Report Overview

Featuring 246 tables and 103 figures – now available in Excel and Powerpoint! Learn More

Global demand for cement and concrete additives is forecast to rise 4.9% per year to $23.0 billion in 2026. This is an acceleration of the pace seen from 2016 to 2021, with gains boosted by:

- rising construction activity resulting from public and private investment in large infrastructure projects, some of which were designed to boost struggling economies following the initial phase of the COVID-19 pandemic

- increasing urbanization – which requires new housing and infrastructure for shifting populations – in developing countries

- continuing switches to higher performance additives in countries that are working to bring local construction practices more in line with those of more developed regions

Gains will also be supported by an acceleration in demand in China – the largest market for cement and concrete additives in the world – as domestic cement demand strengthens following a period of weakness. However, the country’s rate of growth will remain below the global average due to an ongoing moderation in building construction from the rapid expansion of the 2000-2015 period.

Investment in Infrastructure Boosts Additive Demand

Large infrastructure projects – such as the construction of roads, bridges, railways, airports, and water and sewer systems – will be a significant source of demand for cement and concrete additives. A number of large infrastructure projects have been planned to boost local economies that continue to reckon with the effects of the COVID-19 pandemic. Funding for large infrastructure projects – whether initial infrastructure to meet the needs of an expanding and urbanizing populations or projects designed to repair and update existing infrastructure in developed areas – is commonly provided as it creates construction jobs and new demand for a variety of materials, including cement.

Significant infrastructure projects will be initiated by both high-income and low-income countries throughout the world, including the US and China:

- The US passed the Infrastructure Investment and Jobs Act in 2021, which allocates over $1 trillion to construction and repair of highways and bridges and the modernization of mass transit and rail.

- In April 2022, Chinese President Xi announced an “all-out” effort to construct infrastructure, including waterways and high-speed railways, to boost the country’s GDP, which has been negatively affected by periodic lockdowns designed to eliminate the spread of COVID-19.

In addition to supporting demand through the use of large quantities of cement, infrastructure projects boost the additives market by increasing demand for more and higher quality additives. It is critical that roads and bridges maintain their structural integrity for a long time, so government agencies have come to favor road project evaluations that reduce the need for expensive ongoing maintenance, boosting use of superplasticizers, air entrainers, set controllers, and pozzolanic mineral additives.

Historical Trends

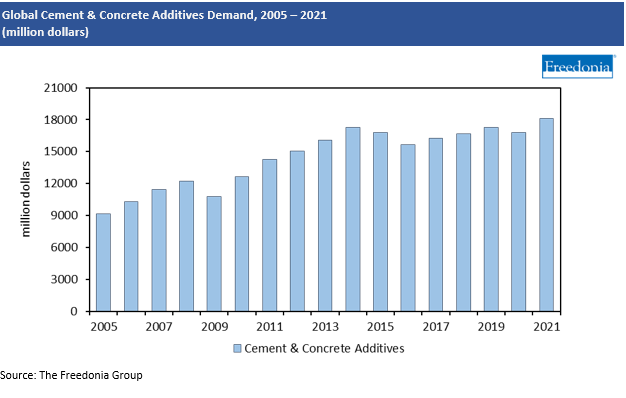

Demand for cement and concrete additives is strongly tied to demand for cement and concrete and overall construction activity. The average volume of additives used per ton of concrete has grown over the past 10 years due to increasing performance requirements, and consequently demand for cement and concrete additives generally grew more quickly than concrete usage.

Annual demand volatility and growth trends tend to vary by product group and the end-use market for the cement or concrete.

- For functions where there are better performing but higher-priced alternatives to commodities, there is a constant process of cost/benefit analysis that could favor either product depending on the circumstances.

- Even in applications where concrete performance is paramount, there are economic considerations to be made regarding the optimum blend, types, and dosages of additives in the mix.

- When there are trends toward the use of higher-value products, particularly among chemical additives, this provides an additional boost to growth in additive market value.

- Variations in additive usage rates among key markets also affects year over year changes in additive demand. The nonresidential building market uses cement and concrete additives at nearly twice the rate of the residential building market on a per ton basis.

A variety of other factors also determine annual demand trends in both volume and value. These include:

- additive price trends

- material availability, especially for large volume mineral additives

- governmental regulations surrounding cement characteristics such as strength

- environmental regulations

- infrastructure spending by municipalities and governments

Regional Demand Outlook

Global demand for cement and concrete additives is expected to increase 4.9% per year to $23.0 billion in 2026:

- Growth will benefit from strong gains in global construction activity, due in part to public and private investment in large infrastructure projects that are designed to boost local economies. For instance, the US – the second largest market for cement and concrete additives – is expected to see nonbuilding construction and related additive demand rise following the passing of the Infrastructure Investment and Jobs Act in 2021.

- The easing of some supply chain bottlenecks in the latter half of the forecast period and the restarting of large construction projects that were delayed because of the pandemic will both help boost demand.

In addition, global growth will be spurred by an acceleration in demand in China – the largest global market for cement and concrete additives – that results from a rebound in domestic cement demand.