Report Overview

Featuring 135 tables and 162 figures – now available in Excel and Powerpoint! Learn More

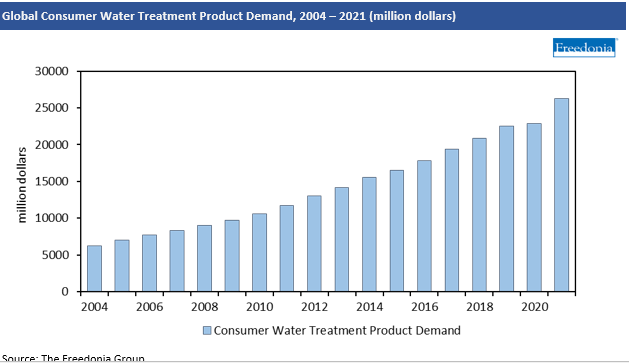

Demand for consumer water treatment products – including systems and replacement parts – is expected to grow 8.4% per year through 2025 to $34 billion, supported by:

Demand for consumer water treatment products – including systems and replacement parts – is expected to grow 8.4% per year through 2025 to $34 billion, supported by:

- rising new housing construction, personal incomes, and economic growth

- continued product development, supporting upgrades and sales of higher value system sales

- ongoing concern for water quality issues and continued education on how water treatment systems can help alleviate them

Although the COVID-19 pandemic slowed sales in 2020, the global consumer water treatment market still posted modest gains in that year, and this rapid expansion will come from a sustained (rather than depressed) base.

China to Account for Half of Market Gains

Global consumer water treatment products sales will be driven by China, where the market will expand at a double-digit rate and account for half of all new sales. Demand for consumer water treatment products grew exponentially over the last decade as the country’s economy and residential building construction boomed, allowing China to overtake the US as the world’s largest market for these products. The already-large market will continue to expand as personal incomes rise at a much faster rate than the global average, making higher value products (as well as multiple units per household) more affordable. In addition, the ongoing urbanization of the population will stoke demand for products such as POE systems, which are often installed in apartment buildings.

Consumer Education Important in Both Developed & Developing Markets

In countries with lower penetration rates of consumer water treatment products, continuing education on the benefits of these products remains essential to increasing demand. Consumer water treatment products can alleviate issues that arise from substandard water systems or limited access to treated water, and potentially offer longer term cost savings than other sources of potable water, such as bottled water.

In countries where consumer water treatment is established and its benefits are well known, educating consumers on new treatment technologies is important. Further improvements to available products – such as systems that remove more contaminants or notify consumers when to replace filters or other parts – can motivate more consumers to invest in upgrades and support more frequent sales of replacement parts.

Membrane Separation Increasingly Popular Due to Its Superior Performance

Membrane separation technology will continue to increase its share of the consumer water treatment market due to its ability to remove more contaminants than a number of other technologies, most notably conventional filtration. This technology is especially useful in areas where there is an inadequate public water system or significant groundwater contamination. However, conventional filtration will continue to play an important role in the market, as its low cost and ability to improve the taste and odor of drinking water as well as remove a fair amount of contaminants make it good option for many consumers.

Historical Trends

Demand for consumer water treatment products is subject to a number of regional variables, including:

- access to potable water

- state of infrastructure and municipal treatment

- awareness of water quality issues and knowledge of options to treat water at the consumer level

- availability of consumer water treatment products

- competition from bottled water consumption and other low-cost treatment techniques

Sales of consumer water treatment products are also dependent on whether a country has a developed and industrialized economy or it is still emerging. Moreover, the current health of the economy can indicate the outlook for the market. A variety of economic factors can drive sales of consumer water treatment products, including:

- new housing construction

- residential building expenditures

- average incomes

- personal consumption expenditures

- gross domestic product

In general, healthy economic trends support increased sales of consumer water treatment products. For instance, growth in new housing construction supports sales of POE systems –and to a lesser extent POU under-sink systems – as these systems are often installed when a home is constructed or within the first year of occupancy. Increases in average incomes allow more consumers to purchase water treatment systems, using disposable income on these systems and their aftermarket components.

Growth in demand for consumer water treatment has continued year over year for the past decade, supported by:

- increased awareness of water quality issues, particularly in light of highly publicized stories concerning water contamination and water threats

- more products with higher level treatment capabilities, including membrane separation systems, entering the market

- substantial growth in large and emerging markets, such China

- wider availability and awareness of systems and their capabilities.

This study covers the global market for consumer water treatment products, which includes consumer water treatment systems and their replacement parts, such as filters and membranes. The main designation for consumer water treatment systems is the point at which treatment occurs, entry or use:

- Point-of-entry treatment is defined as treatment at the location where water enters the household for the first time, prior to being dispersed to the home’s faucets.

- Point-of-use treatment is defined as treatment at the point where water will be consumed or used for other purposes, and is broken out into the following segments:

- under-sink

- countertop

- faucet-mounted

- flow-through

- others, such as atmospheric, showerhead, reusable water bottles, and filter straws

Excluded from the scope of this report are refrigerator water filters and pitchers because these systems are originally sold to equipment manufacturers and only the replacement units are sold to consumers. Water softeners are also excluded from the scope of this study. Demand is also measured by technology used, which includes:

- conventional filtration

- membrane separation

- distillation

- other niche types, such as, UV disinfection, and ozone treatment

The technology under which a particular product is classified is determined by the highest level of treatment in that system. For instance, if a product includes both conventional filtration and reverse osmosis, it is labeled as a reverse osmosis system because that technology removes the most contaminants. Historical data for 2010, 2015, and 2020, and forecasts for 2025 and 2030 are provided for sales of consumer water treatment products at the aggregate level on a country-by-country basis, valued in millions of current US dollars, including inflation. Demand for consumer water treatment systems is provided in units and current dollars and is detailed by technology and product type. Thus, data are presented for water treatment systems by technology (conventional filtration, membranes, and other) and by type (point-of-entry water treatment systems, and countertop, under-sink, faucet-mounted, and flow-through and other point-of-use systems).