4 Key Trends in the US Gutters & Downspouts Market

by Peter Kusnic

April 20, 2021

The COVID-19 pandemic had a varying effect on demand for gutters and downspouts in 2020, with the residential market outperforming expectations as home construction rebounded in the second half of the year and strong storm activity bolstered the need to replace and repair. Additionally, a pandemic-induced influx of younger city-dwellers into the suburbs, many for good, boosted home sales.

In contrast, the commercial market declined as many businesses – especially light commercial establishments that frequently occupy buildings with gutters and downspouts – canceled or delayed projects due to falling revenues.

A new Freedonia Group analysis examines near- and long-term growth opportunities in the US market for gutters and downspouts, which is forecast to expand to advance an average of 2.0% annually to $5.4 billion in 2025. Highlighted below are four of the key findings from our research.

Pandemic’s Varied Impact on Residential & Commercial Markets Will Linger in 2021

The pandemic will continue to affect the residential and commercial gutters and downspouts markets differently even as the virus recedes in the US. For instance, in the residential market, demand in new residential applications will grow, although at a more moderate pace than that seen between mid-2020 and 2021, as continuing interest in living outside of densely populated cores spurs gains in single-family housing completions.

While much smaller than the residential market, the commercial market will continue to be affected by the pandemic as fewer office buildings, restaurants, and retail outlets will be built or refurbished due to a glut of available space.

- A number of businesses – such as restaurants and office complexes – that closed during the pandemic are not expected to reopen. This glut of empty commercial buildings will hamper new construction activity.

- Other structures – such as medical facilities, warehouse and distribution complexes, and data centers – will increasingly be constructed. Many of these buildings will include gutter and downspout systems to minimize leaks and move water off of roof surfaces,

Dominance of Residential Market To Be Bolstered by Design & Construction Trends

The residential market will continue to be the leading outlet for gutters and downspouts. Not only do more than half of the residences in the US already feature gutters and downspouts – which often require replacement – more homeowners are embracing construction projects that encompass these products:

- Homeowners looking to improve drainage around their residences will repair or place gutters, either as a standalone project or as part of more comprehensive roofing work.

- Homeowners are increasingly interested in installing systems with gutter guards to eliminate the need for periodic gutter cleaning.

- Home design trends are leading to increased construction of homes with multiple gables, which both provide visual interest to a home and boost the amount of gutters required for proper drainage.

Gutter Guards Will See Most Rapid Demand Gains Through 2025

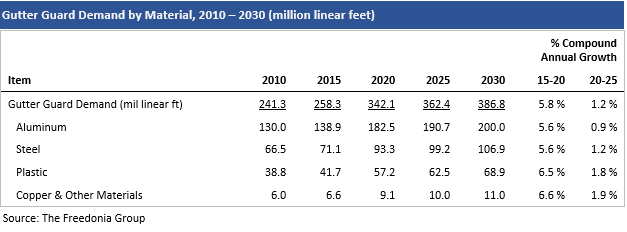

Among all gutter and downspout products, gutter guards will see the fastest growth. These items – which prevent gutters from being clogged by fallen leaves, pine needles, and other debris – will see increasing use as homeowners install these items to minimize the need to periodically clean gutters, a time-consuming and potentially dangerous task. Metal gutter guards will continue to account for the largest share of demand, but plastic products will post above average gains due to their low cost and light weight, which boosts their appeal to those looking for a DIY project.

Rainwater Harvesting Represents an Opportunity to Diversify for Gutter & Spout Suppliers

Growing interest in rainwater harvesting provides growth opportunities for rainware companies and contractors that are diversifying their product lines to combat market maturity. Certain gutter guards, for example, can help strain and channel water into catchment systems. One gutter guard company, Gutterglove, earned Underwriters Laboratories (UL) certification for its steel mesh gutter guard, indicating that the water strained by the product is fit for human consumption.

Rain harvesting has long been popular in dry areas of the West and South but is growing in popularity elsewhere in the US. While some homebuilders add rain harvesting equipment to create more environmentally friendly residences, in most cases these systems are installed by homeowners aiming to reduce water consumption or to be more self-sufficient.

Nearly all states have active rainwater harvesting programs, and reliance on these programs is expected to increase as the effects of climate change on water supplies grows. For instance, in some parts of the world where water scarcity is an increasingly urgent concern, usage of rainwater is mandatory.

Want to Learn More?

Gutters & Downspouts is now available from the Freedonia Group.

About the Author:

Peter Kusnic is a Content Writer with The Freedonia Group, where he researches and writes studies focused on an array of industries.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Freedonia Group Blog Subscription

Provide the following details to subscribe.