Report Overview

Featuring 130 tables and 90 figures – now available in Excel and Powerpoint! Learn More

This study covers the global market for adhesives and sealants. Historical data (2010, 2015, and 2020) and forecasts for 2025 and 2030 are presented for adhesives and sealants demand are presented in metric tons and current US dollars (including inflation) at the global, regional, and country levels.

Markets include:

- construction

- residential

- nonresidential

- nonbuilding

- packaging

- paper and paperboard (e.g., boxes, envelopes, paper retail bags and shipping sacks, sanitary food containers, tubs, cans, drums)

- plastic and other packaging (e.g., blister packaging, aluminum film, foam packaging, pouches, vacuum packaging)

- tapes and labels

- consumer goods

- footwear

- books and publications

- household glues

- other consumer goods, such as toys, games, and sports equipment

- transportation equipment

- motor vehicles

- other transportation equipment (e.g., aerospace vehicles, aircraft, golf carts, military equipment, motorcycles, railroad equipment, ships and boats, snowmobiles)

- textiles

- nonwovens

- other textiles (e.g., technical fabrics)

- other markets

- appliances

- electrical and electronic product manufacturing

- furniture assembly

- jewelry

- machinery production

- medical and dental products

- sporting goods

In addition, demand is analyzed by product type, including:

- water-based

- solvent-based

- reactive

- hot melts

- natural (e.g., cellulosic adhesives, protein adhesives, vegetable oil-based sealants)

- other products (e.g., bituminous, sodium silicate, polyvinyl butyral)

Unmodified starch adhesives used in the production of corrugated board are excluded. In addition, binder resins used in the production of engineered wood products such as plywood and particleboard are not considered adhesives and are excluded from demand totals.

Regional Trends

Adhesives and sealants find use in all countries, with demand levels differing widely depending on the country’s economic size and level of development. Requirements for formulated adhesives and sealants rise commensurate with the manufacture of packaging materials and durable goods, as well as with increases in construction activity and the use of more advanced construction materials. Per capita income levels also impact market size, affecting local purchases of consumer goods manufactured with adhesives and sealants, as well as sales of glues, pastes, and other products used in home repairs, do-it-yourself (DIY) projects, and crafts.

The adhesive and sealant product mix in a given region or country is shaped by a variety of factors, including the:

- size and performance of local adhesive- and sealant-consuming industries (such as packaging, transportation equipment, and footwear)

- implementation of environmental protection regulations

- availability and cost of particular adhesive and sealant technologies

The Asia/Pacific region, led by China, will remain the largest regional adhesives and sealants market. China’s global dominance in a number of key end-use industries – including appliances, electronics, footwear, furniture, machinery, and packaging – will continue to bolster the country’s position as the world’s top consumer of adhesives and sealants. In emerging economies in the region, suppliers of packaging adhesives will benefit from rising demand for packaged consumer goods, supported by growing urban populations and improving disposable income levels.

India will see the most rapid advances of any major national market, boosted by rising:

- public infrastructure spending, which will drive strong growth in domestic construction activity (and related adhesives and sealants use)

- domestic sales of motor vehicles, which will fuel output and capacity expansions by major automakers in the country

A rebound in motor vehicle production in Japan and South Korea will support demand in these countries

Pricing Patterns

The pricing of adhesives and sealants primarily depends on:

- the supply/demand balance and cost of raw materials

- formulations and grades

- the intended application

- other input costs – including labor, electricity, and fuel

Few adhesive and sealant producers are back-integrated into raw material supply; however, back integration is common only for silicone sealant and starch-based adhesive manufacturers. As most producers purchase their key raw materials, feedstock pricing is a major component of the final cost of formulated specialty adhesives.

Among the ingredients used to produce adhesives and sealants, the base resin accounts for a large share of ingredients and thus the primary driver of product cost. The price range for adhesives and sealants is wide – even within specific chemical types such as polyurethanes and acrylics – with actual cost depending on the exact base resin and functional additives in the formulations. In general, however, prices tend to be highest for reactive adhesives used in structural applications and lowest for starch and sodium silicate adhesives for low-end paper packaging markets.

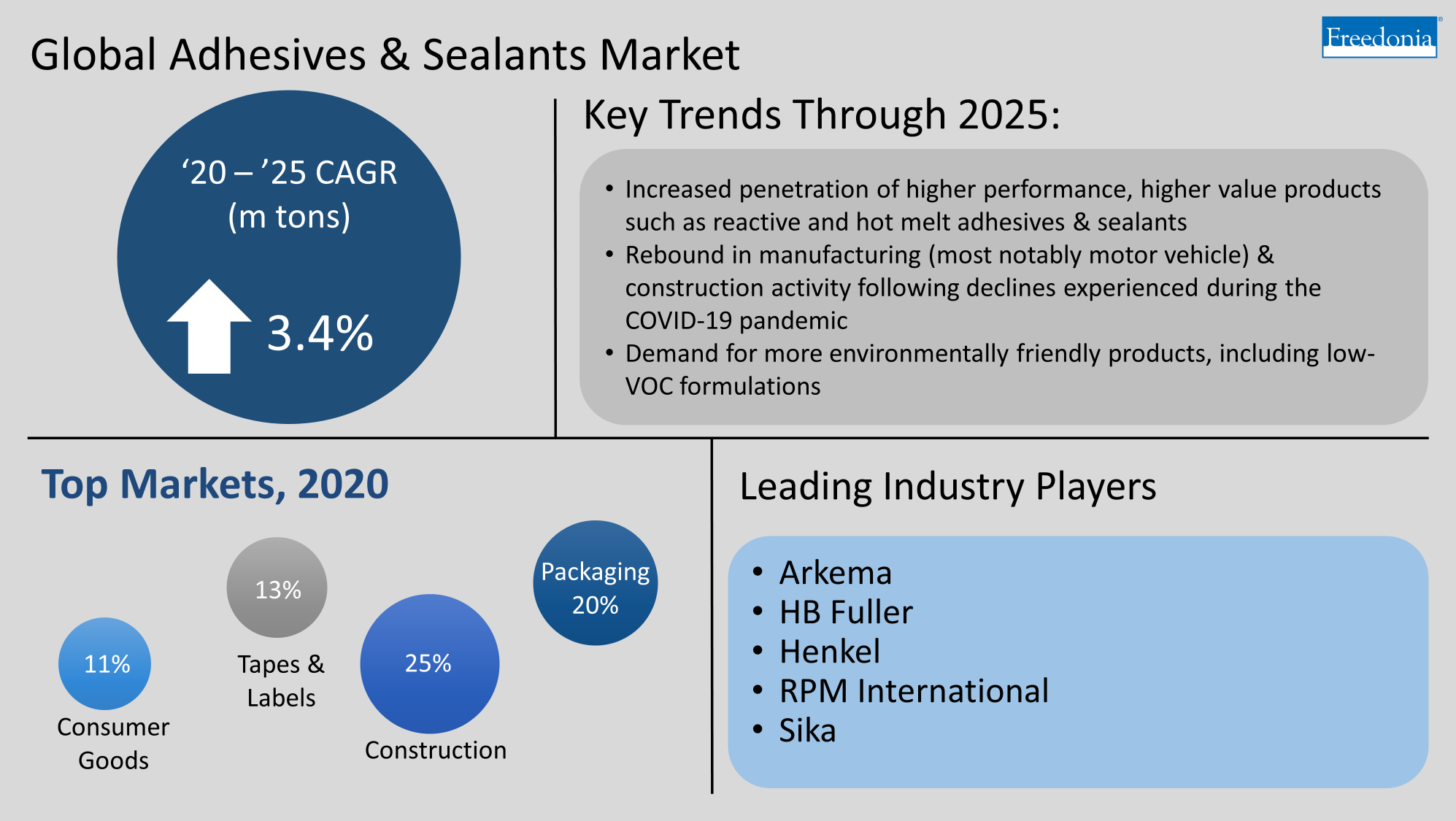

Global demand for adhesives and sealants is forecast to grow 3.4% per year to 24.7 million metric tons valued at $81.0 billion in 2025. Gains will be supported by:

- rising construction activity and infrastructure investment in developing countries, boosted in the short term by rebounds from losses seen during the COVID-19 pandemic

- an increase in manufacturing output, most notably of transportation equipment, and ongoing increases in manufacturing activity of consumer goods in emerging economies

- the continuing transition in manufacturing, assembly, and construction from mechanical fasteners to adhesive bonding

China Remains Dominant, but Developing Asia/Pacific Countries Offer Strong Potential

The Asia/Pacific region is forecast to account for over 70% of all volume demand growth between 2020 and 2025. Growth in manufacturing output, notably for export markets, will drive demand for adhesives and sealants used in the manufacture and packaging of a wide variety of goods across the Asia/Pacific region. More than half of those gains will stem from the outsized Chinese market. However, faster growth is occurring in India, Indonesia, Thailand, and other countries with developing manufacturing sectors. Reactive adhesives and sealants, which are commonly used as epoxies in electrical and electronic products, particularly stand to benefit.

While Water-Based Products Remain Popular, Reactive & Hot Melt Have Good Opportunities

Water-based adhesives and sealants will remain the most used product through 2025, accounting for nearly one-third of all demand, due to their relatively low cost, ease of use, and low emissions, which make them more environmentally friendly than solvent-based products. While water-based products already tend to favored in developed areas where consumers have concerns about contaminants and there are regulations in place monitoring their use, they are likely to gain ground in developing areas as consumers in those areas are also able to specify such products.

Hot melt and reactive adhesives and sealants are expected to have some of the best opportunities:

- Gains for reactive products will be supported by solid growth in construction activity and motor vehicle production, markets where the superior performance properties of reactive products are preferred and sealing is becoming more important. Gains in motor vehicles in particular will benefit from a significant recovery in manufacturing from a low base during 2020 and 2021.

- Hot melt demand will be bolstered by the growing textile market, where they continue to replace conventional stitching in hems due to their rapid cure rates. Use of nonwoven products such as wipes and masks surged during 2020 and 2021, and these rates are expected to remain elevated. Additionally, the market for personal hygiene products is expanding in both developed countries with aging populations and in developing economies where personal incomes are rising.