Report Overview

Featuring 128 tables and 84 figures – now available in Excel and Powerpoint! Learn More

Global material handling equipment demand is forecast to grow 5.1% annually through 2026 to $194.5 billion, supported by:

- expanding global agricultural, energy, forestry, manufacturing, mining, and logistics and transportation sectors

- surging e-commerce and the related construction of new facilities

- increasing use of state-of-the-art material handling equipment technologies in mature markets because of growing concerns about workforce issues

- shifts toward more capable and reliable models, as well as reduced use of manual material handling techniques in developing nations

- the adoption of new product standards, industry regulations, and environmental rules that encourage investment in new machines

- a rebound in global tourism activity, which will encourage product sales at airports, ports, entertainment facilities, and retail locations

Labor Shortages & New Worker Protections Support Gains in the Large Manufacturing Market

Manufacturing, particularly of durable goods, has long dominated the market for material handling equipment. Durable goods are widely used and labor-intensive to manufacture without machinery, making them among the first applications in which significant machinery investment is worthwhile in developing areas.

Despite this large established base, manufacturing markets continue to offer strong opportunities for new sales. Industrial enterprises around the world will increasingly replace older material handling equipment with newly developed technologies because of intensifying competition, adoption of new government regulations, and growing concerns about a variety of workforce issues.

Workforce issues are of particular importance in driving sales of new material handling equipment. Labor shortages, rising labor costs, and skilled technician shortages will push manufacturers in many countries to invest in automated models. The adoption of new worker protections will similarly encourage the shift to newly developed models with greater capabilities and additional safety features.

Trade & Distribution Market to Record Fastest Growth

The diverse trade and distribution segment of the global material handling equipment market is forecast to grow at the fastest rate of any market, aided by surging e-commerce activity and a rebound in international trade. Among trends boosting demand are:

- purchase of material handling equipment for use in new warehouses, fulfillment centers, and customs facilities

- construction of new retail and wholesale establishments as tourism continues to recover around the world

- use of high-value, advanced material handling technologies – such as automated storage and retrieval systems and automated guided vehicles – in trade and distribution applications

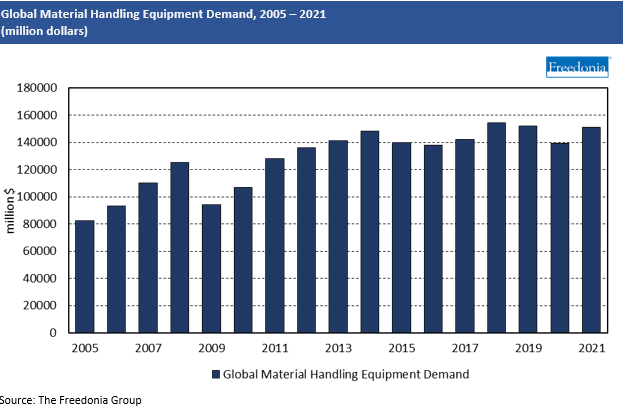

Historical Trends

Global material handling equipment market trends are directly impacted by a wide range of factors, including:

- The widespread use of such machines in a diverse range of industries, including agriculture, construction, e-commerce, energy, forestry, manufacturing, mining, tourism, infrastructure, and transportation and logistics.

- Replacement product sales primarily drive growth in most countries that have mature and diverse economies.

- While properly maintained material handling machines have long lifespans, they are sometimes replaced based on availability of more capable models (offering productivity and efficiency gains) rather than need.

- More than half of all global material handling equipment demand is concentrated in the US, China, Japan, and Germany – all of which are economic powerhouses.

Other factors can have positive or negative impacts on the global material handling equipment market’s growth, including:

- economic conditions, levels of international trade and foreign investment, fixed investment spending trends, and changes in the value of a country’s currency

- rising or declining agricultural, construction, forestry, manufacturing, mining, and tourism activity

- rising or declining energy production

- patterns in government infrastructure spending

- changes in the prices and availability of material handling equipment

- the introduction of new material handling technologies

- the adoption of new product and safety standards and environmental regulations, all of which encourage shifting to newly developed models

- increasing concerns about varieties of workforce issues, ranging from higher labor costs to worker retention to the availability of skilled operators

Countries with developing economies frequently see prolonged periods of growth when operators:

- continue to ramp up production

- benefit from inflows of foreign capital

- begin to use the equipment more intensively

- shift toward more capable, pricier models

Replacement sales are a smaller driver of gains in these markets because their stocks of equipment are quite small and relatively new. However, some of the inexpensive models used in these nations will end up having to be replaced earlier than high-end material handling machinery.

Regional Outlook

Demand by Region

Through 2026, global material handling equipment demand is forecast to advance 5.1% per year to $194.5 billion, a significant improvement over the 2016-2021 rate of growth. The expansion of the world material handling equipment market will be aided by:

- rising international trade and a rebound in global foreign investment activity

- the expansion of the global agricultural, energy, forestry, manufacturing, mining, and logistics and transportation sectors

- surging e-commerce and the related construction of new facilities

- increasing use of state-of-the-art material handling equipment technologies in mature markets, attributable to growing concerns about workforce issues

- shifts toward more capable and reliable models, as well as reduced use of manual material handling techniques in developing nations

- adoption of new product standards, industry regulations, and environmental rules that encourage investment in new machines

- a rebound in global tourism activity, which will encourage product sales for airport, port, entertainment facility, and retail applications

Collectively, these and related trends will fuel growth across all regional markets, albeit to varying extents. With the exception of Eastern Europe – which experienced rapid growth in recent years and will be negatively impacted by the conflict in Ukraine in the near term – the outlook for all other regional material handling equipment markets is expected to strengthen during the forecast period.

The Asia/Pacific, North America, and Western Europe regions are forecast to account for nearly 90% of market gains globally between 2021 and 2026. Led by China, the Asia/Pacific region is projected to account for 37% of new material handling equipment demand. Numerous other large regional markets are expected to see healthy growth.