Report Overview

Featuring 90 tables and 47 figures – now available in Excel and Powerpoint! Learn More

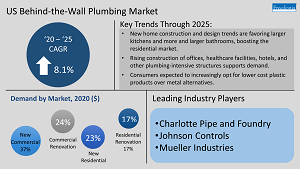

Demand for behind-the-wall plumbing in the US is forecast to increase 8.1% annually through 2025 to $17.9 billion, with market value driven up by strong price growth for key raw materials, particularly PEX and all metal materials. Though demand in real terms will be more moderate, real growth in the market will result from a:

- rebound in commercial building construction

- continued high level of new housing construction coupled with a move toward larger bathrooms

- high level of home renovation activity, continuing trends begun during the COVID-19 pandemic

A shift in product mix toward plastic behind-the-wall pipe and fittings – which are less expensive than metal products – is expected to restrain even faster value growth.

Market for Plastic Behind-the-Wall Plumbing Products Continues to Strengthen

Although metal products hold a greater share of the market in value terms, plastic products are the most widely used in behind-the-wall plumbing applications and they are expected to continue gaining share:

- PEX is growing in popularity because of its low cost, resistance to breakage, and durability relative to both copper and PVC.

- PVC is inexpensive relative to metal and is also easy to cut and install

Despite these advantages, metal products continue to benefit from their resistance to impact damage, and the ability to withstand high pressures, which boosts their use in high-value applications.

Commercial Market to Remain Leading Behind-the-Wall Plumbing Segment

Commercial buildings account for the majority of behind-the-wall plumbing demand, largely because they are mandated to include extensive fire suppression systems. Though demand fell in 2020 and commercial building construction remained depressed in 2021, it is expected to rebound in 2022 and continue to grow through 2025. As the market rebounds, demand in plumbing-intensive structures like offices, hospitals, hotels, and senior living facilities – which require not only extensive fire suppression systems but also multiple bathrooms and kitchen facilities – will gain a boost from a low base.

New Home Construction & Design Trends to Boost Residential Demand

Strength in new single-family home construction is anticipated to boost behind-the-wall plumbing products, as a wide variety of plumbing products are installed during initial construction. Additionally, new homes are expected to include more and larger bathrooms with elaborate features – such as his-and-her sinks – that require more plumbing fixtures, further driving gains. Interest in renovation among homeowners spending more time in their homes should also boost residential behind-the-wall demand growth, as many of these projects are anticipated to involve kitchen or bathroom renovations.

Construction Industry Outlook

A key factor affecting demand for behind-the-wall plumbing is the health and composition of the US building construction industry. Plumbing is installed in essentially every structure erected in order to supply water or, in the case of radiant flooring, provide an energy-efficient method of heating and cooling a space. All but the most primitive buildings with kitchens and bathrooms have water distribution and drain, waste, and vent systems, but other applications for behind-the-wall plumbing products are less ubiquitous:

- Fire suppression systems are required in all commercial buildings and multifamily housing, but they are only required in single-family homes in a fraction of municipalities (e.g., California and Washington, D.C.).

- Radiant flooring systems are optional installations that have historically been most prevalent in high-end residences and consumer-facing commercial locations like resorts and hotels. Because radiant flooring provides energy efficiency benefits, it is becoming more common in larger commercial spaces like warehouses.

Real building construction expenditures are expected to increase 1.0% per year through 2025, a significant deceleration from the 2015-2020 period:

- Residential building construction is expected to continue to advance as interest in buying homes remains strong and homeowners continue to invest in and remodel their residences.

- Commercial building construction is anticipated to rebound from the contraction caused by the coronavirus pandemic, supporting the construction of manufacturing and warehouse facilities as well as of structures such as office, retail, and lodging sites, which are all likely to have many bathrooms and some kitchens – as well as radiant flooring in some higher end sites – in addition to fire suppression systems.

Kitchen & Bath Remodeling Activity

Spending on home kitchen and bathroom renovation projects is projected to advance about 5% annually to just under $100 billion in 2025, supported by such factors as:

- a favorable lending environment and rising property values, which encourage homeowners to take out home equity loans to fund renovations

- homeowners continuing to renovate and expand kitchens to facilitate meal preparation, such as by adding prep sinks or pot fillers

- the efforts of homeowners to add or remodel bathrooms to facilitate aging in place, create multigenerational residences, or simply to improve convenience

- consumers’ perceptions that kitchen and bathroom renovation projects are a more effective way of increasing a home’s value relative to other remodeling projects

Kitchen remodeling is the larger segment, accounting for about 60% of growth. Gains in this area will be promoted by the increasing installation of:

- larger kitchens that promote family gatherings and entertaining guests

- kitchens with such amenities as kitchen islands with prep sinks, LED lighting, and larger and more cabinets

- professional-style kitchens – which incorporate more fixtures and fittings – to facilitate meal preparation

This Freedonia industry study analyzes the $12.6 billion US behind the wall plumbing industry. It presents historical demand data (2010, 2015, 2020) and forecast (2025 and 2030) by product (pipe, pipe fittings, valves, and sprinklers), application (fire suppression, water distribution, drain, waste, & vent systems, and radiant flooring), and market (new commercial, commercial renovation, new residential, residential renovation). The study also evaluates company market share and competitive analysis on industry competitors including Charlotte Pipe & Foundry, Johnson Controls, Mueller Industries, and NIBCO.

This study analyzes the US market for behind-the-wall plumbing products, which are defined as the pipes and related components of a pipe system used to carry water to and from supply and sewer mains and standpipes. Pipe and fittings visible to the user of a kitchen or bathroom are excluded from the scope of this study, as are the products used outside of a structure (such as water and sewer mains). Pipe and fittings in a basement or crawlspace are included in the scope of this study, even if they are visible and not technically “behind-the-wall”. Sprinkler heads, while also visible, are also included in the scope of this study.

Products covered by the study include:

- pipe, both plastic and metal:

- Plastic includes crosslinked polyethylene (PEX), polyvinyl chloride (PVC), chlorinated polyvinyl chloride (CPVC), acrylonitrile-butadiene-styrene (ABS), polypropylene random copolymer (PPR), and other plastic resins.

- Metal includes copper, galvanized steel, and ductile iron (which is also called “cast iron”.

- fittings such as:

- tees, including diverter tees

- elbows

- couplings (also called connectors), including adapters, reducers, unions, olets, barbs, nipples, cleanouts, and slip joints

- pipe supports, including hangers, clamps, struts, clips, and ties

- other products, such as air eliminators, expansion tanks, traps, wyes, caps, plugs, and manifolds

- valves include:

- air entrapment

- antiscald

- ball

- butterfly

- check

- gate

- globe

- needle

- plug

- solenoid

- stop

- zone

- fire sprinklers (or sprinkler heads), including standard response, quick response, early suppression fast response (ESFR), and residential types

Applications for behind-the-wall plumbing products include:

- fire suppression systems, including wet pipe, dry pipe, pre-action, and deluge types

- distribution (the supply of potable water to plumbing fixtures and fittings in kitchens and bathrooms)

- drain, waste, and vent, or DWV (the carrying of waste streams from plumbing fixtures to sewer lines)

- radiant flooring systems (networks of pipe and related components used to heat or cool part or all of a structure)

This study only considers radiant flooring systems that use water to heat or cool a space to a desired temperature, as those systems are connected to a structure’s plumbing network.

Markets covered in this study are:

- commercial buildings, including:

- institutional buildings (e.g., healthcare and educational facilities, religious establishments)

- office, trade, and lodging structures (e.g., office buildings, retail establishments, hospitality facilities, warehousing and storage facilities not located on industrial sites, and other commercial structures such as banks and theaters)

- industrial facilities (e.g., manufacturing plants and associated offices);

- other nonresidential structures such as airport and bus terminals, recreational buildings, police stations, fire stations, and prisons

- residential buildings, including:

- single-family detached houses

- single-family attached houses (e.g., townhouses)

- apartment or condominium buildings with multiple dwelling units

- manufactured homes, which are housing units constructed on a permanent chassis with wheels for on-road transportation to the site at which the unit will be placed

Excluded from the definition of residential buildings are housing units located in structures whose primary purposes are something other than habitation. Thus, a small living space contained in a larger retail facility would be classified as part of a retail building and not a residential building.

Sales of products used in behind-the-wall plumbing are presented in value terms (US dollars) at the manufacturers’ level and in unit terms. Pipe demand is presented in terms of length, while demand for fittings is presented in the number of units sold. Historical data for 2010, 2015, 2019, 2020, and 2021 and forecasts for 2022, 2025, and 2030 are presented for both value and unit demand. The study also identifies leading suppliers in key product segments and discusses factors that affect the marketing and distribution of behind-the-wall plumbing products in the US.