Report Overview

Chemical and pharmaceutical manufacturing will continue to account for a majority of demand. See why...

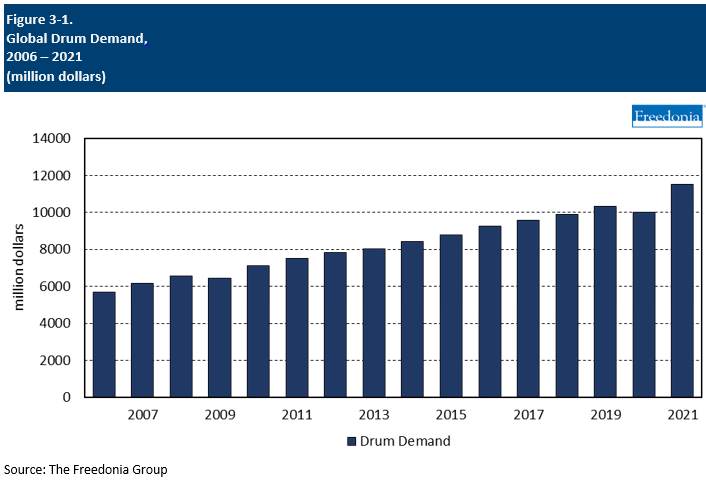

This Freedonia industry study analyzes the $11.5 billion global drums industry. It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by material (steel, plastic, fibre), and market (chemicals and pharmaceuticals, food and beverage, agricultural products, plastic/rubber/fiber products, durable goods, other). The study also evaluates discusses leading suppliers including Armando Alvarez, Greif, Mauser Packaging Solutions, Nampak, and SCHÜTZ.

This Freedonia industry study analyzes the $11.5 billion global drums industry. It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by material (steel, plastic, fibre), and market (chemicals and pharmaceuticals, food and beverage, agricultural products, plastic/rubber/fiber products, durable goods, other). The study also evaluates discusses leading suppliers including Armando Alvarez, Greif, Mauser Packaging Solutions, Nampak, and SCHÜTZ.

Featuring 156 tables and 81 figures – available in Excel and Powerpoint! Learn More

Global demand for drums is projected to increase 3.3% annually to $13.5 billion in 2026. As fairly well-established products, drum demand will be driven by the increasing output of the manufacturing markets in which they are most commonly used – chemicals and pharmaceuticals, which accounted for 55% of global drum use in 2021, and food and beverage (21%).

Steel Drums Remain Most Used Type; Plastic & Fibre Drums Find Opportunities

Steel drums will remain the most prevalent type due to their ability to withstand structural damage that can be caused by the solvents and solvent-based substances packaged in them. However, plastic and fibre drums will continue to find usage globally:

- Plastic drums are projected to retain their market presence, in part due to expanded use of refurbishment and reconditioning services.

- Fibre drums, whose share of the global market has declined in recent decades, are expected to benefit the increased use of film liners that are designed to extend the drums’ functional lives and from their lower cost.

All Drum Types Offer Some Level of Sustainability

Although not as heavily scrutinized as consumer packaging, concerns over sustainability exist for bulk packaging, and packaging types that incorporate sustainable features can encourage their use. In the case of drums, steel, plastic, and fibre types all feature characteristics associated with sustainability:

- Steel drums can be reused extensively; reconditioned examples can offer substantial cost savings and source reduction benefits.

- Plastic drums can also be reused, and therefore offer some of the same advantages as steel drums. Moreover, reusable plastic drums do not face nearly the same level of environmental scrutiny as single-use plastic packaging products.

- Fibre drums, which are made from paperboard, can be made from recycled raw materials and recycled into such raw materials.

Historical Market Trends

The bulk packaging industry in general – and the drums segment in particular – rely heavily on trends in economic growth and manufacturing activity, with demand generally tracking manufacturers’ shipments.

- Some large nondurable goods markets – such as food and beverages, pharmaceuticals, and agricultural products – are necessities and demand tends to be less cyclical.

- Other nondurables – such as industrial chemicals, rubber, paints and coatings, and adhesives – are more sensitive to economic swings due to their extensive usage in the cyclical industrial, automotive, and construction markets.

Construction activity and durable goods production levels also affect demand for drums, although they are not widely used in some bulk packaging markets, such as building materials, appliances, furniture, and electronics.

Other factors supporting demand for drums include:

- the appeal of reusable products, in the case of steel and plastic drums

- preference for sustainable products, such as fibre drums

Pricing Trends

Pricing is a critical competitive factor for drums due to intense industry competition, the wide availability of substitute products, and the undifferentiated nature of many types of bulk packaging. A range of factors impact prices for drums, including:

-

raw material and labor costs

-

energy and transportation expenses

-

material supply levels (product availability)

-

manufacturing capacity levels

-

international trade activity

-

the availability of alternative shipping products including other types of packaging, as well as tanker trucks and other containers

-

industry competitiveness within specific applications

Raw material prices tend to have the greatest influence on the costs of drums. Steel, plastic resin (particularly polyethylene), and paperboard costs are the main raw materials used to make drums.

While raw materials pricing fluctuations are important, drum prices may not always directly reflect them, as producers often absorb raw material price increases, especially minor or temporary price hikes, to remain competitive. The ability to raise prices can also be limited under annual or multi-year contracts in which the price is fixed for a given period, an approach often used by large-volume purchasers.

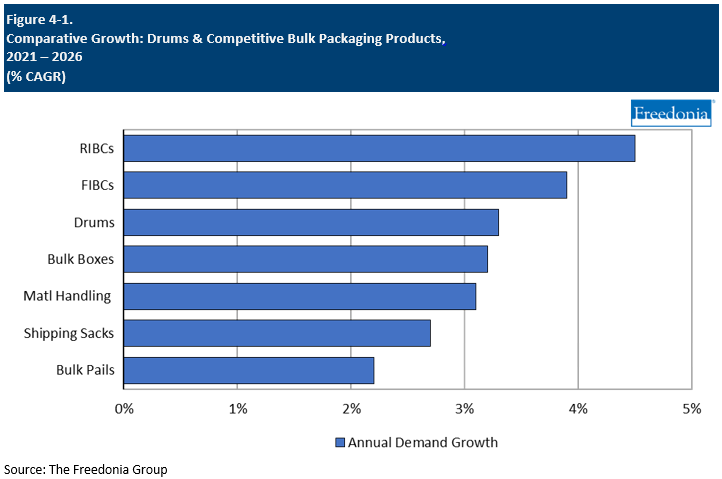

Competitive Products

While a large portion of product competition in the bulk packaging market is from other bulk packaging products (e.g., drums compete with IBCs, large pails, and bulk boxes in certain applications), drums also face competition from other shipping containers. In terms of markets:

- The chemical and pharmaceuticals market utilizes many liquid ingredients, and these can be transported in tanker trucks or metal tanks instead of in drums. Food and beverage production and the agricultural goods markets also utilize large amounts of liquid ingredients. While tanker trucks can contain up to six separate compartments, it is possible to transport a larger number of different liquids using bulk packaging such as drums.

- Dry ingredients can be shipped in cans, bottles, jars, and other rigid packaging. However, these containers can be more costly than bulk packaging (such as drums) and generate more waste.