Recent Pet Food Usage Trends to Watch

by David Sprinkle

November 16, 2021

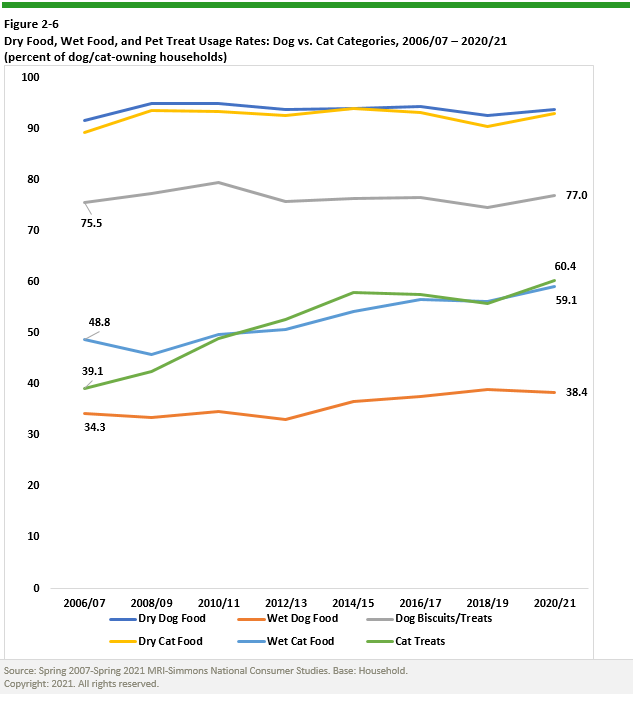

From a bird’s eye view of historical usage rates, several trends are evident in pet food and treats. Premiumization, and even reinvention, of products has driven the growth in dry pet food and in dog treats, along with increases in pet population. Purchasing rates for dry pet food remain flat given its ubiquity. The same is true of dog biscuit/treats.

The real growth in usage rates shows up on the cat side of the pet aisle. As Packaged Facts has reported, usage rates for cat treats have been on a tear, rising from 39% in 2006/07 to 60% as of 2020/21. In addition, purchasing rates for wet cat food rose from 49% to 60% over the same period.

Since wet pet food can be dispensed as a treat, those segments flip roles – at least to a degree – in the dog vs. cat food categories. While use of wet dog food has edged upward, purchasing rates for wet cat food remain significantly higher and are rising faster. In turn, while the use cat of treats has jumped, usage rates for dog biscuits/treats remain significantly higher.

For more information on these and other trends, see U.S. Pet Market Focus: Pet Food Update, 2021, which covers retail sales and segmentation across the U.S. market for commercial dog and cat food.

About the blogger: David Sprinkle is the Research Director and Publisher of Packaged Facts. With over 15 years of experience in the market research industry, David is world renowned for his industry studies and expert analysis on the pet industry.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Packaged Facts Blog Subscription

Provide the following details to subscribe.