Report Overview

Do you need an accurate accessment of this fast-growing, emerging market?

-

Answers on amount of investments

-

Current and forecasted growth of infrastructure and private charging stations

Look at the level of detail below.

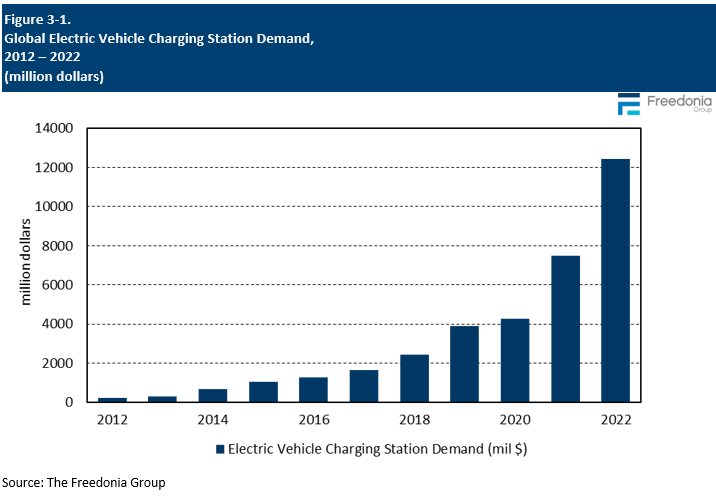

This Freedonia industry study analyzes the $12.55 billion global EV charging station industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (EV charging station hardware, EV charging station software, EV charging station services), market (public and semi-public, private residential, fleets), and region (Americas; Europe, Middle East, and Africa; Asia/Pacific). Charging station demand and stock by charging level (level 1, level 2, level 3) are also addressed. The study also evaluates company market share and competitive analysis on industry competitors including ABB, ChargePoint, Starcharge, State Grid Corporation of China, TELD, and Tesla.

global EV charging station industry. It presents historical demand data (2012, 2017, and 2022) and forecasts (2027 and 2032) by product (EV charging station hardware, EV charging station software, EV charging station services), market (public and semi-public, private residential, fleets), and region (Americas; Europe, Middle East, and Africa; Asia/Pacific). Charging station demand and stock by charging level (level 1, level 2, level 3) are also addressed. The study also evaluates company market share and competitive analysis on industry competitors including ABB, ChargePoint, Starcharge, State Grid Corporation of China, TELD, and Tesla.

Featuring 199 tables and 68 figures – available in Excel and Powerpoint! Learn More

Read the blog about EV Charging Stations!

Global demand for electric vehicle charging stations is forecast to increase 16% per year to $26.6 billion in 2027. In unit terms, sales will increase 20% per year to 37.0 million charging points. Falling product costs will contribute to increased deployment, although this will temper the pace of gains in value terms. Rising EV purchases will spur rapid growth in private charger demand, while governments will continue to provide strong regulatory support for the deployment of publicly accessible EV charging stations.

EU Policy Driving Rapid Gains in European Markets

Sales of EV charging stations in both Western and Eastern Europe are expected to increase far faster than the global average. Growth will be fueled by EU climate policies, which aim to end sales of new ICE vehicles by as early as 2035. Governments will continue to support this initiative through a variety of policy tools, including rebates for EV charging station providers and tax incentives for EV owners.

Several West European nations – most notably Sweden and Norway – were early adopters of EVs and, as a result, have developed their charging station markets significantly faster than the rest of the world. Growth in these relatively mature markets will slow, but larger economies in the region will begin catching up on EV adoption and fuel large gains in charging station demand. In addition, East European markets with underdeveloped charging infrastructure will roll out stations rapidly to comply with EU policy goals.

Private Residential & Fleet Markets to Post Above Average Growth

The public and semi-public market accounted for the majority of EV charging station demand throughout the 2010s, reflecting high equipment costs and government efforts to increase EV adoption by deploying public charging infrastructure in anticipation of future need. While this market will retain the largest share of demand over the near term, other segments will account for increased shares.

Growth in the private residential market will be linked to new EV sales; the most basic, level 1 charging cables – commonly bundled with vehicles – will account for the majority of gains in unit terms. In addition, greater adoption of EVs in high-income nations will promote significant sales of level 2 home charging stations.

The fleet market for EVs will be boosted by greater use in applications like taxis, delivery, and rental cars. In addition, heavy electric vehicles – currently a niche – will be deployed in more significant numbers. Fleet charging solutions for applications like electric buses tend to carry very high values, reflecting both the power needs of heavy vehicles and use patterns that call for a low number of vehicles per charger.

Future Potential for EV Adoption Allows North American Nations to Gain Market Share

The Americas was the smallest regional market for EV charging stations in 2022, reflecting lower rates of EV adoption in the US and Canada than in West European nations. However, high vehicle ownership rates give these countries massive future potential for EV and charging station demand. Growth in both countries is expected to exceed the global average, and the Americas will account for an increasing share of global EV charging station demand throughout the 2020s.

Historical Market Trends

Demand for EV charging stations is primarily driven by production and use trends for battery electric vehicles (BEVs). Historically, market trends for plug-in hybrid electric vehicles (PHEVs) were also an important driver of demand. However, PHEVs represent a transitional technology and will rapidly decrease in importance going forward.

Among EV charging products, sales of level 1 equipment are most tightly linked to EV sales trends, with owners and operators of EVs representing the primary market for these products. Level 1 charging equipment is typically included with purchases of new EVs, on close to a one-to-one basis. Expansion of the EV park also supports increasing replacement sales of these products.

The majority of demand for level 2 and level 3 charging equipment represents infrastructure investment by either commercial or governmental entities. As a result, trends in sales of these products are less directly impacted by year-to-year fluctuations in EV sales but are also influenced by the willingness and capacity of these entities to afford such investments.

The utility of electric vehicles themselves is tied to the capabilities of supporting infrastructure. In order to stimulate adoption of EVs, governments have therefore sometimes invested in EV charging networks beyond the immediate needs of presently existing EV fleets. As a result, many countries have seen volatility during the early development phases of their EV charging station markets, with year-to-year investment in public charging stations sometimes declining significantly in cases where infrastructure expansion temporarily outpaced growth in EV usage.

Despite sources of volatility, the global EV charging station market has expanded rapidly since 2012 alongside the EV market. Sales of EV charging stations have increased at a double-digit annual rate in almost every year, with annual growth falling below 40% in only three years between 2012 and 2022. Even in 2020 – the first year of the COVID-19 pandemic – demand for EV charging stations posted healthy growth, aided by automaker prioritization of EVs in allocating supply-constrained components.

Electric Vehicle Charging Market Overview

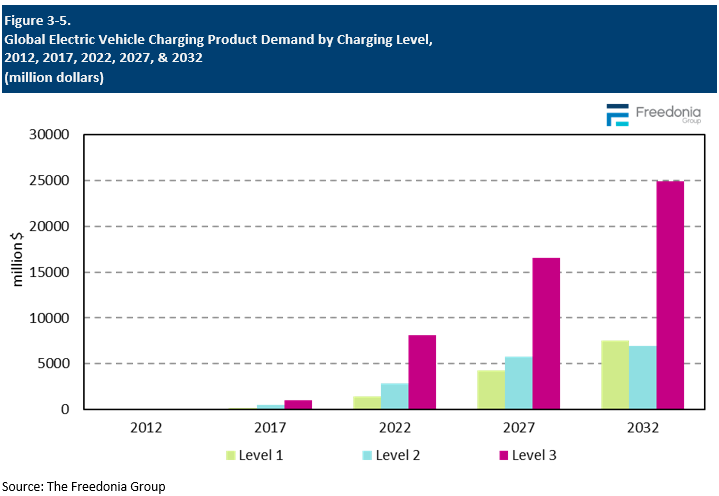

Demand by Charging Level

EV charging stations are commonly segmented by charging level:

- Level 1 charging refers to charging using basic wall outlets. In North America, such outlets typically use 120V AC power.

- Level 2 charging refers to charging using higher levels of AC charging than in level 1 charging. Level 2 charging systems can use the type of outlets used for large appliances such as washing machines.

- Level 3 charging refers to charging systems using DC power. Level 3 charging systems can also be referred to as direct current fast charging (DCFC) or simply as DC charging systems.

Through 2027, global demand for EV charging stations is forecast to increase 16% per year to $26.6 billion. Level 3 charging stations will account for the majority of growth, reflecting the very high costs of these systems.

Growth in sales of both level 2 and level 3 charging stations will be significantly stronger in unit terms than in value terms, as the price of these more complex systems is expected to drop as technology advances and economies of scale take hold. Faster growth in value terms for level 1 charging stations will be partly attributable to a higher price forecast, as these products are fairly simple and have relatively limited potential for cost reductions as the industry develops.

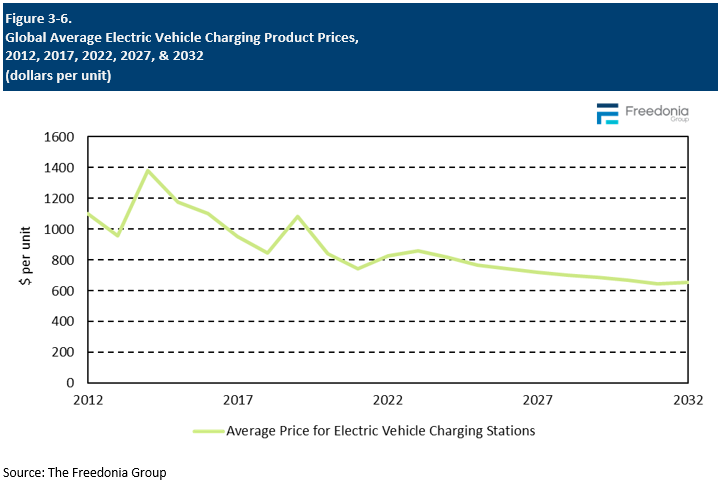

Pricing Patterns

Prices for EV charging stations are impacted by a variety of factors:

- costs of raw materials and components

- energy costs

- labor and logistical costs

- government regulations

- innovations in production processes

The EV charging station industry includes a wide range of products that can vary significantly in cost. At the low end, a basic consumer charging cable for level 1 charging can cost as little as $100, while hardware for a level 3 fast charging station can cost over $50,000 per port. Costs can also vary significantly within a single charging level based on application:

- a private residential level 2 charger typically costs $500 or less at the manufacturer’s level

- level 2 chargers for public and semi-public applications can cost $3,000 or more

As EV charging stations represent a relatively young market, in recent history, costs have typically declined over time due to improvements in production processes and developing economies of scale. These factors have mainly manifested in level 2 and level 3 charging stations, as level 1 chargers tend to be relatively simple products with less potential for cost reductions.

As with many other industries, the inflationary environment associated with the COVID-19 pandemic led to higher than average price growth in 2021 through 2022. Increased component costs offset the broader cost reduction trend, and prices for level 2 and level 3 chargers in most applications increased in these years (although this change was masked to an extent by changes in the product mix).

With supply chains stabilizing and materials and energy costs normalizing, prices for level 2 and level 3 EV charging stations are again expected to decline going forward. On a like-for-like basis, annual cost reductions for most of these products are expected to be around 1% through 2027, although changes in the geographic and market composition of demand will continue to impact trends in observed average product cost. Prices for level 1 EV chargers are expected to increase at a moderate rate, reflecting the relative technological maturity of these products.