Report Overview

Featuring 49 tables and 31 figures – now available in Excel and Powerpoint! Learn More

This study analyzes the global motor vehicle market for thermoplastic elastomers (TPEs) by region and product. For the purposes of this study, a thermoplastic elastomer is defined as any thermoplastic material that exhibits elastomeric properties; TPEs therefore offer the functional performance characteristics of thermoset rubber but are processed using the methods and machinery of rigid thermoplastics.

TPEs covered in this report are:

- copolyester elastomers (COPEs)

- polyolefin elastomers (POEs)

- styrenic block copolymers (SBCs)

- thermoplastic polyolefins (TPOs)

- thermoplastic polyurethanes (TPUs)

- thermoplastic vulcanizates (TPVs)

- specialty types (including polyether block amide, silicone-based TPEs, fluoropolymer-based TPEs, and vinyl-based TPEs)

SBCs that do not exhibit elastomeric properties (i.e., high styrene products that contain roughly 60% or more styrene) are excluded from the scope of this study.

While TPOs and TPVs are “polyolefin elastomers” in a technical sense, they are defined separately for the purposes of this study. Furthermore, vulcanized olefin elastomers such as EPDM and ethylene-propylene rubber are not TPEs and are thus excluded.

Compounds with vulcanized elastomers are considered to be TPVs rather than TPOs. Various sources and manufacturers differ on the degree of vulcanization required to define an olefinic TPE as a TPV, so estimates of current global demand can vary.

For the purposes of this report, motor vehicle TPEs are defined as those used in light, medium, and heavy motor vehicles in both OEM and aftermarket applications, including exterior, structural, engine, mechanical, and interior applications:

- exterior and structural (e.g., body panels, hoods, lift gates, exterior lights, fire wall silencer, fascia, trim)

- engine and mechanical, including gaskets, belts, and hoses, as well as air ducts and cuffs, and wires and cables

- interior (e.g., instrument panels, airbag doors, carpet backing, consoles, door panels and trim, floor mats, steering wheels)

Historical data (2009, 2014, and 2019) and forecasts for 2024 and 2029 are presented for automotive TPE demand in metric tons.

Demand by Elastomer Type

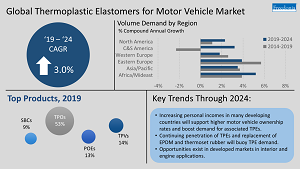

Global demand for TPEs in motor vehicle applications is forecast to grow at a 3.0% annual rate to 2.2 million metric tons in 2024. Although the COVID-19 pandemic has had a significant impact on TPE in motor vehicle applications – demand declined in 2020 as motor vehicle production dropped, particularly in the US, and consumers delayed large purchases, including of new motor vehicles – the market is expected to return to pre-pandemic levels by 2021.

Through 2024, gains will be bolstered by:

- rising use of TPVs and other TPEs in window and door seal applications, where they are continuing to replace or complement thermoset rubber

- relatively healthy growth in interior and mechanical applications, with SBCs gaining share from thermoplastics in interior skins where soft touch and UV resistance are valued performance properties

- accelerations or rebounds in motor vehicle output in a number of major TPE markets, including China, Germany, and the US

However, TPE demand in the motor vehicle market is more vulnerable to fluctuations in underlying industry performance than less mature applications. Demand growth in thermoplastic polyolefins will be particularly tied to trends in vehicle output; nearly all major vehicle suppliers already use TPOs in bumper fascia, limiting further penetration of these products and keeping sales expansions slow.

Demand by Application

Demand for TPEs in motor vehicle applications is expected to rise:

- Exterior and structural applications will continue to account for the largest share of TPE demand, as TPE is frequently used in bumper fascia and body panels.

- The lightweighting abilities of TPE will support demand in engine and mechanical applications, most notably the increasing use of TPV gaskets, belts, and hoses in place of those made from rubber.

- The aesthetic advantages of TPE – including its soft feel and ability to approximate leather – will drive demand in interior applications.

Demand by Region

The Asia/Pacific region is expected to remain the largest regional market through 2024, boosted by the large size of the motor vehicle industry in China. Growth will be supported by rising ownership of motor vehicle in the region, enabled by increasing personal incomes. However, stronger gains will be limited by demand declines in Japan and below average growth in South Korea.

Eastern Europe will grow at an above average rate, buoyed by an acceleration in motor vehicle production in the region, as well as ongoing replacement of thermoset rubber by TPEs. Rebounds in motor vehicle output in the US, both major motor vehicle TPE markets, will support moderate growth in demand in North America. In Western Europe, accelerating demand for TPEs in Germany will be offset by declining motor vehicle production in France and slowing output in other countries in the region.