U.S. Pet Population in the Wake of COVID-19

by David Lummis

April 5, 2021

When the initial impacts of COVID-19 started being felt beginning around March 2020, the pet industry anticipated that dog ownership especially would get a boost among a national population that found itself homebound, socially isolated, and well aware of the mental and physical health benefits of pet ownership, including in relation to stress.

Even so, few anticipated the extent to which pet appeal would be unleashed, with a surge in pet adoption and acquisition not only of dogs but also of cats and other types of pets, including reptiles and small mammals such as rabbits, hamsters, and gerbils. Packaged Facts survey data now show that, among current pet-owning households, 35% adopted pets in the 12-month period ending February 2021.

The overall percentage of U.S. households owning pets therefore notched up to 56% in 2020, with 44% of households owning dogs, 25% owning cats, and 12% owning other pets (including fish, birds, small mammals, and reptiles/amphibians).

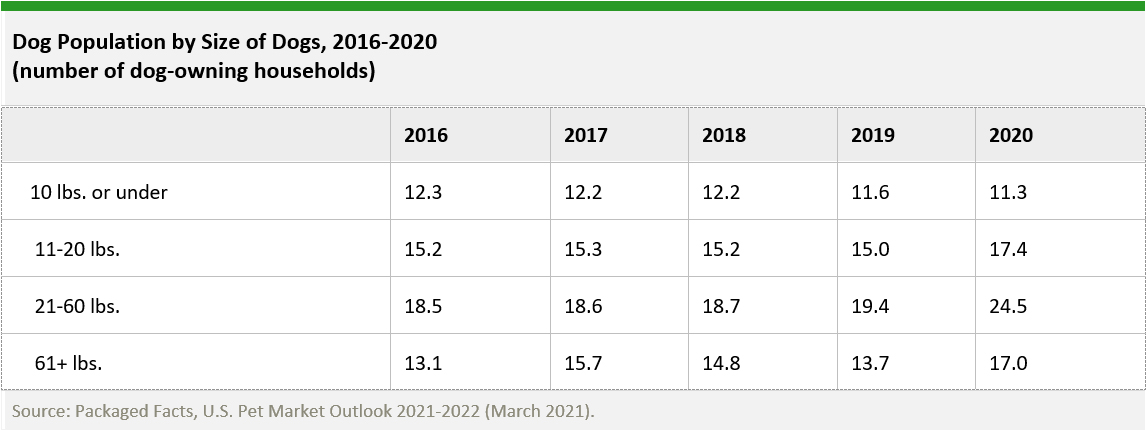

With this reset of pet ownership, the pet population is showing a pendulum swing toward medium-size dogs, and away from the smallest dogs, partially in tandem with the “suburbanization” of lifestyles in the wake of COVID-19.

- Packaged Facts survey data for February 2020 vs. February 2021 show the share of dog owners with small (9-24 lbs.) dogs dipping from 41% to 36%, while the share with medium-size (25-40 lbs.) dogs edged up from 35% to 38%.

- MRI data show a 6 million jump in the number of households with medium-size dogs, more broadly classified as those weighing 21-60 lbs., from 18.5 million in 2016 to 24.5 million in 2020.

By age rather than type or size of pet, the big story is senior pets. As of 2020, 55% of dog households and 53% of cat households had senior pets, with the share of dog-owning households with senior pets rising by ten percentage points from 45% in 2014 to 55% in 2020.

Older pets mean more companion animals are suffering from age-related conditions, including mobility- and weight-related. Senior-targeted pet products target age-related special needs, and because of their more specialized health focus, senior products and services are typically priced well above the market average. Older pet populations also drive human-style advancements in veterinary care, medications, and supplements supported by newer payment options such as pet insurance and pet wellness plans. Moreover, as pets age, the human/animal bond deepens even further, creating an increased willingness among pet owners to do whatever it takes to keep their pets healthy and happy for as long as possible.

Where to Learn More

For more information, see U.S. Pet Market Outlook 2021-2022, which analyzes current and projects future retail sales and trends across the U.S. pet industry, factoring in the known and longer-term impacts of the coronavirus pandemic.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Packaged Facts Blog Subscription

Provide the following details to subscribe.