Report Overview

Continuing interest in home improvement and rebounding motor vehicle production drives growth.

Continuing interest in home improvement and rebounding motor vehicle production drives growth.

This Freedonia industry study analyzes the $43 billion US flooring industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (resilient, nonresilient, carpets and rugs) and market (residential, nonresidential, transportation). Annual historical data and forecasts are also provided from 2019 to 2026. The study also evaluates company market share and competitive analysis on industry competitors including AHF Products, Shaw, Dixie Group, Engineered Floors, Mannington Mills, Interface, Mohawk Industries, and Tarkett.

Featuring 115 tables and 36 figures – available in Excel and Powerpoint! Learn More

Check out the Flooring blog!

Through 2027, US demand for flooring products is forecast to rise 2.5% per year to 30.6 billion square feet, valued at $54.3 billion. Going forward, market advances will be supported by:

-

continuing consumer interest in home improvement projects – such as kitchen and bathroom remodeling – that frequently entail the replacement of older or worn flooring

-

heightened end user interest in replacing flooring before the end of its useful life with materials that offer better aesthetic or performance properties, such as luxury vinyl tile (LVT)

-

rising commercial building construction, boosting demand for vinyl, ceramic, and carpet tile products

LVT to Become Most Popular Product in US, Ending Carpet’s Decades-Long Dominance

In 2024, LVT is projected to surpass carpeting as the most popular flooring product in the US. Over the last decade, growth in luxury vinyl tile has been explosive; it ranks among the fastest-growing flooring products ever introduced to the US. Volume demand for LVT rose 28% per year from 2012 to 2022, increasing in share from 4% to 31% of the total market. Demand has been, and will continue to be, supported by the product’s favorable performance properties relative to carpet – easy installation, superior aesthetics, and improved durability.

Residential Remodeling Continues to Drive US Flooring Market

The residential remodeling market accounted for 53% of total US flooring demand in 2022, making it the largest market segment of the industry. Although gains will not be as robust as they were during the 2017-2022 period – when home renovation projects surged in 2020 and 2021 as a result of the pandemic – they will be sizable. Demand will continue to be supported by the country’s large stock of older homes, many of which have large expanses of installed carpeting; the owners of many such residences will opt to replace their flooring, and frequently do so with hard surface products. Those that look like wood or natural stone will particularly benefit, as they fit modern design trends.

Rising Motor Vehicle Production Aids Demand for Carpets

Although carpet demand will decline due to a shift away from wall-to-wall tufted carpeting, greater losses will be offset by improving motor vehicle production, which had declined markedly during the pandemic. Motor vehicle production declined in 2020 due to a combination of supply chain issues – most notably a semiconductor shortage – and high interest rates, and has been slow to recover despite healthy consumer demand. With most supply chain issues having either resolved themselves or eased significantly, motor vehicle production is poised to grow at a rate more in line with pre-pandemic periods. As such, demand for needlepunch carpeting – which accounts for most transportation demand – will improve significantly.

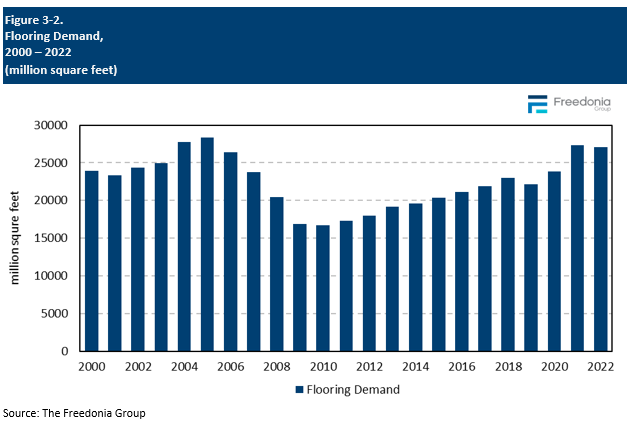

Historical Market Trends

Annual flooring demand is most heavily influenced by trends in the construction industry. Demand for flooring in volume terms is somewhat insulated from economic variations in new construction activity because of the significant replacement need in residential and commercial building applications:

-

A large base of installed flooring is subject to high levels of wear and will require replacement at some point as a matter of course.

-

Flooring may be damaged before the end of its lifespan by building fires or severe weather, requiring new flooring to be installed.

-

Flooring also serves a decorative purpose, so it may be replaced before the end of its product lifespan if a consumer desires to change the appearance of the structure in which they are installed.

The US market for flooring is somewhat more insulated from volatility in volume terms because of large replacement demand, both in residential and commercial building construction applications. However, outbreaks of severe weather – particularly those accompanied by heavy precipitation – can cause carpets and rugs to become wet or damage hardwood, laminate, and vinyl composition tile flooring. In most cases, these materials must be replaced and new flooring installed

Volatility in flooring market value can be more extreme than that seen in unit terms due to spikes in product pricing. For example, in 2021 and 2022, pandemic-related supply chain issues and high raw material costs led to flooring price increases than in turn caused value demand to be somewhat less tethered to area demand.

Demand by Flooring Type

Demand for flooring in the US is projected to advance 2.5% per year through 2027 to 30.6 billion square feet. Market value will rise 4.7% annually to $54.3 billion in 2027.

Resilient flooring, primarily LVT, continues to gain share at the expense of carpets and rugs and is expected to provide the vast majority demand growth in area terms. Nonresilient flooring will also see gains, although the cost effectiveness and performance of LVT has cut into nonreslient’s share of the market. Nevertheless, both types of hard surface flooring will benefit from:

-

continuing consumer preference for hard surface flooring instead of installed carpeting

-

increasing efforts by homebuilders to make their properties more desirable to potential purchasers by adding hard surface flooring in parts of a home where it was not traditionally specified, such as living and family rooms

-

homeowners looking to improve the appearance and value of their residences by installing hard surface flooring, especially products that resemble natural wood or stone

-

commercial building owners and manufacturers looking to reduce maintenance and replacement costs by removing carpeting and opting for hard surface flooring

Carpet and rug demand is expected to decline in area terms, restrained by a sharp contraction in the use of wall-to-wall tufted carpeting in residential remodeling applications – the largest market for these products – as consumers increasingly opt for hard surface flooring, particularly LVT.

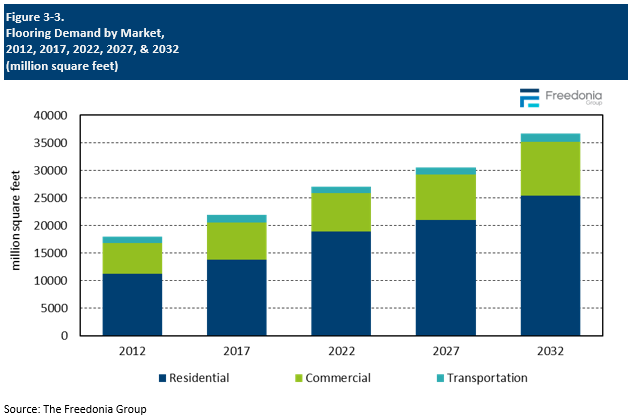

Demand by Market

Demand for flooring in the US is projected to advance 2.5% per year through 2027 to 30.6 billion square feet. Market value will rise 4.7% per year to $54.3 billion in 2027.

The residential market accounted for the largest share of US flooring demand in 2022 with a 70% share due to the:

-

large number of residences (especially single-family homes) erected in any given year

-

large stock of existing homes, many of which have installed carpeting that is well past its recommended product lifespan

-

much higher propensity of homeowners (compared to commercial building owners) to replace flooring for aesthetic as well as performance reasons

While growth will be restrained by weak housing construction outlook, demand for residential flooring will be supported by:

-

increases in average housing unit sizes for single-family and multifamily homes

-

continuing homeowner interest in home improvement projects (such as kitchen and bathroom remodeling) that often call for the replacement of existing flooring and the installation of new materials

Demand for flooring in the commercial market is forecast to rise at a faster rate than residential, supported by a rebound in new commercial building construction and an acceleration in commercial building remodeling.

Consumption of flooring in the transportation equipment is expected to rebound, in tandem with motor vehicle production.

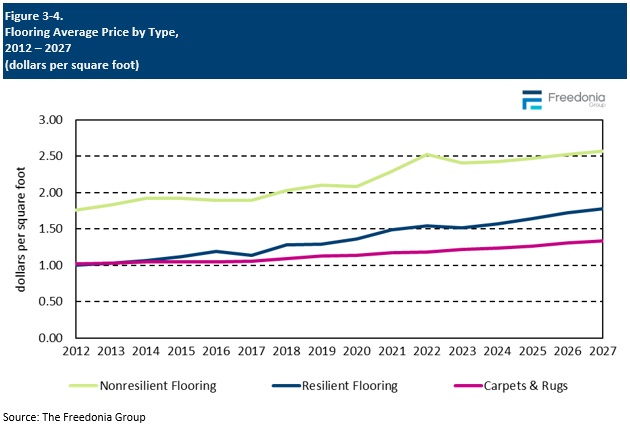

Inflation & Pricing Trends

Average prices for flooring are impacted by a variety of factors, including price variations in raw material and energy costs, as well as tariffs imposed on imports.

The average price for flooring products is projected to increase 2.2% per year to $1.78 per square foot in 2027. This will represent a deceleration from the 2017-2022 period, when prices spiked in 2021 2022. These spikes were a delayed result of the COVID-related temporary shutdowns of many manufacturing facilities. Once the global economy began to open back up in 2021, the effects of these shutdowns were felt by flooring producers, as supply was not able to keep pace with demand as construction activity increased at a solid pace:

-

Supply chain issues and raw material shortages caused a spike in prices for wood and plastic based flooring materials.

-

Ceramic producers saw an unusual increase in prices due to increasing natural gas prices, as the production of ceramic tile is highly natural gas intensive.

Going forward, price growth will be supported by:

-

the increasing use of higher value LVT products, such as stone-plastic composite and wood-plastic composite

-

the introduction of higher value carpeting as a means of luring consumers away from LVT and other hard surface flooring

- ongoing increases in the cost of materials used to make these products