Report Overview

Featuring 91 tables and 73 figures – now available in Excel and Powerpoint! Learn More

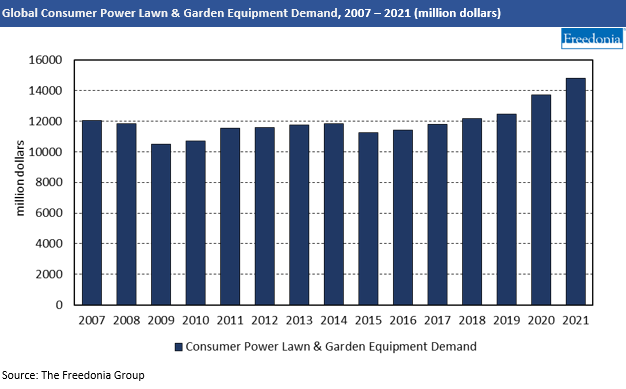

Global consumer demand for power lawn and garden equipment is projected to increase 2.1% per year to $15.2 billion in 2025. While rising consumer spending and single-family housing construction will provide sales opportunities, suppliers will be challenged to build on an elevated pandemic-era market.

Pandemic-Related Boom in DIY Drives Sales

An increase in time spent at home due to the COVID-19 pandemic spurred increased participation in DIY activities – including lawn and garden care – beginning in spring 2020. As a result, sales of power lawn and garden equipment to consumers were at elevated sales levels in 2020 and 2021. This trend was particularly noticeable in the US, which is by far the largest market for these products worldwide.

While short-term societal shifts have been a boon to the consumer power lawn and garden equipment industry during the pandemic, it remains to be seen how much of these gains can be retained. It is expected that sales growth will slow through 2025 as:

- Some consumers who increased their participation in DIY activities during the pandemic shift back to relying on landscaping services.

- Those who continue to DIY their yard care may have already purchased the equipment they need and will not need to repair or replace in the short term.

However, many pandemic-era trends – particularly the expansion of remote work – may prove to be permanent to an extent, potentially allowing sustained higher sales.

Robotic Mowers Offer Opportunities Outside of DIY

Robotic lawn mowers are already popular in Western Europe and are expected to become even more prevalent throughout that region in the 2020s. These products have not yet caught on in the US and hold opportunities for significant growth, although the particularly strong DIY lawn care culture and high average yard sizes in that country makes it uncertain whether they will be able to achieve market penetration similar to that in Europe.

Robotic lawn mowers could also be an important tool for lawn and garden equipment suppliers to generate sales outside of the US and Western Europe. In many lower income countries, demand is suppressed by lack of interest in DIY lawn care, and this cultural factor poses a restraint on sales gains even as countries like India achieve rapid economic growth. Robotic mowers hold the potential to not only take market share from commercial landscaping services, but to serve as a bridge to greater consumer interest in lawn care products.

Battery-Powered Equipment Holds Best Prospects

Rising penetration of battery-powered consumer lawn and garden equipment has been one of the most important trends of the 21st century and will remain a major factor throughout the 2020s. Battery power will continue to increase its market share in handheld products like string trimmers, while a newer trend is the use of this technology in larger products like riding mowers. As the technology improves, it is expected that battery-powered consumer lawn mowers will become an increasingly significant share of the market.

Historical Market Trends

Consumer demand for power lawn and garden equipment is impacted primarily by the health of the general economy and personal income levels, as well as by climate and weather patterns.

Sales of these products are sensitive to fluctuations in:

- consumer spending

- housing completions

- residential lot sizes

- cultural preferences, including the presence of a lawn culture

In addition to economic factors, demand for power lawn and garden equipment can be significantly impacted by weather patterns and climate change. For example:

- Snow blowers see higher market penetration in regions with colder weather.

- Regions that experience less rainfall and/or see adoption of water-saving landscaping techniques, such as xeriscaping, are less likely to require power lawn and garden equipment to maintain grass and plants.

Regional Trends

Demand by Region

Global consumer demand for power lawn and garden equipment is forecast to rise 2.1% per year to $15.2 billion in 2025. Sales growth is expected to moderate somewhat, as demand in 2020 was elevated by consumers spending more time at home during the COVID-19 pandemic.

North America and Western Europe will account for a combined 92% of growth through 2025, with the US alone comprising 64% of sales gains:

- This is mainly attributable to the longstanding dominance of these regions in consumer sales; markets in these regions tend to be mature, and growth will not be particularly fast.

- Increased single-family housing construction and rising consumer spending will provide growth opportunities, although this will be offset by the waning of short-term pandemic impacts.

- Some gains will accrue from the rising penetration of robotic mowers, which will offer homeowners seeking to avoid labor an alternative to hiring landscaping services.

The pace of gains in the Asia/Pacific region will also be modest, as the mature markets of Australia and New Zealand account for a large share of consumer demand in the region.

Growth in consumer power lawn and garden equipment sales will be stronger in low-income countries, particularly in the Africa/Mideast region, where growth in consumer spending and single-family housing construction will provide a boost to sales. However, the lack of ingrained lawn care cultures in these countries will continue to restrict the potential market size in the near term.