Report Overview

Featuring 245 tables and 81 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2011-2031. Now, also with tables featuring year by year data for 2018-2025.

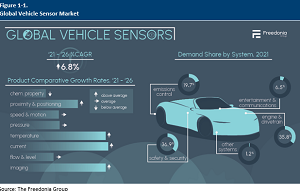

Global demand for vehicle sensors is forecast to increase 6.8% per year to $44.4 billion in 2026, driven by:

- rising electrification of vehicles and efforts to increase automation and comfort amenities in a variety of vehicle types, leading to greater use of more and different types of sensors per vehicle

- a shift away from ICE vehicles toward electric models, which use more sensors per vehicle to monitor current and temperature

- rising income levels, which support production of higher value vehicles

- ongoing recovery in motor vehicle production following the COVID-19 pandemic, when production was originally halted and then significantly impacted by semiconductor and other supply shortages

Vehicle Industries to Be Transformed by Electrification

The transition to electric vehicles represents the most important trend facing the vehicle sensors industry in the 2020s. Electric vehicles (EVs) already use sensors more intensively than comparable internal combustion engine (ICE) vehicles, and the per vehicle sales premium that sensor suppliers derive from EVs is expected to widen going forward. In addition, EVs make use of different sensor types than ICE vehicles, with the growth of EVs representing a boon to sales of temperature and current sensors, while negatively impacting sales of chemical property sensors.

Growth in the use of EVs is expected to be fastest in Western Europe, with EU nations in Eastern Europe also posting rapid gains due to the organization’s climate policies. As of fall 2022, EU nations are planning to end most sales of new ICE cars by 2035. The transition to electric vehicles in other regions is expected to be slower, but this will remain a key trend through the 2020s and well into the 2030s.

Autonomous Vehicles Represent Long-Term Growth Opportunity

While autonomous vehicles are expected to remain rare in the near term, growth in these products represents a major opportunity for sensor suppliers. Autonomous vehicles require a wide array of high-precision sensors in order to avoid collisions and meet the strict safety standards that will be required for broad deployment.

Sensor manufacturers can support the development of the autonomous vehicle market by investing in products for advanced driver-assistance systems (ADAS). Many of these systems can be viewed as a transitional technology toward fully autonomous vehicles. ADAS require similar sensor support to that needed by autonomous vehicles and are becoming increasingly common in higher-end motor vehicles.

Improving Safety Standards Continuing to Support Sales Gains

Evolving vehicle safety standards have historically represented a major driver of vehicle sensor sales growth, and this trend is expected to continue for the foreseeable future. For example, in July 2022 new regulations imposing a variety of safety features took effect in the EU. Among the newly mandated systems that will require sensor support are intelligent speed assistance, drowsiness and attention detection, reversing detection, and accident data recording.