Report Overview

Featuring 21 tables and 13 figures – now available in Excel and Powerpoint! Learn More

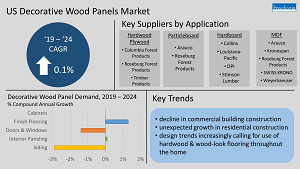

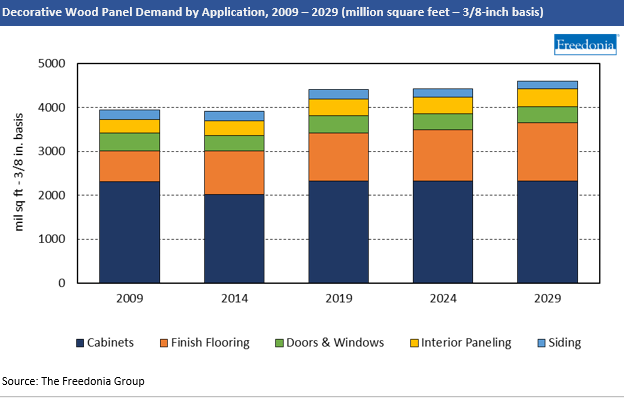

Demand for decorative wood panels is projected to remain around 4.4 billion square feet, as measured on a 3/8-inch basis, through 2024, restricted by:

- a moderation in new home construction, as many products that utilize decorative panels – such as cabinets and siding – are installed during the construction process

- a decline in commercial building construction in the early part of the forecast period, as losses will not be recovered even after the market begins to rebound

- declining use of decorative wood panels in siding and doors

Preventing declines in decorative wood panel demand will be an increase in their use in finish flooring applications as well as sustained demand for cabinets. Both markets will benefit in the short term from unexpected growth in residential construction, while finish flooring is expected to offer longer term gains due to continued design trends favoring use of hard surface flooring.

Unexpected Interest in Residential Construction Sustains Decorative Wood Panel Demand

Decorative wood panel demand is concentrated in the residential market, where these products are commonly used in such applications as cabinets and finish flooring. Growth in both residential remodeling and new home construction in the second half of 2020 and into 2021 and 2022 helped prevent losses for these products throughout the pandemic.

Although new home construction and residential renovation spending are expected to regress back toward 2019 levels near the end of the forecast period, losses will be offset as the commercial market begins to turn around from prolonged losses, particularly among such buildings as offices, healthcare facilities, and schools and universities, which are intensive users of decorative panels in cabinets and interior wall panels.

Finish Flooring Application a Bright Spot for Decorative Panels

While demand for decorative wood panels will remain flat or decline in most applications by 2024, finish flooring will be an exception, growing over this period. Gains will be driven by the rising use of flooring made from hardwood plywood because of its aesthetic and performance properties, which will lead consumers to specify it over less durable materials. Design trends are increasingly calling for use of hardwood and wood-look flooring throughout the home, including in rooms where carpet and tile once predominated.

Other design trends, however, are having a moderating effect on decorative wood panel demand. The continued popularity of open floor plans is reducing the number of doors installed per home, and interior wood paneling remains relatively unfashionable as a wall covering, with homeowners instead turning to products such as wallpaper and tile to add interest to their wall spaces.

Demand by Application

Demand for decorative wood panels is expected to reach 4.4 billion square feet, as measured on a 3/8-inch basis, in 2024, similar to the 2019 level. Faster gains will be restrained by:

- a decline in demand for panels used in doors due to weakness in commercial building construction and the rise in popularity of open floor plans

- stagnation in cabinets demand due to volatility in the residential market and weakness in construction of the commercial buildings in which these products are most commonly installed, combined with reduction in the amount of particleboard used per cabinet

Preventing declines in decorative wood panels demand will be an increase in their use in finish flooring.

Cabinets

Demand for decorative wood panels used in cabinets affixed to building structures is projected to remain flat through 2024 at 2.3 billion square feet, as measured on a 3/8-inch basis. Demand growth will be prevented by:

- a moderation in new residential construction following strength in the early part of the forecast period

- a drop in the construction of commercial buildings in which cabinets are often used, particularly hotels, office buildings, restaurants, and educational facilities

Preventing losses in decorative wood panel cabinet demand will be:

- the high level of homeowner preferences for the aesthetic of wood cabinets in their residences compared to cabinets made of other materials

- the favorable performance properties of wood, including structural strength and resistance to wear

Decorative wood panels used in cabinet manufacture include:

- particleboard

- hardwood plywood

- MDF

- hardboard

- softwood plywood

Concentration of wood panel use – as well as the type of wood panel – depends somewhat on the type of cabinet. Higher end cabinets tend to only use these products in unseen components such as the cabinet box, while lower end products use wood panels in a wider range of applications:

- Hardwood plywood is most commonly used to produce higher end, custom cabinets.

- Particleboard dominates low- to mid-range stock cabinets, though material improvements have allowed these products to be increasingly used in higher end cabinets as well.

- Hardboard is sometimes specified in cases where strength, durability, and water resistance are particularly important.

Demand for particleboard, the dominant decorative wood panel product used in cabinet manufacture, is expected to decline due in part to decreases in the amount of particleboard used in cabinet production. While it will remain the most used product for cabinets, it will lose share to cabinets made from hardwood plywood – which is considered more aesthetically pleasing – and to MDF, which is less expensive.