Report Overview

Featuring 30 tables and 12 figures – now available in Excel and Powerpoint! Learn More

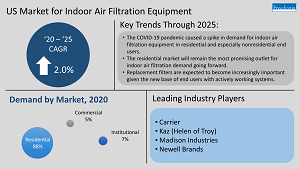

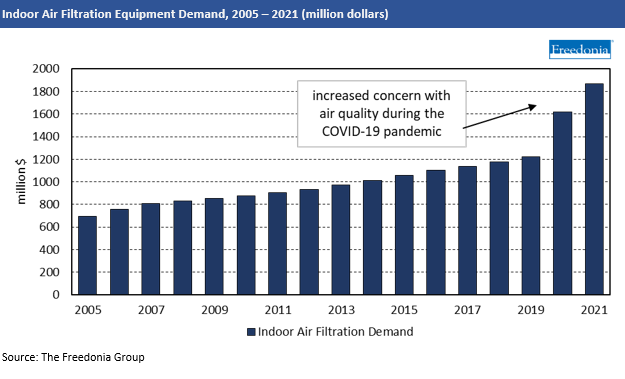

Demand for indoor air filtration equipment – including central systems, local units, and replacement filters – is expected to grow 2.0% per year through 2025 to $1.8 billion from a high 2020 base. Concerns about airborne viral loads that came to light during the COVID-19 pandemic produced a large spike in demand in 2020 and 2021. This increased level of awareness about indoor air quality – along with ongoing concerns about respiratory ailments and increased building construction – is expected to maintain demand levels well above those seen before the pandemic. However, growth will be relatively slow during the latter half of the forecast period as demand moderates to a more sustainable level.

Local Systems See Faster Short-Term Spike, but Central Systems Offer Longer Term Gains

In 2020 and 2021, local or portable air filtration systems saw stronger demand gains than central systems in every market. Local systems offered end users in these markets an air filtration system that was both easily installed and more likely to possess HEPA filtration capabilities. In contrast, central systems are more likely to require professional installation and may not be compatible with pre-existing HVAC systems. As a result, central systems will offer better opportunities beyond 2021. Additionally, central systems benefit from gains in residential building construction, where homeowners will continue to install systems that can treat the entire house as opposed to one room.

Residential Market Remains Top Opportunity for Suppliers of Air Filtration Systems

The residential market accounts for the majority of indoor air filtration system sales, because consumers are more willing to invest in products that will allay their concerns over poor air quality. Consumers who suffer from asthma or other health ailments or are concerned about inhaling bad air caused by wildfires, which are increasingly common, particularly in the western half of the US. Additionally, the pandemic has forced more consumers to spend more time at home and prioritize their air quality, a trend that will likely continue as many employees continue to work from home, either permanently or as part of a hybrid model.

Replacement Filter Demand Supported By Increasing User Base & Higher Value Products

Replacement filters experienced strong gains in 2020 and 2021 due to:

- existing owners of air filtration equipment purchasing or stocking up on filters

- the large number of new users buying systems and replacement filters together in order to reduce the indoor transmissibility of the coronavirus

Going forward, suppliers of replacement filters will benefit from this enlarged user base. Sales of higher value products like smart systems will help create recurring revenue, while systems with multiple levels of filters will support volume gains. However, competition from generic replacement filters will continue to limit price growth, counteracting inflationary pressures to an extent.

Historical Market Trends

The use of indoor air filtration systems is typically motivated by a need to improve indoor air quality due to:

- health concerns, such as seasonal allergies, asthma, or immunocompromised individuals

- odors

- concern over air pollution from air contaminants such as particulates, VOCs, or microbials

- wanting to live a healthy lifestyle generally

Additionally, sales of these products are dependent on macroeconomic factors, such as:

- building construction and renovation

- personal consumption spending

- housing completions and housing sales

- demographic trends

In addition to an increase in the number of air filtration systems, demand for replacement filters is supported by consistent filter replacement among current system end users, along with improvements to air filtration technology, such as filter replacement indicators and higher value filters.

Markets

Demand by Market

The residential market – which accounted for 88% of indoor air filtration equipment sales in 2020 – is the largest and most mature when comparing adoption on a per-household or per-building basis. Consumers, for a variety of reasons, have been more likely to take steps to improve their indoor air quality. For instance, consumers who are susceptible to asthma or other health ailments use air purifiers to prevent potential breathing issues at home. Additionally, consumers are most likely to see the cost of these products as more worthwhile in terms of value, since they personally reap the benefits and they generally have less building space to treat.

While the nonresidential markets for HVAC equipment are larger in value terms than the residential market, adoption of indoor air filtration has not occurred to the same extent. Building owners have typically relied on central HVAC filters to provide clean air to the various parts of a building. That said, the COVID-19 pandemic has made improving indoor air quality paramount in nonresidential spaces like schools. Federal funding from COVID-19 relief bills have allowed schools to make considerable investments in their indoor air filtration systems.