Report Overview

What is driving growth in medium and heavy vehicle sales?

-

e-commerce

-

rising tourism

-

economic rebound in China

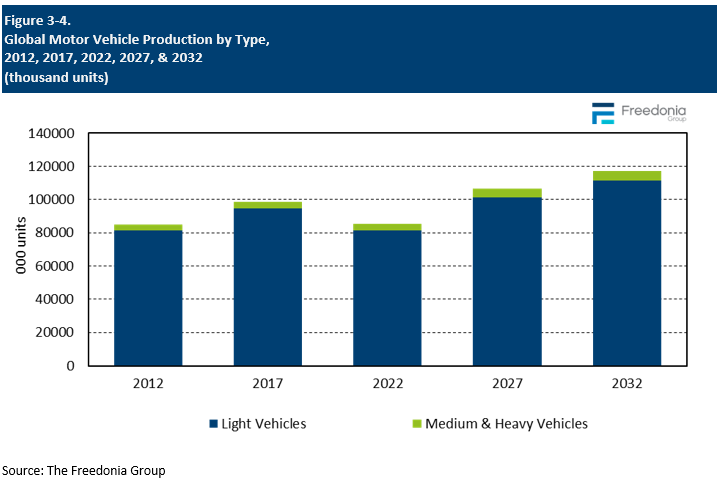

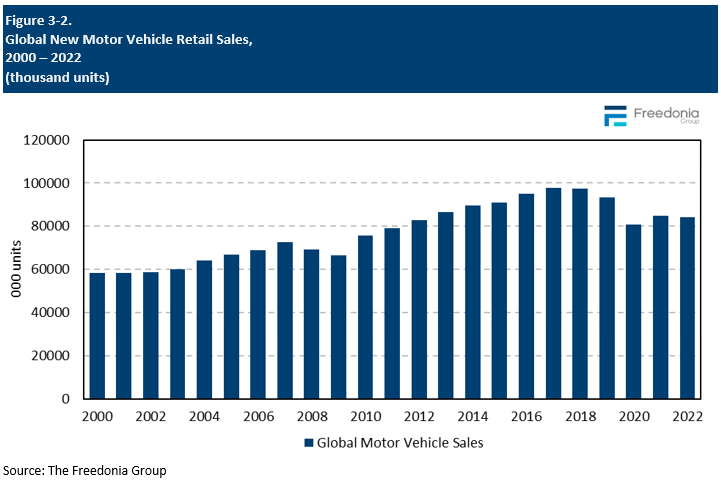

This Freedonia industry study analyzes the 84 million unit motor vehicle market. It presents historical sales, production and vehicle parc data (2012, 2017, and 2022) and  forecasts (2027 and 2032) by region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, and Africa/Mideast) and vehicle type (light vehicles; medium and heavy vehicles). The study also includes annual data and forecasts from 2019 to 2026.

forecasts (2027 and 2032) by region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, and Africa/Mideast) and vehicle type (light vehicles; medium and heavy vehicles). The study also includes annual data and forecasts from 2019 to 2026.

Featuring 205 tables and 38 figures – available in Excel and Powerpoint! Learn More

Global retail sales of motor vehicles are forecast to increase 4.7% annually to 106 million units in 2027, while motor vehicle production is projected to rise 4.5% annually to 106.7 million units. Sales and production gains will be driven by:

- rising income levels, which will increase the numbers of first-time vehicle buyers in developing countries

- resolution of many supply chain issues, including shortages of semiconductors, which plagued the automotive industry from 2020 to 2022

Environmental & Emission Concerns Support Sales & Production of Electric Vehicles

Electric vehicles, most notably battery-electric vehicles, are expected to increase their share of light vehicle sales and production in the wake of stricter emissions regulations and government-mandated phase-outs of gas-powered vehicles. The Asia/Pacific region will account for the largest share of growth, with automakers in China expanding their manufacturing capacity and nascent markets such as India rapidly increasing their adoption of these vehicles. Numerous OEMs expect to open new electric light vehicle plants in the coming years, with many of them based in North America and Western Europe.

Fast Growth in Eastern Europe Results from Improvement in Russian Motor Vehicle Market

Eastern Europe will see the most rapid global growth in new motor vehicle sales and production as Russia’s market rebounds off a depressed 2022 base. Although Russia’s invasion of Ukraine led to widespread sanctions and economic contraction in Russia, domestic production will expand to fill the void left by an exodus of Western brands, and sales will benefit from government efforts to provide favorable loans for Russian-made vehicles. Motor vehicle sales in Russia will also be supported by increasing availability of Chinese-made offerings.

Sales of Medium & Heavy Vehicles Driven by China, E-Commerce, & Rising Tourism

Gains in medium and heavy vehicle sales and production will significantly outpace the light vehicle segment in part due to China, the largest market for these vehicles. After lockdowns related to the country’s “Zero-COVID” policy idled some motor vehicle factories and disrupted the economy, the cessation of this policy has begun to normalize economic and manufacturing activity. This in turn will prompt many businesses to expand their medium and heavy vehicle fleets. Other factors will also support sales of medium and heavy vehicles:

- The continued popularity of e-commerce will bolster demand for medium and heavy freight haulage and delivery vehicles. The pandemic accelerated the trend toward online shopping, and e-commerce will continue to expand its share of total retail sales.

- The ongoing recovery of the tourism industry from pandemic-related lows in 2020 and 2021 will boost sales of motor coaches and other types of buses.

New Motor Vehicle Retail Sales

Historical Trends

Motor vehicle retail sales represent the number of units of new motor vehicles sold in a country each calendar year, including both domestically produced and imported vehicles.

Retail motor vehicle sales are affected by a number of factors, including:

- price

- availability of vehicles

- availability of financing and attractive interest rates

- overall health of the economy

- changes in population size

- market maturity

In general, motor vehicle sales are dependent upon consumer spending trends, which are themselves tied to the state of the overall economy. Economic prosperity tends to encourage spending on costly durable goods such as motor vehicles, while economic downturns with high levels of unemployment tend to make such purchases unfeasible.

Changes in population size can impact motor vehicle sales, with growth in a population tending to provide more potential vehicle buyers. However, this factor can be tempered by the level of market maturity in a given area, with some highly mature motor vehicle markets like North America providing fewer opportunities for growth than areas where motor vehicles are not as widely adopted or available.

New Vehicle Sales by Region

The Asia/Pacific region is by far the largest region for motor vehicle sales in the world. Absolute gains will be aided by growth in income levels, particularly in India (one of the largest motor vehicle markets in the region), giving more consumers the financial resources to purchase vehicles. Although sales of light vehicles in China will grow at a relatively slow rate due to declining population, they remain significant in absolute terms.

North America is expected to see below-average growth in sales due to market maturity in the US and Canada and the increasing age of automobiles in use in North America due to improved durability of vehicles, which hinders sales of new products.

Despite being a mature motor vehicle market, Western Europe will post above average sales growth, as supply shortages lessen and automakers are better able to meet pent-up demand that was limited by pandemic-related supply chain issues, temporary plant closures, and other factors.

Above-average growth in the Africa/Mideast region will be helped by increasing urbanization and industrialization, which will make motor vehicles more practical and necessary for travel. Additionally, in Turkey – the largest sales market for motor vehicles in the region – income levels will rise faster than the regional average, enabling more consumers to purchase vehicles.

Above-average sales growth in Central and South America will be aided by an acceleration in growth in income levels in Brazil, the largest motor vehicle sales market in the region.

Motor Vehicle Production

Historical Trends

At the global level, motor vehicle production is primarily affected by motor vehicle demand, which is dependent upon factors such as disposable income levels and population growth. Other important factors impacting motor vehicle production include:

- labor costs

- economic incentives (such as tax breaks) from host countries

- geographic proximity to important markets

- the ability to develop export markets

- availability of raw materials and components

- plant openings, closings, and expansions

In recent decades, many North American and West European motor vehicle manufacturers have sought to remain competitive by shifting a significant amount of production capacity to regions such as the Asia/Pacific and Eastern Europe where labor costs are lower and governments offer attractive incentives for setting up local production operations.

In regions such as North America, vehicles imported from overseas are not uncommon as trade agreements between nations and regions have developed over the years to facilitate the trading of numerous goods. However, vehicle suppliers can typically reduce their shipping costs by placing production operations close to the source of demand. As a result, many West European automakers have production capacity in Eastern European nations with lower production costs, which are relatively close to Western Europe markets. In addition, Northern African countries such as Morocco have become vehicle manufacturing hubs due to their proximity to Italy, Spain, and France.

Motor vehicle production is also dependent upon the availability of important raw materials and components. Because vehicles are highly complex products made of interdependent systems, a shortage of one or more components such as semiconductors and wiring harnesses makes the final assembly of vehicles impossible.