Demand for Wastepaper in US, China Has Recyclers Thinking Inside the Box

by Sarah Schmidt

February 8, 2017

The volume of paper packaging recovered from the US municipal solid waste (MSW) stream is forecast to grow 0.5% annually through 2021. Corrugated boxes constitute 93% of recovered paper packaging due to their widespread use in shipping goods and a well-established infrastructure for recycling them. Most corrugated boxes constitute secondary packaging and don’t reach consumer homes. They are used to deliver goods grouped in bulk to distribution and retail locations. Hence recycling efforts are centralized at relatively well-known retail locations rather than widely dispersed consumer residences.

Upticks in Manufacturing, E-Commerce Driving Demand for Corrugated Boxes

US paper and paperboard production is expected to grow due to a number of trends. US demand for durable and nondurable goods will increase along with disposable personal income, heightening demand for corrugated boxes as containers for shipping products to stores and directly to consumers. Upticks in e-commerce activity will also contribute to this demand, as more boxes will be needed for the multitude of direct-to-consumer shipments.

Recovered Boxes Are an Important Raw Material...In the Manufacture of New Boxes

These trends will, in turn, incentivize recovery of paperboard from the waste stream due to the fact that recovered fiber is a valuable manufacturing input in the production of new corrugated boxes. In fact, the average corrugated box features 47% recycled content. Recovery of paper packaging will be particularly driven by paperboard production in China, the US’ leading export destination for recovered corrugated boxes and other types of paper.

In China, forest resources – and thus virgin fiber – are insufficient to meet the requirements of a growing paper packaging industry. Wastepaper was in such high demand in China over the 2000s that the paper trade created vast wealth for some of its participants, including Zhang Yin, who earned the nickname “Queen of Trash”.

Historical Restraints

Commercial users of corrugated boxes in the US, such as distribution centers and retail outlets, are a major source of paper packaging that ends up in MSW. At the same time, nearly 80% of retailers and grocers sell corrugated boxes to dealers or directly to paper mills, which allows a lot of paper packaging to bypass the MSW system. Coupled with packaging lightweighting efforts by manufacturers, volumes of paper packaging generated in the MSW stream declined over the 2006-2016 decade. In addition, single-stream recycling, the favored US collection method, restrained growth in recovery volumes. This method comingles all recyclable materials, which can lead to contaminants that render some materials unsuitable for recycling

Recovery Rate for Paper Packaging Stalls As Recycling Infrastructure Matures

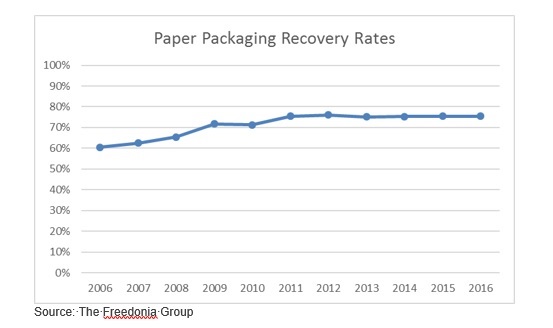

During the 2006-2016 period, the reach of US recycling programs increased, driving gains in recovery volumes and recovery rates (ie, the share of generated material that is recovered), since more paper packaging was available for recycling and relatively less trash was disposed of in landfills. Recovery rates for paper packaging rose dramatically between 2006 and 2011, reaching over 75% as materials recovery facilities (MRFs) invested in infrastructure upgrades to improve recovery efforts. Although recovery volumes grew through 2016, recovery rates began to stall in 2011 as the infrastructure for recovering paper from MSW matured.

At the high recovery rates achieved, further expansion is no longer realistic. New technology that separates paper from MSW with better success is not expected through 2021, and extensive growth in the reach of recycling programs is also not anticipated. In addition, the weakening of paper fibers from successive repulping limits recovery rates. Some corrugated boxes and other paper products that already have a high level of recycled content may be too weakened to recycle again, and will instead go to landfills, restraining both recovery volumes and recovery rates.

Want to Learn More?

For in-depth analysis of MSW packaging trends, see Recovered Packaging: United States, a report published by the Freedonia Focus Reports division of The Freedonia Group.

This report contains historical data and analysis of recovered and generated volumes of packaging in the MSW stream from 2006-2016 with projections to 2021. Recovery volumes of packaging are segmented by source as follows:

- paper

- glass

- wood

- metal

- plastic.

For more analysis of MSW paper trends, see Recovered Paper: United States. This report contains historical data and analysis of recovered and generated volumes of paper in the MSW stream from 2006-2016 with projections to 2021. Recovery volumes of paper are segmented by type as follows:

- packaging

- mixed

- newspaper & mechanical.

While you’re there, you can check out related reports such as Municipal Solid Waste: United States and Corrugated Boxes: United States.

About the Author

Cara Brosius is a Research Analyst with Freedonia Focus Reports. She holds a degree in economics, and her experience as an analyst covers multiple industries.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Focus Blog Subscription

Provide the following details to subscribe.