Co-Branded Cards in a Consumer Payment Trends Context

by Elizabeth Rowe

August 2, 2021

In many ways, longer-term trends in the consumer payment industry remain in place notwithstanding the pandemic, albeit with COVID-19 curves and warp-speed accelerations.

The longest-term trend in payments is the change in payment instrument use from checks and cash to cards. Those cards may be debit or credit, and they may be tapped, swiped, or dipped at a payment terminal, or used for ecommerce via a laptop or mobile device.

About six in ten consumer payments are now made with debit, credit, or prepaid cards. Debit cards are used the most, followed by credit cards then by cash. More than half of consumers do not use paper checks at all, and 2019 was the first year that consumers used credit cards for more payments than cash.

Younger adult consumers have been especially disinterested in cash; a third of those under age 50 say they never use cash when paying in-store. Digital channels have given rise to their own forms of payments, with almost two-thirds of consumers having adopted at least one online payment method, such as PayPal, Venmo, or Zelle.

MRI-Simmons Spring 2021 data, as cited in Packaged Facts’ Co-Branded Credit Cards in the U.S. (July 2021), show that 74% of adults have credit cards in their name, and 30% of adults (or 40% of cardholders) have used a credit card in the last 30 days.

Moreover, 29% of adults (or 73.7 million) have co-branded credit cards in their name, somewhat below the 32% of adults with store-only credit cards. In keeping with the all-purpose nature of co-branded cards, however, a somewhat higher percentage of adults use co-branded cards monthly than use store-only cards monthly. Similarly, the number of customers who use their co-branded cards at once a month is higher for warehouse club or Amazon/Prime co-branded cards than for co-branded department store cards overall.

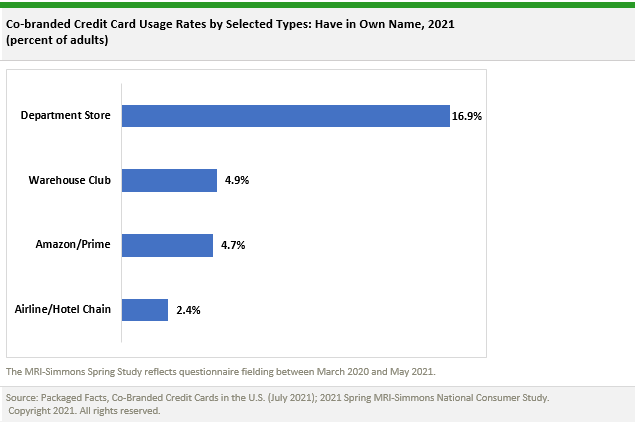

By type of co-branded credit card, MRI-Simmons data show 17% of adults with department store co-branded cards (for a total of 42.8 million cardholders), 5% with warehouse club co-branded cards, 5% with Amazon/Prime co-branded cards, and over 2% with airline/hotel branded cards. Frequency of use patterns, however, reset the hierarchy: the number of customers who use their co-branded cards at once a month is slightly higher for warehouse clubs or for Amazon/Prime than for department store cardholders overall.

Where to Learn More

Find additional analysis of the U.S. market for co-branded credit cards in the newly released Packaged Facts report Co-Branded Credit Cards in the U.S.

About the blogger: Elizabeth Rowe is a consumer payment cards and services analyst for Packaged Facts.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Packaged Facts Blog Subscription

Provide the following details to subscribe.