Will Healthcare Inflation Remain at Historically Low Rates?

by Leon Mengri

July 18, 2017

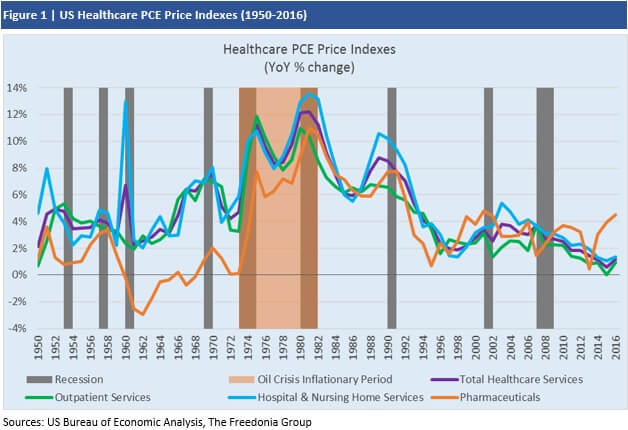

The slowdown in healthcare cost inflation, often attributed to the 2007-2009 recession, has generated questions such as what caused it and whether it will last. Notably, as Figure 1 shows, the rate of healthcare inflation has dropped to historically low levels, suggesting structural factors could also be a major driver of the slowdown.

Is the 2007-2009 Recession the Major Cause of the Slowdown in Healthcare Cost Inflation?

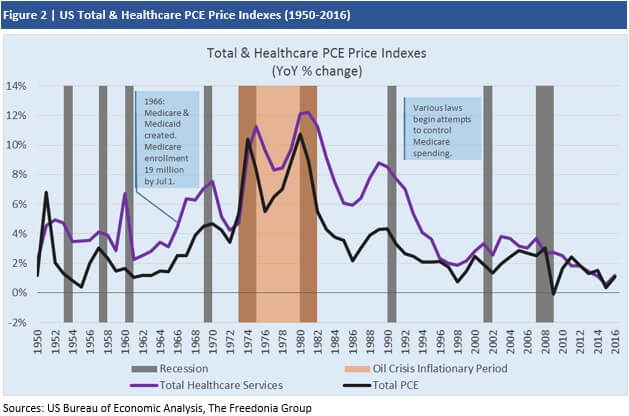

As Figure 2 shows, recessions usually cause general inflation – as measured by the personal consumption expenditures (PCE) price index – and healthcare inflation (measured via the healthcare PCE price index) to slow. Most recently, the 2007-2009 recession caused such a slowdown. However, healthcare inflation has continued to trend downward well past 7 years since the end of the recession. The relationship between healthcare inflation and general inflation seems to have changed since roughly 2010, suggesting structural factors are at play.

Severed Ties between Healthcare Inflation & General Inflation

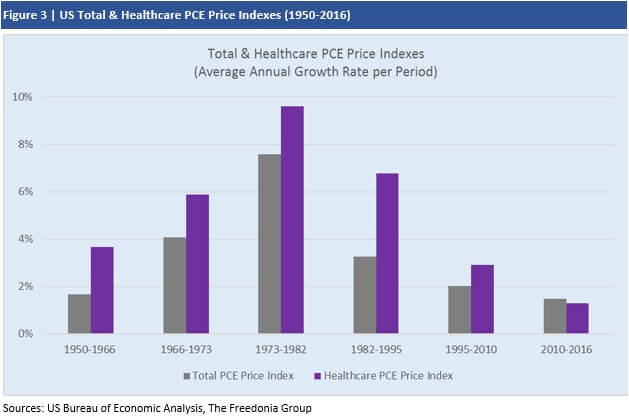

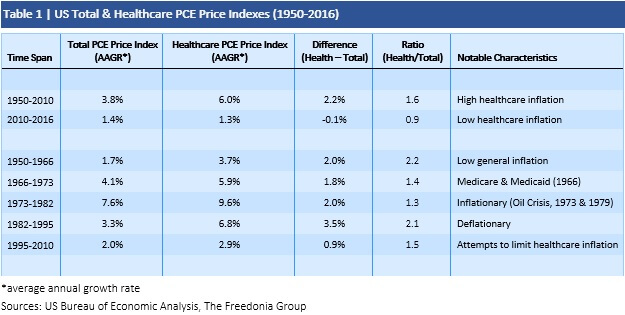

Healthcare inflation increased at an average of 1.6 times the rate of general inflation over the 1950-2010 period, per Table 1. In effect, the rate of healthcare inflation averaged 2.2% points above the rate of general inflation over the 1950-2010 span. The tendency for the rate of healthcare inflation to rise faster than general inflation held during a number of time periods within the 1950-2010 span that featured different inflation dynamics. As Figure 3 and Table 1 show, the relationship held during the:

- low-inflation years of 1950-1966

- in the period following the implementation of Medicare and Medicaid in 1966 and during a much higher inflationary environment

- during the highly inflationary period of 1973-1982

- continued into the 2000’s even as general and healthcare inflation registered at considerably lower rates than in the past.

However, since roughly 2010, that relationship seems to have broken down. During the 2010-2016 period, healthcare inflation rose at only 0.9 times the rate of general inflation; healthcare inflation gains averaged 0.1% below general inflation.

Structural Factors: Attempts to Limit Healthcare Inflation

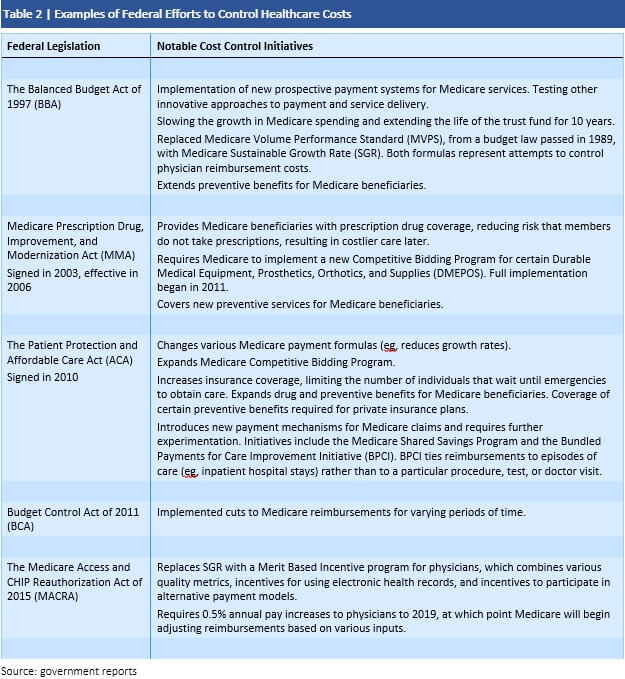

Examples of structural factors that likely lowered the rate of healthcare inflation include increasing out-of-pocket costs for members of private insurance plans and the government's efforts to control Medicare spending growth. Private insurers often use Medicare reimbursement rates as a benchmark, so Medicare cost controls create wider effects. Two analyses from the Federal Reserve Bank of San Francisco point to Medicare cost control efforts as a key driver of the slowdown in healthcare inflation after the 2007-2009 recession. Given the structural factors that have helped placed downward pressure on healthcare inflation, it is reasonable to expect a continuation of low inflation rates.

Examples of legislative attempts to control healthcare cost inflation, largely through reforming Medicare reimbursements, are presented in Table 2.

Learn More

For more insights into the US healthcare industry, see Healthcare: United States, a report published by the Freedonia Focus Reports division of the Freedonia Group. The report forecasts US healthcare expenditures and funding in US dollars to 2021. Healthcare expenditures are segmented by type in terms of:

- hospital

- physician and clinical

- dental

- other professional providers

- nursing and continuing care facilities

- home healthcare

- other providers such as worksites and schools

- medical product retail sales

- nonpersonal.

US healthcare funding is also forecasted to 2021 in US dollars and segmented by source:

- private healthcare insurance

- Medicare

- Medicaid

- out-of-pocket

- healthcare investment

- other healthcare insurance programs, other third-party payers and programs, and public health activity.

To illustrate historical trends, total healthcare expenditures, total funding, and the various segments are provided in annual series from 2006 to 2016.

Related Focus Reports include Healthcare Insurance: United States, Medical Implants: United States, Medical Services: United States, Medical Equipment & Supplies: United States, and Pharmaceuticals: United States.

About the Author

Leon Mengri is a Senior Market Research Analyst with Freedonia Focus Reports. He conducts research and writes a variety of Focus Reports, which offer concise overviews of market size, product segmentation, business trends, and more.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Focus Blog Subscription

Provide the following details to subscribe.