Report Overview

Packaging of food is something we see every day, but what drives the decisions of consumers and manufacturers?

-

Cutting costs and attracting customers

-

Sustainability conversions with transitions to molded fiber and bioplastics

-

Source reductions with use of flexible packaging like pouches

Get the insights you need to compete.

This study examines the US market for food packaging, defined as primary and secondary packaging materials sold to food manufacturers, primarily for products targeted at  retail or foodservice markets. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2018-2026. Data are provided in current dollar value and units. Also provided is an analysis of key industry players.

retail or foodservice markets. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2018-2026. Data are provided in current dollar value and units. Also provided is an analysis of key industry players.

Featuring 164 tables and 81 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Read a discussion regarding 3D Printing

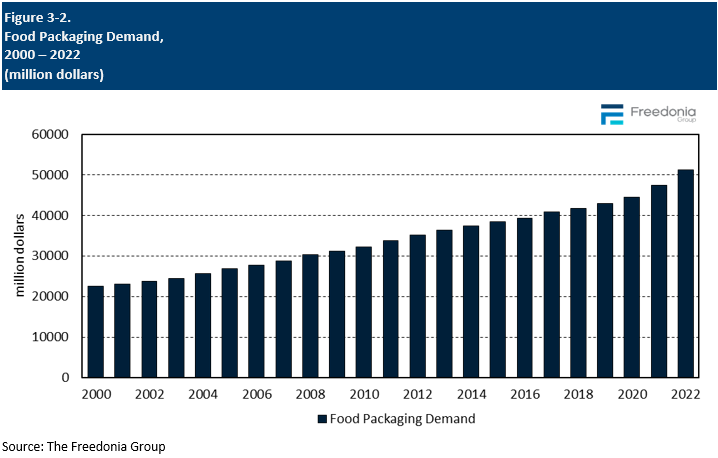

Demand for food packaging is forecast to increase 2.5% per year to $58.1 billion in 2027, with real growth of 1.2% per year to 540 billion units. While growth in unit terms will remain relatively steady, market value growth will be affected by an easing of high raw material prices and supply chain issues that caused pricing for most products to surge in 2021 and 2022. In general, the food market is challenging for packaging suppliers due to the vast number of distinct applications in which packaging must not only meet specific performance criteria, but also be cost effective and fall in line with changing sustainability goals and consumer preferences:

- Premium, high-performance products – such as aseptic cartons, skin packaging, and bag-in-box formats – will see the strongest advances.

- Fresh and frozen food formats continue to see the fastest growth, with conventional shelf-stable formats somewhat lagging.

- Plastic will continue to be the largest and fastest growing of the major food packaging materials, although sustainable materials like molded fiber will experience faster growth overall as they penetrate new applications.

- The outlook for paper-based packaging will be mixed, with sluggish gains in products like folding cartons overshadowing healthy gains in growth areas like aseptic cartons and food cups.

Sustainability Remains Top Concern for Packaging Products, Drives Innovations

Sustainability continues to be among the highest profile concerns in the food packaging market, with producers of different formats and materials jockeying to be seen as the most eco-friendly. Actions taken to improve sustainability include greater focus on recyclable and compostable packaging, incorporating recycled and post-consumer content into packaging, light weighting and source reduction, and improving shelf-life to reduce food waste. Additionally, many manufacturers are working to increase the performance of sustainable solutions, such as developing aqueous barrier solutions for paper and molded fiber products to allow their use in a wider variety of applications while still maintaining their recyclability or compostability.

While plastic is the leading target for sustainability conversions, end users continue to value plastic over other materials based on cost and performance. To address sustainability concerns, manufacturers have increasingly focused on ensuring that their plastic packaging is recyclable and incorporates recycled content, as well as offering more bioplastic options.

Convenience & Performance Remain the Most Important Factors for Food Packaging

Packaging is one of the key ways that food companies differentiate their products, so new formats are always in demand. As such, high-performance products are expected to take share from traditional packaging; formats like aseptic cartons, vacuum skin packaging, stand-up pouches, and bag-in-box will continue to see the strongest gains as they afford a variety of benefits – including extended shelf-life, lighter weight, ease of dispensing, improved sanitation, and a more premium appearance – over traditional, lower-cost packaging options like bags, wrap, and cans.

Historical Sales Trends

Shifts in demand for food packaging from year to year are determined by a few factors, primarily related to the production and marketing of food products. These activities in turn are influenced by:

- demographic trends such as age, average household size, and levels of disposable income

- consumer spending on food and the balance between at-home and away-from-home meals

- food preferences (e.g., demand for enhanced convenience or for organic products)

- restaurant and other foodservice industry revenues

In addition, several competitive variables determine the mix of packaging types used and their cost, including:

- raw material and conversion costs

- changes in the mix of foods being packaged, particularly in terms of food format (canned, dried, frozen, fresh)

- trends in packaging size and format, such as shifts toward smaller single-serving packages, family size units, or multipacks

- the proportion of food that is sold via retail channels versus foodservice establishments

- environmental and regulatory factors, including trends such as source reduction, the use of recycled content, and recyclability

Food packaging demand growth in 2021 and 2022 experienced a strong acceleration in value terms compared to previous years due to the significant inflation following supply chain issues caused by the 2020 pandemic. However, unit growth in those years was below the historical average as consumers facing increased prices opted to cut back on purchases.

Applications Overview

Most food products are packaged in some way before being sold to end users, with some types of fresh produce being one notable exception. The market value of packaging sold for different food applications varies depending on the performance requirements, the volume of packaging needed, and the materials used.

Applications for food packaging include:

- meat, poultry, and seafood

- fresh produce

- prepared foods

- dairy and dairy alternatives

- baked goods

- sauces, dressings, and condiments

- processed fruits and vegetables

- savory snack foods

- candy and confections

- other processed foods (including dry coffee and tea, baby food, flours and grains, sweeteners and syrups, spices and seasonings, eggs, fats and oils, meat alternatives, soft drink syrups, meal replacements and protein powders, and other a variety of other food items)

Demand for food packaging is forecast to grow 2.5% per year to $58.1 billion in 2027, with real growth of 1.2% annually to 540 billion units. Nearly all broad food categories will see growth not far from the average due to the diversity of food products included in each segment, the most notable exceptions being prepared foods and processed fruits and vegetables:

- Prepared foods, which include ready-to-eat and ready-to-heat items, are expected to see among the fastest growth among major food categories due to their convenience and the growing availability of fresh product offerings, as well as continued strong growth in frozen variants.

- Candy and confections will also experience fast growth, owing to the trend toward smaller individually wrapped versions of larger candies and continued inroads by higher value packaging that provides better performance or sustainability advantages, increasing both real and nominal demand.

- Demand for processed fruits and vegetables – primarily canned products – will see below average gains due to market maturity and limited opportunities for new product development (exceptions being riced and spiralized frozen vegetables).

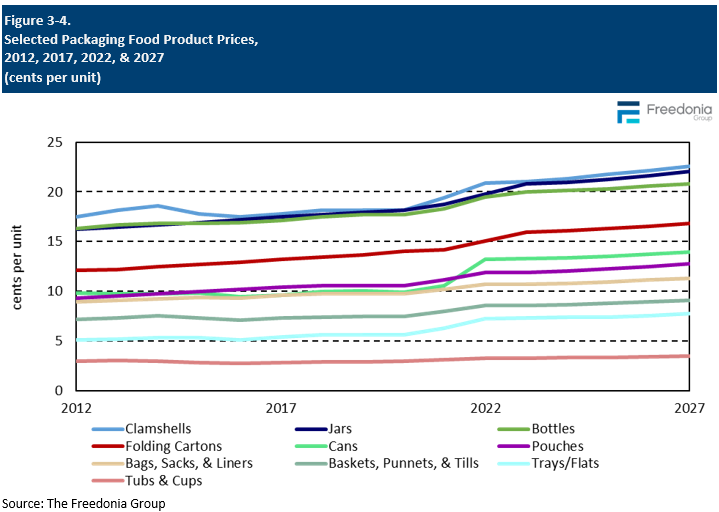

Packaging Pricing Trends

Pricing is an important factor in selecting packaging for a particular food application. Price competition in the industry is intense, due to the prevalence of relatively low-technology, commodity-type products.

The primary determinant of pricing for food packaging is the cost of raw materials, which typically represent 50% to 60% of the final packaging price.

Other key factors influencing the price of food packaging include:

- the degree of lightweighting and downsizing activity – efforts that cut costs per unit by reducing the packaging size

- the presence of value-added features such as spouts and reclosable zippers

- the packaging product mix, both in terms of package size and material composition

- supply chain pressures – packaging producers are often squeezed between large raw material suppliers on one end and large food processors on the other, leaving them less options for pricing flexibility

- pressure to improve sustainability, which can result in the use of higher cost packaging materials

In 2021, the price of many raw material inputs used in the production of food packaging – plastic, paper, glass, and aluminum – increased dramatically due to shortages caused by supply chain issues, leading to a large increase in end pricing of food packaging products. These price increases continued through most of 2022 – with aluminum and glass packaging seeing price growth even into 2023 – though paper and plastic packaging prices have mostly flattened.

Going forward, packaging pricing is expected to normalize, with the major packaging material categories – plastic, paper, metal, and glass – forecast to see price growth in line with historical trends beginning in 2024.

However, pricing of molded fiber – among the fastest growth packaging materials – is expected to remain flat, reflecting diverging trends:

- Advancements in manufacturing and tooling processes will decrease the price of production.

- Increased focus on performance and aesthetic of molded fiber products will increase average price.

- Growth in domestic production will initially increase pricing as manufacturers switch to newer manufacturing processes. However, this will lead to decreasing production costs and lower average prices over time.

Food Production Trends

The most important factor in the amount of food packaging needed is the outlook for food production, both in terms of the volume produced and the types of food that are popular. While trends in the amount of food produced and consumed at the aggregate level tend to be relatively stable – tracking growth in population and food pricing levels – the mix of food produced can vary over time influenced by changing consumer dietary preferences. This change can, in turn, impact the type and amount of food packaging needed.

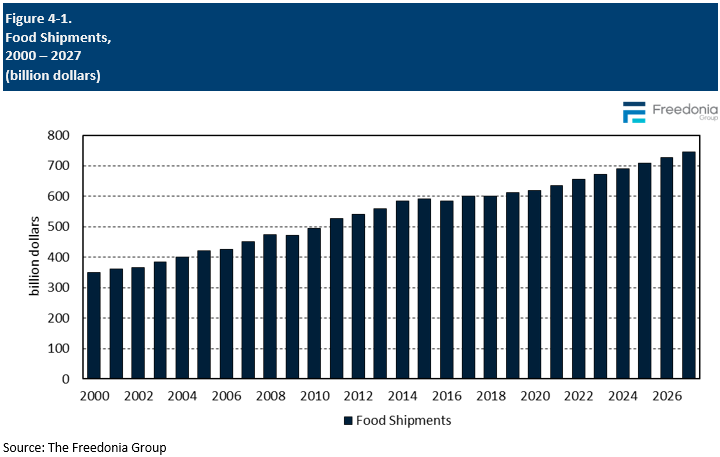

Food shipments, including fresh produce, are forecast to rise 2.6% per year to $746 billion in 2027, with real growth of 2.4% annually to $584 billion, adjusted for inflation:

- Snack food will see favorable growth, boosted by the trend toward more, smaller meals throughout the day and continued new product introductions.

- Meat, poultry, and seafood will account for the highest share of output value, aided by a renewed focus on proteins for healthy lifestyles, although competition from meat alternatives will limit advances to some degree.

- Frozen fruit, vegetables, and specialty foods will see favorable growth, boosted by their convenience and improved nutritional profile compared to shelf-stable products.

- Fresh produce will see above average growth following declines in 2021 and 2022.