Auto Leasing: Cultural Shift or Cyclical Market?

by Sarah Schmidt

February 8, 2017

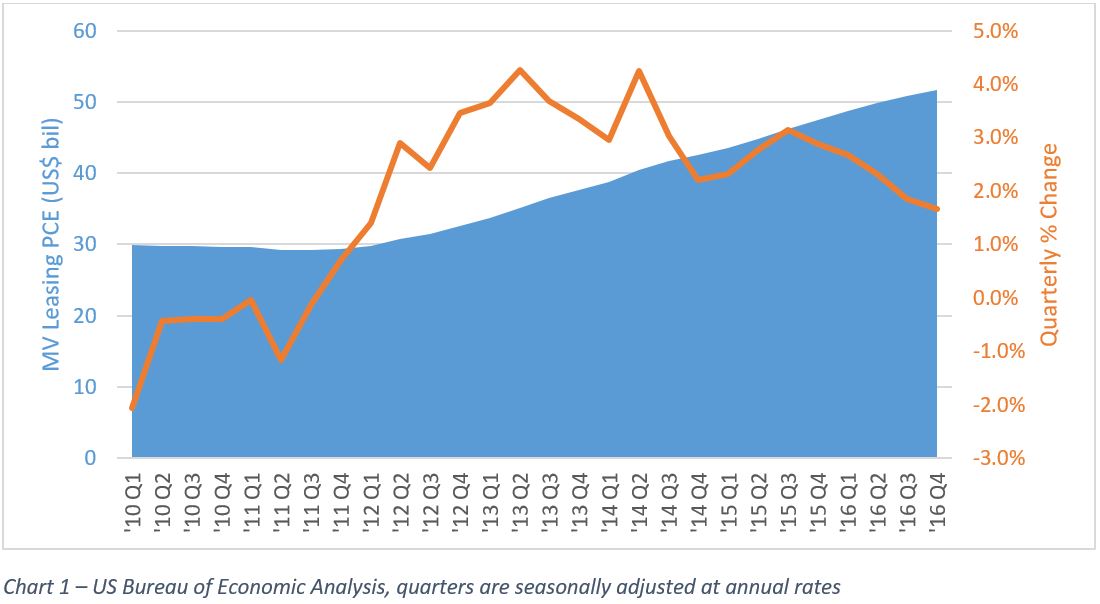

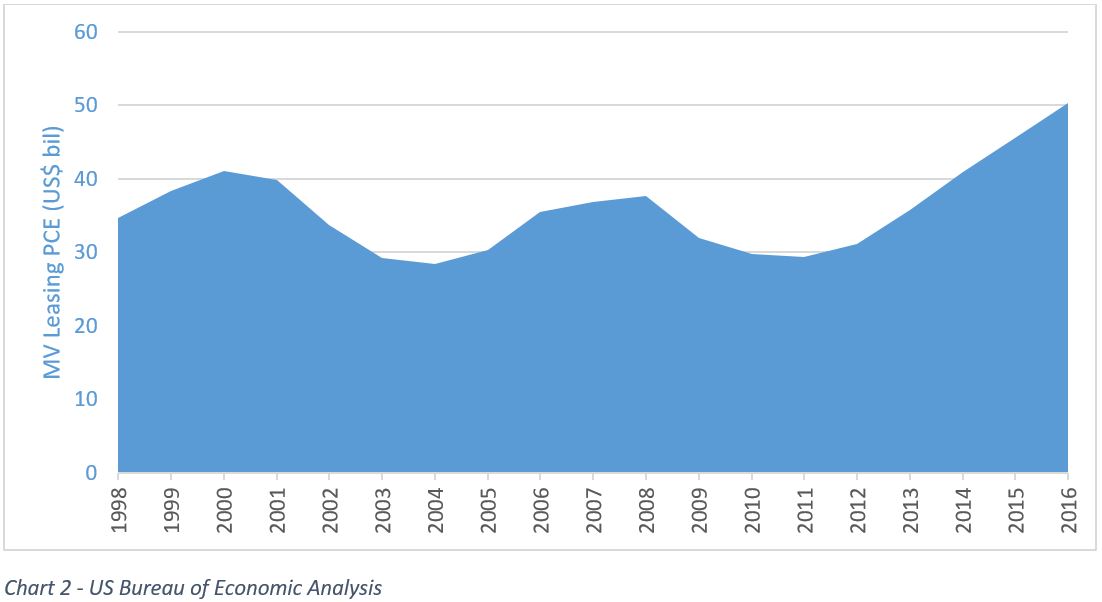

US consumer spending on motor vehicle leases surpassed historic peaks in 2015. While some theorize that cultural changes have driven this trend, macroeconomic factors have also played an important role. Is the current level of demand sustainable, or is it doomed to decline?

Cultural Shift

Many observers have speculated about why leasing has risen in popularity so much over the past five years. Some have posited that it may be signaling a shift in consumer preferences. Buyers may just be choosing to lease because they are getting used to, and even preferring, subscription model services where they pay a monthly or annual fee for a product over which they never gain ownership. In addition, the consumer doesn’t have to worry about expensive repairs, as the vehicle is normally under warranty – by the time the warranty has expired, so has the consumer’s lease.

Other reasons could include the ever advancing technological features in modern vehicles. Just as today’s cell phones go from cutting edge to antiques in just a few years, many of the features on today’s “infotainment” systems may become outdated just as soon. If consumers hold having up-to-date tech in their vehicle as a priority, then the relatively short-term commitment of leasing is appealing.

Macroeconomic Explanation

While some of these arguments may be accurate, there are also macroeconomic factors that should be considered in the analysis of this trend. With interest rates at historic lows over the past several years and off-lease vehicles enjoying high residual values, dealers have been able to offer monthly lease fees that are much lower than payments would be on a traditional loan for the same vehicle. This lure of lower payments has also caused an increasing number of consumers to take out extended auto loans, with terms up to 72 or 84 months in length.

Some History

New vehicle leasing is a market that can experience significant cyclical fluctuations. Over a decade and a half ago, consumer spending on leases was seeing a similar boom, achieving levels not again reached until 2015. This bubble was fueled by low lease payments, which resulted from a high level of subvention (ie, subsidization) by automakers. However, once vehicles began coming off lease, they flooded the market with a wave of well-maintained used cars. This caused the prices of used vehicles to plummet, prompting monthly payments for new leases to rise and drawing many consumers to buy instead of lease.

With leasing gaining momentum and surpassing historic peaks over the last few years, an abundance of newly off-lease vehicles is beginning to hit the market. Dealers and automakers assert that they have learned their lesson and have taken steps to prepare, so a decline as bad as the previous collapse is unlikely. In addition, a possible shift in consumer preferences may support demand for auto leases despite rising payments. However, the cyclical nature of the market will still probably result in spending on motor vehicle leases descending from its current pinnacle in the upcoming years.

Learn More

For more insights into the US Motor Vehicle Leasing market, see Motor Vehicle Leasing: United States, a report recently released by the Freedoina Focus Reports division of The Freedonia Group. The report includes revenues from US consumer expenditures segmented by automobile and truck markets in 2005-2015 historical series with forecasts to 2020.

For reports on the comprehensive US market for motor vehicles or its alternative, public transport, check out Motor Vehicles: United States and Public Transport: United States. Or, if it is the financial side of the market that intrigues you, try Commercial Banking: United States.

About the Author

Luke Hickman is a Market Research Analyst for Freedonia Focus Reports. He holds a degree in economics, and his experience as an analyst covers multiple industries.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Focus Blog Subscription

Provide the following details to subscribe.