The Aluminum Industry is Looking Shiny, For Now

by Sarah Schmidt

April 10, 2019

The aluminum industry is looking up. Historically low aluminum prices have finally risen due to the effect of the US government’s tariffs on imported primary aluminum. However, the future of the industry may not be quite so bright if the tariffs are repealed.

Historical Aluminum Prices

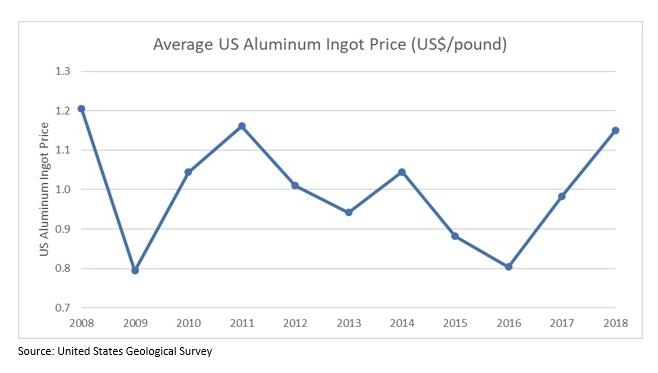

Aluminum suppliers saw strong price volatility over the 2008-2018 decade. Prices crashed during the 2007-2009 recession as slowdowns in most aluminum end markets reduced demand for the metal. After resurging through 2011, prices trended downward as foreign producers competed away market share from domestic producers with inexpensive imports. Prices reached a nadir in 2016, as heavy import competition caused the shuttering of several US aluminum smelters.

US Government Imposes Tariffs & Duties

Aluminum prices averaged a 6.1% annual drop between 2011 and 2016 due to an oversupply of cheap imported aluminum. Companies in China have been accused of dumping aluminum in the US market – i.e., selling aluminum products for less than their fair value to build market share. In response, the US government, spurred on by domestic producers of aluminum, has engaged in a number of trade disputes and imposed anti-dumping duties, especially on Chinese imports:

- In November 2018, the US Department of Commerce (DoC) imposed duties on Chinese alloyed aluminum sheet.

- In March 2018, the DoC imposed anti-dumping duties on Chinese aluminum foil.

- In June 2018, the US government imposed Section 232 tariffs of 10% on aluminum imports from most countries.

Effects of the Tariffs

These measures raised domestic aluminum prices and the Section 232 tariffs triggered retaliatory tariffs from Canada and Mexico. Aluminum prices rose in 2017 as manufacturers stockpiled aluminum, threatened by the impending 2018 tariffs. The imposition of these duties continued to boost aluminum prices through 2018.

The boost to aluminum price has been reflected by a spate of investment by domestic producers; for example, Century Aluminum began expanding its Kentucky plant to produce an additional 90,000 metric tons of aluminum billet annually. Meanwhile, Alcoa announced plans to restart three of the five production lines at its previously-idled Indiana smelter.

Canada Far More Competitive to US Producers than China

Despite the outsized concern over Chinese aluminum imports, most primary aluminum imports to the US don’t originate from China. The majority (52%) is imported from Canada. In fact, Alcoa – the second-largest producer of primary aluminum in the US – produces much of its aluminum in Canada, from where it supplies the US market in addition to its US production.

Canada has a leg up on the US aluminum industry, as plants there are newer, more efficient, and often use hydroelectric power, which is an inexpensive source of electricity. For example, Alcoa uses its Manicouagan hydroelectric dam to generate power for its Quebec smelting operations. Power costs usually comprise somewhere between 20% and 40% of the costs of making new primary aluminum; as a result, companies that use inexpensive electricity can produce aluminum more cheaply.

However, this state of affairs may not last. The improved economic environment has only come about because of the imposition of tariffs and antidumping duties. While the future of the tariffs is uncertain, betting future profitability on the existence of a politically controversial executive action is risky. Should the tariffs be repealed, cheap imported aluminum would return to the US market, forcing prices – and domestic primary producers – back into the headlong retreat they experienced between 2011 and 2016.

Right now, aluminum companies are making hay while the sun shines. Whether that effect will outlast the tariffs, however, is highly uncertain. Domestic manufacturers should update their plants so they can be more competitive if tariffs are removed. Otherwise, the global overcapacity in aluminum production will likely result in an import surge, wiping out the gains seen since 2017.

Want to Learn More About Aluminum?

We have you covered. For additional information and analysis of US industry trends, see Aluminum: United States, a report published by the Freedonia Focus Reports division of The Freedonia Group. This report forecasts to 2023 US aluminum demand and production in metric tons at the manufacturer level. Total demand is segmented by market in terms of:

- transport equipment

- containers and packaging

- building products

- electrical

- other markets such as consumer durables, cookware, and machinery

Total demand in nominal US dollars is also forecast to 2023.

Total production is segmented by type as follows:

- primary

- secondary

To illustrate historical trends, total demand, total production, the various segments, and trade are provided in annual series from 2008 to 2018.

To clarify industry terminology in the context of this report, bauxite is mined at mines, alumina is refined at refineries, and primary aluminum is produced at smelters. Aluminum refers to metallic aluminum and alloys thereof, and unless otherwise specified, does not include unprocessed aluminum scrap. Secondary aluminum includes aluminum produced from both new and old scrap. Re-exports of aluminum are excluded from demand and trade figures.

While you’re there, check out some of our related reports, which include:

- Fabricated Metal Products: United States

- Global Mining Equipment

- Industrial Castings: United States

- Metal Services: United States

- Motor Vehicles: United States

- Packaging: United States

- Recovered Metals: United States

- Sheet Metal: United States

- Soft Drinks: United States

About the Author

Owen Stuart is a Market Research Analyst with Freedonia Focus Reports. He conducts research and writes a variety of Focus Reports, and his experience as an analyst covers multiple industries.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Focus Blog Subscription

Provide the following details to subscribe.