Report Overview

Featuring 72 tables and 99 figures – now available in Excel and Powerpoint! Learn More

Global demand for formulated herbicides is expected to rise 3.3% per year to $39.9 billion in 2025; over the same period, demand for herbicide active ingredients is projected to increase 2.2% per year to 4.0 million metric tons. Gains will be primarily supported by rising demand from the dominant agricultural market due to:

- greater herbicide resistance in weed populations

- increasingly intensive agricultural practices in Central and South America and the Asia/Pacific region

- improved access to newer, improved herbicide formulations and herbicide use education in developing markets

The best opportunities for nonagricultural herbicides are expected in countries with expanding middle classes and increasing cultural emphasis on attractive outdoor spaces.

Herbicide Resistance in Weeds Will Promote Demand for New Herbicide Formulations

Decades of herbicide overapplication in nearly every major market have contributed to the proliferation of weed populations that are highly resistant to herbicides, including glyphosate, the dominant herbicide active ingredient. To combat these weeds, pesticide users will have to continue to increase the number of herbicide applications in a season, or turn to improved herbicide formulations. Many new herbicide formulations are more expensive, and include multiple active ingredients and improved adjuvant blends.

Evolving Agricultural Practices Will Support Shift in Herbicide Product Mix

With demand for agricultural products for food, fuel, and other uses continuing to rise, and overall global cropland area projected to remain nearly flat, agricultural production per hectare is expected to continue to increase – necessitating increased investment in agricultural inputs such as herbicides. Additionally, efforts to make agriculture somewhat more environmentally friendly will continue to support demand for herbicides used in applications such as no-till agriculture, which utilizes herbicides for pre-planting weed control in order to reduce erosion.

Lawn & Garden Applications Will Be Impacted by COVID-19 Pandemic & Shifting Cultures

Nonagricultural herbicide markets will remain highly diverse, with the US continuing to account for by far the largest share of these segments. After a decrease in professional lawn and garden residential services and an increase in do-it-yourself (DIY) gardening in the US in 2020 – when many consumers were spending more time at home – the US commercial and consumer markets are expected to shift slightly back to pre-pandemic trends. In other countries, rising personal incomes will support increased spending on gardening as a hobby. Additionally, increasingly urban populations and an emphasis on tourism in many developing countries will continue to support greater investment in the beautification of urban green spaces.

Impact of COVID-19 Pandemic

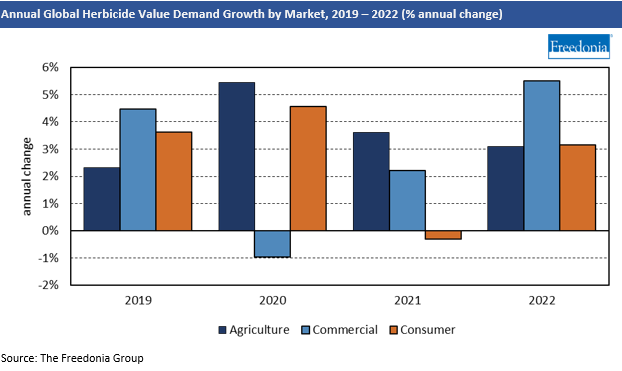

Although the COVID-19 pandemic impacted the various sectors of the global herbicide industry differently, the overall market was largely sustained by the fact that agriculture and food production are “essential” activities. As a result, demand for agricultural herbicides was not substantially affected, though there were some instances where global production and trade of active ingredients and other necessary components were disrupted.

Temporary shutdowns at chemical production facilities due to social distancing measures – particularly in the US, Europe, and China – contributed to brief supply shortages in the spring of 2020. Though most pesticide producers manufacture their agricultural products throughout the winter in anticipation of spring and summer planting and growing seasons, the temporary slowdown in production and trade of agricultural herbicides had a brief negative impact on overall agricultural herbicide consumption.

The commercial and consumer markets for herbicides experienced significantly different effects as a result of the COVID-19 pandemic, particularly in the high-income markets in North America and Western Europe:

- Some applications, like the use of herbicides for public health reasons (i.e., controlling hazardous plants such as poison ivy in public areas), were generally minimally impacted, as these uses continued to be necessary.

- The overall economic downturn during the pandemic and the closure of many office and retail spaces caused a substantial contraction in parts of the commercial market as landscaping at empty commercial space tends to be more focused on basic maintenance of lawns and garden spaces, instead of improvements and efforts to enhance beauty.

- Public budget cuts also impacted spending on some public spaces, although this was partially offset by increased attention to some public outdoor spaces such as parks, which were crucial outlets for families seeking time away from at-home isolation.

The most significantly impacted segment of the commercial herbicide industry was the residential lawn and garden service sector:

- Early in the Northern Hemisphere’s spring and summer season in 2020, there was a brief surge in the number of households remodeling or improving outdoor patio and garden space, which generally benefited these service providers.

- However, increased time at home led many homeowners to take over their own lawn and garden maintenance activities, either because of budget restrictions or because the homeowner was adopting gardening as a hobby.

- As a result, the residential service sector saw net declines in overall pesticide spending in 2020.

Some sectors of the herbicide industry have benefited from the pandemic, particularly in the US. A surge in home gardening activities contributed to strong growth in business for nurseries raising plants for sale to home gardeners. The consumer herbicide market saw a surge in activity as the number of households participating in some level of garden activities increased. Inexperienced and novice gardeners are generally more likely to spend more for value-added pesticide formulations and packaging, which further boosted sales in this category.

As the global population better adjusted to the ongoing pandemic, the herbicide market’s volatility from 2020 to 2021 settled. Not all of the new gardening participants stuck with their new hobby, and many households reverted to the use of landscaping and gardening services for managing lawn and garden pest control.