Report Overview

Featuring 45 tables and 66 figures – now available in Excel and Powerpoint! Learn More

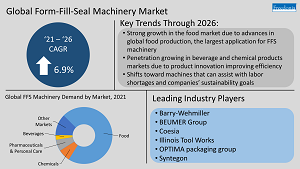

Global form-fill-seal (FFS) packaging equipment demand is forecast to expand 6.9% annually to $5.2 billion in 2026, supported by:

- rising value-added food production, the largest market for FFS machinery, leading to construction of new factories and expansion of existing sites

- competitive inroads made in applications – such as beverages and chemicals – that are currently more commonly served by stand-alone filling machines

- the continuing shift away from manual packaging techniques among small and mid-sized industrial enterprises around the world

- rising demand for state-of-the-art FFS models in mature markets (and some developing ones, like Thailand) because of concerns about workforce issues and the desire to reduce costs

- new environmental regulations and industry initiatives to increase use of green packaging, such as pouches, which often requires operators to replace older machines with new FFS equipment compatible with these materials

- ongoing shifts in some markets from rigid to flexible packaging, most notably pouches, as FFS machinery is the primary type of equipment used to produce pouches

FFS machines will continue to capture market share from stand-alone filling equipment due their greater production rates, flexibility, efficiency, and ability to automate key tasks.

China & the US Dominate Sales as Demand for Advanced FFS Equipment Grows

The US and China are forecast to account about half of all FFS packaging equipment sales growth because of their large and highly competitive manufacturing sectors:

- In the US, increased spending on advanced packaging technologies will boost productivity, reduce labor costs, and allow for greater customization of packaging. Strong interest in providing packaging that is viewed as sustainable will also encourage companies to invest in new FFS machines that are compatible with green packaging materials.

- In China, greater mechanization of packaging processes, preferences for flexible packaging in some applications, and rising use of advanced packaging equipment (driven by increasing foreign participation in Chinese industries and intensifying competition globally for a number of export-oriented industries) will support market gains.

Food Industry Will Continue to Drive Demand Growth for FFS Packaging Machinery

Food manufacturing is expected to account for 66% of global packaging machinery gains, attributable to industry output growth and manufacturers’ investments in new production and packaging capacities. Evolving consumer preferences on packaging design and intensifying competition in the global food industry will also push operators to replace older machines with more capable models (e.g., short packaging runs and greater customization capabilities). Growth will be aided by the strengthening of regulatory frameworks in both developing and mature markets (e.g., environmental, product, and safety standards). This trend will spur sales of more advanced FFS models, such as machines with ultra-clean capabilities, and contribute to FFS equipment capturing market share from stand-alone filling machines.

Historical Market Trends

Trends in the global form-fill-seal (FFS) packaging equipment market are primarily affected by the following factors:

- The manufacturing sector is a critical component of every economy, but industry output levels vary greatly by country.

- The US and China – by far the two largest packaging machinery markets – together account for 46% of world FFS packaging equipment demand and have outsized effects on global trends.

- Replacement product sales are the primary driver of growth in most countries that have with established manufacturing industries.

- FFS machinery – when properly maintained – have long lifespans, though there is little aftermarket for used equipment since it is both commonly outdated and difficult to retrofit to other applications.

Among the secondary factors that can have a positive or negative impact on the global FFS equipment market’s growth, including:

- economic conditions, levels of international trade and foreign investment, and fixed investment spending trends

- changes in the value of a country’s currency

- changes in manufacturing, with trends in the food, chemicals, and pharmaceutical and personal care product industries being of particular importance

- the increasing or decreasing availability of new FFS equipment and changes in equipment prices

- the introduction of new FFS packaging technologies, which can spur both new and replacement machinery sales

- the adoption of new product, health, and safety standards, and environmental regulations (e.g., restrictions on the use of plastics)

Countries with developing manufacturing bases frequently see prolonged periods of growth as operators:

- continue to ramp up production

- begin to use FFS equipment more intensively

- shift toward more capable, pricier models

Replacement sales are a smaller driver of gains in developing markets because their stocks of FFS machinery are quite small and relatively new.

Regional Trends

Demand by Region

Sizable quantities of FFS packaging machinery are used in all of the regions of the world. This can be attributed to:

- the concentration of FFS equipment demand in the food, chemical, and pharmaceutical and personal care product industries, all of which are industries found in every region

- the high cost of much of the packaging equipment classified here compared to other product types (e.g., stand-alone filling equipment, wrapping machines)

- the compatibility of FFS machines with multiple packaging materials and suitability for a wide range of applications

- widespread availability of equipment in a range of price points

Global demand for FFS machinery is projected to increase 6.9% annually to $5.2 billion in 2026. The Asia/Pacific, North America, and Western Europe regions will account for 86% of additional demand during the forecast period because they each feature an immense, diverse, and highly-competitive manufacturing sector. Combined product sales in the smaller Africa/Mideast, Eastern Europe, and Central and South America markets are expected to grow nearly 8% annually in 2026, but gains in absolute terms will be modest.

The expansion of the global food, pharmaceutical and personal care product, and chemical industries – as well as rising industry mechanization rates in developing nations and increasing sales of more sophisticated equipment, including both automated and specialty models – will provide impetus for growth through 2026. In addition, demand will be supported by the increasing share of products packaged in pouches, which primarily use FFS for production.