

demographic factors like the size of the resident population, age distribution patterns, ethnic diversity, geographic distribution, and immigration

The wine industry is also influenced by less predictable factors – weather patterns, grape harvests, raw material prices, technological innovations, medical and health related research, governmental regulations, extensive foreign trade activity, and changes in consumer preferences and tastes – that are beyond producers’ control. What those companies can control are facets like advertising, marketing, and new product introductions, which all typically have a greater impact on the beverage product mix than total beverage demand; they can also impact the type and amount of packaging used.

Wine packaging demand is further influenced by overall trends in the packaging industry. Among the factors included here are environmental and regulatory issues such as sustainability initiatives, which can spur demand for packaging that is perceived to be environmentally friendly. Other key considerations that affect consumer preferences for beverage packaging include convenience, size, image, and technological developments. While these factors are certainly in play for producers and users of wine packaging, it should be noted that the wine industry is somewhat more dependent on tradition than many other parts of the beverage industry, and that wine producers are less able to offer an enormous array of package sizes, due to federal regulations about package sizes.

Materials Competition

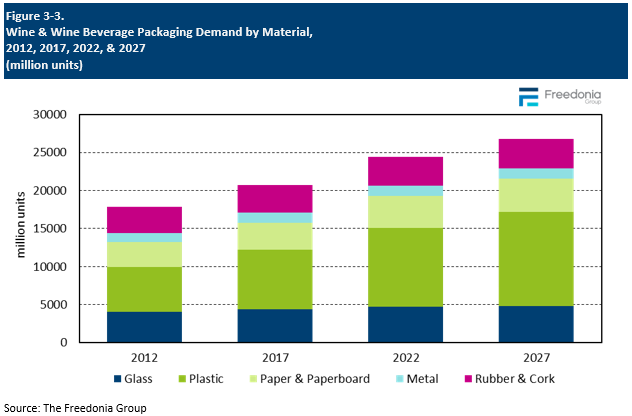

Demand for wine packaging is expected to rise 2.5% per year to $3.3 billion in 2027, with real growth of 1.8% annually to 26.7 billion units; this will be aided by continuing growth in packaged wine production and gains for alternative packaging formats, which will boost demand in value terms.

Glass remains the leading material for containers in the wine industry due to its upscale, premium image and performance attributes (e.g., superior protection of wine during extended periods of storage). However, real demand for glass bottles will grow only slightly as cost issues and consumer preferences spur a shift toward alternative packaging; a significant share of small (187 milliliter) glass bottles have been converted to plastic. Nonetheless, glass bottles will remain the primary packaging option for US wine producers. Value growth will also be somewhat bolstered by continued price increases of glass compared to other materials, many of which have normalized following a period of intense inflationary pressures.

Plastic is used to make wine bottles, pouches, and bladders for bag-in-box formats, as well as for closures, capsules, and labels.

Paperboard comprises a significant portion of wine packaging demand; it is expected to see gains due to the continued penetration of aseptic cartons and bag-in-box formats, which offer a variety of advantages:

-

Cartons are highly portable, feature great billboard space, offer a premium appearance, and impart a perception of sustainability.

-

Bag-in-box formats offer a great price-to-volume ratio, as well as increased sanitation and ease-of-dispensing.

Metal comprises the smallest segment of wine packaging demand and its outlook will be weak, though this masks diverging trends:

-

Metal cans will continue to post healthy gains as wine coolers and flavored wines position themselves against similarly packaged flavored alcoholic beverages, such as seltzers and other malt-based beverages that have gained popularity in recent years.

-

Tin capsules will decline as wine producers increasingly elect to replace them with paper or plastic variants, or stop using capsules altogether because of cost concerns and their extraneous nature. However, they will retain their market presence in upscale wines that tend to adhere to more traditional packaging formats.

The wine market is unique in that a significant portion of packaging demand is accounted for by otherwise niche materials, namely cork stoppers and other specialized closures. Cork comprises the majority of wine closure demand, but growth will be below average due to its high cost.

Foreign Trade

There is a substantial international trade in both wine and the raw materials used to manufacture containers (e.g., aluminum, plastic resins), but finished, empty beverage containers are minimally involved because of the inefficiency inherent in shipping them. Most packaging products are made domestically, often at facilities within a few hundred miles of their end users.

There are exceptions for wine packaging products, though. Glass wine bottles see appreciable imports, with Mexico, China, and Canada among the leading sources thereof in 2022. In early 2024, the US International Trade Commission announced an investigation into the possibility that domestic suppliers faced material injury from Chilean, Chinese, and Mexican bottles allegedly being sold in the US for less than their fair market value. The investigation and potential antidumping actions are expected later in the year.

Cork stoppers are another wine packaging product for which trade is especially significant. Portugal is both the world’s largest harvester of cork and the leading supplier of cork closures imported to the US. There are other sources of imported cork closures, but nearly all cork originates in Portugal and a handful of its neighboring countries.