Tax Day 2019: A Look at Walmart Tax Services

by Sarah Schmidt

April 15, 2019

Today is Tax Day 2019 and among the many options consumers will inevitably choose to help file on time is to head to their local Walmart for assistance. The supercenter has enjoyed a longstanding relationship with Jackson Hewitt, one of the largest tax preparation services in the country. Filing with Jackson Hewitt in 2019 is likely to be even more appealing as the company was among those that claimed that its early filers “saw larger refunds and overall lower tax liabilities” during a time when some other early filers were reporting the opposite, according to an article by the Detroit Free Press.

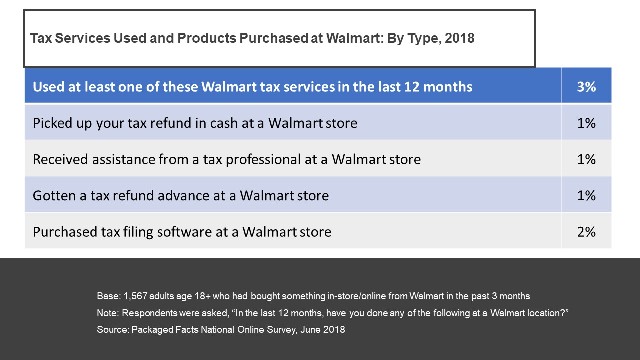

According to Packaged Facts’ National Consumer Survey featured in the report U.S. Financial Services Focus: The Walmart Shopper, about 3% of respondent Walmart purchasers have used a Walmart tax service in the last 12 months at a Walmart store by: picking up their tax refund in cash, receiving assistance from a tax professional, or getting a tax refund advance at a Walmart location.

The Jackson Hewitt Connection

For more than a decade, Jackson Hewitt has had the exclusive right to provide tax preparation services within Walmart stores, and the relationship has deepened over time.

For fiscal (April) 2010, the last year Jackson Hewitt filed an annual report as a public company, 17% of the tax returns it prepared were generated in stores located in Walmart, a share that has surely since increased as Jackson Hewitt’s relationship with Walmart deepened. For context, during the 2010 tax season, it had 1,770 Walmart locations; by the 2017 tax season, it had about 3,000 Walmart locations.

Historically, compensation to Walmart consisted of fixed license fees for each Walmart store in which a Jackson Hewitt Tax Service office operated, additional fees based on the number of tax returns prepared by each office in the applicable tax seasons, and additional fees based on the preparation and filing of tax returns through Jackson Hewitt’s online tax preparation software.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Packaged Facts Blog Subscription

Provide the following details to subscribe.