COVID-19 Pandemic Drives Use of More Packaging in the Fresh Produce Aisle

by Peter Kusnic

April 2, 2021

Elevated consumer grocery sales and sanitation concerns amid the pandemic are accelerating trends toward more packaging in the produce aisle.

Demand for prepackaged produce soared amid the pandemic – in part due to increased concerns about handling loose bulk items that have been handled by others, but moreover because consumers have been cooking more than ever before at home. Looking for ways to save time and effort in the kitchen, many consumers turned to convenience foods, including packaging-intensive ready to eat (RTE) fresh produce:

- Sales of plastic containers increased 5% in 2020, the biggest gain of the main produce packaging types – boosted by their intensive use with RTE salads, as well as pre-cut produce such as apple slices, melon spears, and carrot sticks, are typically sold in clamshells, cups, and other rigid plastic containers.

- The sharp increase in organic produce sales further bolstered demand, as higher value plastic containers are popularly used with these premium brands, whereas non-organic brands tend to employ bags or pillow pouches due to their lower cost.

Additionally, prepackaged fruits and vegetables further benefited from the sharp rise in online grocery sales and curbside pickup during the pandemic, as these items typically feature fixed weights and prices and are more amenable to online shopping than loose produce.

Even before the pandemic, use of fresh produce packaging was on the rise, as more grocery shoppers were beginning to realize the greater convenience of RTE foods like salad and pre-cut/pre-slice fruits and vegetables compared to their unpackaged bulk-bin counterparts.

These and other consumer trends helped mitigate steeper sales losses in the $5.5 billion US market for produce packaging in 2020, as demand for produce and related packaging plummeted in the foodservice sector as a result of economic shutdowns early on in the pandemic and subsequent dine-in capacity restrictions after restaurants reopened.

What can produce packaging suppliers expect as the pandemic recedes? Below, we highlight key trends from a new Freedonia Group analysis of this increasingly dynamic market.

Fresh Produce Packaging Sales to Increase 3.7% Annually Through 2024

Looking long term, demand for fresh produce will be driven by rising demand for produce sold in some form of packaging, including pouches, bags, and rigid plastic containers. Additionally, more intensive use of higher value packaging types that offer convenience and ease-of-use features, superior performance and shelf life, and/or improved environmental footprints, will boost value gains.

Nonetheless, stronger increases will be limited by relatively slow growth in overall domestic produce output, with declines projected for a number of key fruit and vegetable types, including tomatoes and citrus.

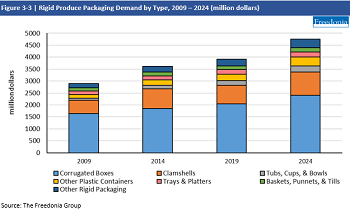

Rigid Plastic Containers to Outperform All Other Major Packaging Types

As in 2020, sales of plastic containers are expected to outpace those for all other major produce packaging categories through 2024, as clamshells and other plastic containers continue to supplant commodity bags and pillow pouches due to their good protective and display properties, especially with RTE foods such as salads and pre-cut/pre-sliced fruits and vegetables.

Within the corrugated boxes market, retail-ready types are forecast to see strong gains, supported by further penetration in retail stores, as well as by anticipated growth in warehouse clubs and discount stores (e.g., Costco, ALDI) that predominantly display products in retail-ready packaging.

Other packaging products projected to post above-average growth include stand-up pouches – for their convenience and display advantages – and reusable plastic containers (RPCs) for their reusability and efficiency.

Salad & Berries Remain Largest Fresh Produce Packaging Applications

Salad and berries will remain the largest markets for fresh produce packaging in value terms, together accounting for over 20% of total demand. Salad’s market position is supported by its strong sales in consumer and foodservice markets, as well as by its intensive use of higher value packaging types – such as two-piece plastic containers and modified atmosphere packaging (MAP). Berry packaging sales are similarly aided by strong consumer demand, as well as by their relatively intensive use of higher cost rigid packaging containers due to their greater need for protection compared to other produce types.

Sustainability Remains a Primary Goal for Produce Packaging Suppliers

Many companies are requiring use of sustainable packaging going forward for various reasons – whether due to environmental regulations, consumer demand for more environmentally practices, or recognition of the financial benefits, including increased shipping efficiency and sometimes reduced materials costs.

Sustainable packaging is increasingly important across consumer industries, but especially in the produce industry, in part because consumers who purchase such products tend to be environmentally conscious. Additionally, many are accustomed to buying produce in the bulk format common of traditional grocery stores, and the introduction of new or additional produce packaging can be off-putting, especially when it is used with organic produce.

Such negative conceptions can be assuaged through use of packaging that is biodegradable, recyclable, or made of bio-based or recycled materials. Many companies are using environmentally friendly packaging that gives the impression that the purchase is healthful and natural. For example:

- Sambrailo’s ReadyCycle containers are 100% recyclable clamshell alternatives made from paperboard and lacking additional labels, adhesives, and coatings.

- Visy has developed fiber-based punnets under the Enviropunnet brand name as an alternative to plastic punnets.

Want to Learn More?

Fresh Produce Packaging is now available from the Freedonia Group.

About the Author:

Peter Kusnic is a Content Writer with The Freedonia Group, where he researches and writes studies focused on an array of industries.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Group Blog Subscription

Provide the following details to subscribe.