Lively Insights into the US Life Insurance Industry

by Leon Mengri

January 10, 2018

According to LIMRA, an insurance industry organization, about 70% of US households have some form of life insurance. Here are some key insights into this $560 billion industry (in 2016).

Life Insurance Takes Third Place

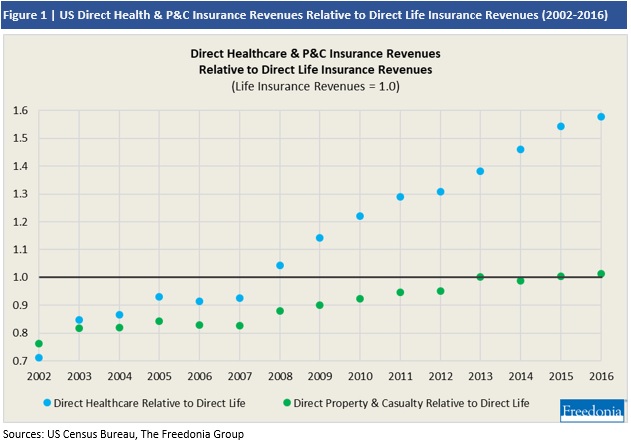

Life insurance is big business in the US; through 2007 it was the largest sector in the US insurance industry. Revenues in nominal US dollars were only surpassed by those of the healthcare insurance industry in 2008, and remained larger than the direct property and casualty (P&C) insurance industry through 2015. However, relatively slow population growth limited the prospects for life insurance sales. On the other hand, rising healthcare costs and growth in the number and value of the US building and motor vehicle stock, as well as the general liability facing US businesses, helped the healthcare and P&C insurance industries, respectively, surpass the life insurance sector.

Slow Population Growth Limits Revenue Gains

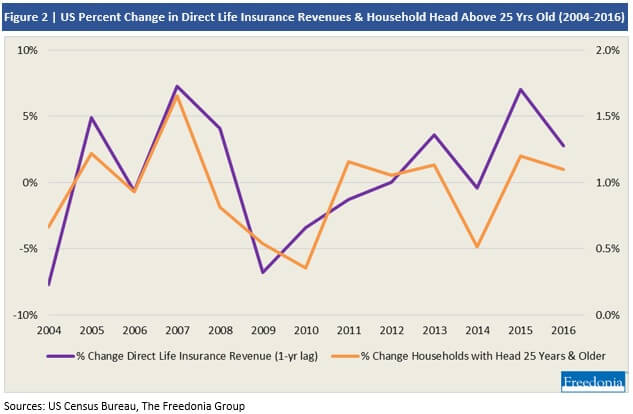

Slow overall population growth, including among the age groups and households most likely to have young kids and feel the need to purchase a new life insurance policy, has limited more rapid revenue growth. For instance, over the 2004-2016 period, the percent change in the number of households headed by an individual over the age of 25 saw periods of relatively fast and slow growth, which was in part a driver of the respective acceleration and deceleration in the revenues of the life insurance industry. Nevertheless, above-average population advances among individuals over the age of 65 have generated business from those interested in purchasing life insurance to fund funeral and other end-of-life expenses.

Major Revenue Sources

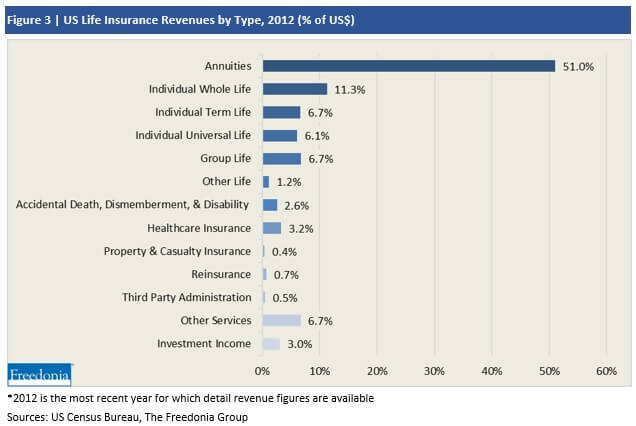

In 2012 – the most recent year for which detailed revenue figures are available – 86% of the revenue of establishments primarily engaged in providing life insurance services was derived from the provision of life insurance. However, a sizable amount, 14%, was generated from the sale of other insurance types, other services, and investment income.

Key Definitions

Life insurance types include:

- annuities

- accident and health (e.g., cancer and critical illness)

- accidental death and dismemberment

- disability

- term, universal, and whole life

Term life insurance provides coverage for a limited number of years, which appeals to individuals with children who desire an affordable monthly premium for coverage that lasts until their children become adults. Whole life is a form of permanent life insurance, as it provides lifetime coverage and the face value of the policy is payable to beneficiaries upon the death of the policyholder. The monthly premiums and the value of the policy are fixed. In addition, whole life policies build cash value over time that can be withdrawn as a loan or other arrangement to pay for expenses. Another type of permanent life insurance, universal life, offers more flexibility compared to whole life, because policyholders may adjust the premiums and coverage amounts, within certain limits. Furthermore, policyholders with variable universal life insurance may choose the investments that their premiums are placed in.

Learn More

For more insights into the US insurance industry, see Insurance: United States, a report published by the Freedonia Focus Reports division of The Freedonia Group. This report forecasts US insurance revenues in nominal US dollars to 2021. Insurance revenues are segmented by establishment type in terms of:

- direct healthcare

- direct life

- direct property and casualty

- reinsurance

- agencies and brokerages

- other insurance establishments such as third-party administrators of insurance and pension funds, and claims adjusters

To illustrate historical trends, total revenues, the various segments, and trade are provided in annual series from 2006 to 2016.

Related Focus Reports include Commercial Banking: United States, Employment Services: United States, Healthcare: United States, Healthcare Insurance: United States, Medical Services: United States, and Pharmaceuticals: United States.

About the Author

Leon Mengri is a Senior Market Research Analyst with Freedonia Focus Reports. He conducts research and writes a variety of Focus Reports, which offer concise overviews of market size, product segmentation, business trends, and more.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Focus Blog Subscription

Provide the following details to subscribe.