Report Overview

Eastern and Western Europe drive growth through 2026.

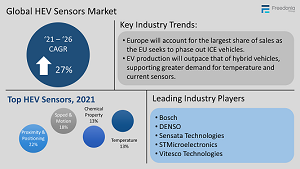

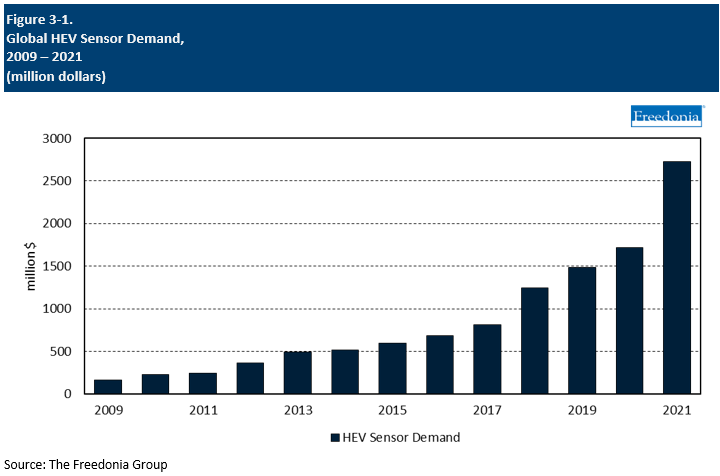

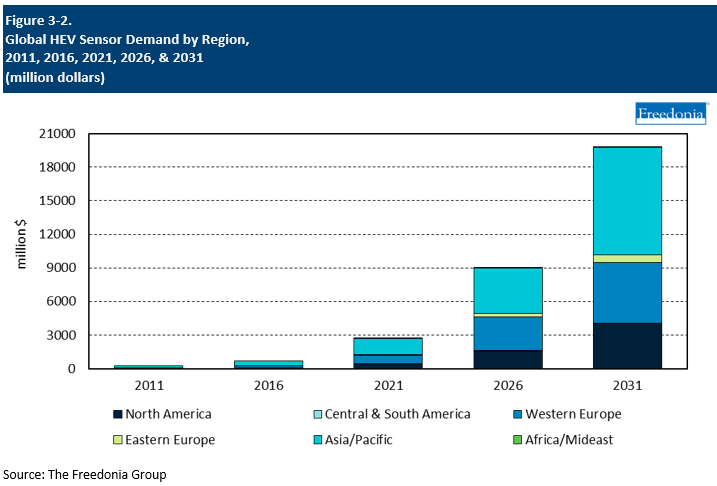

This Freedonia industry study analyzes the $2.7 billion global HEV sensor industry. It presents historical demand data (2011, 2016, and 2021) and forecasts (2026 and 2031) by type (proximity and positioning, speed and motion, chemical property, temperature, pressure, current, flow and level, imaging, and other sensors), vehicle system (safety and security, engine and drivetrain, emissions control, navigation and communications, and other systems), vehicle type (light vehicles, medium and heavy vehicles), and region (North America, Central and South America, Western Europe, Eastern Europe, Asia/Pacific, Africa/Mideast). The study discusses the impact of the COVID-19 pandemic. The study also evaluates competitive analysis on industry competitors including Bosch, DENSO, Sensata Technologies, STMicroelectronics, and Vitesco Technologies.

Featuring 210 tables and 34 figures – available in Excel and Powerpoint!

This report includes data from 2011-2031 in 5 year intervals and tables featuring year-by-year data for 2018-2025.

Read the blog on HEVs

Global demand for sensors in HEV applications is forecast to increase 27% per year to $9.0 billion in 2026. Growth will be fueled by continued rapid expansion of the global HEV industry, with manufacturing of electric vehicles posting particularly strong gains.

Environmental Policies Driving Strong Growth in Europe

European markets are expected to account for a large share of global HEV sensor sales growth through 2026, with rapid gains expected in both Western and Eastern Europe. Market expansion will be fueled by aggressive targets for the phaseout of ICE vehicles – including hybrid vehicles – under EU climate policy. EU-wide targets include a date of 2035 for ending sales of new ICE cars, while many countries in the region have adopted even more ambitious targets of their own.

Western Europe will account for the larger portion of growth, reflecting high income levels that will allow for rapid adoption of electric vehicles. East European HEV markets are less developed and are therefore expected to grow even faster from small bases. Demand for HEV sensors in Eastern Europe will be boosted by the region’s increasing importance in manufacturing vehicles for export to Western Europe. Attempts to develop domestic HEV markets in Eastern Europe will also provide opportunities for manufacturers of lower-end EVs, as consumers in the region are expected to remain relatively income-constrained compared to those in Western Europe.

EV Market to Overtake Hybrid Vehicle Market

While hybrid vehicles accounted for the majority of global HEV output in 2021, EVs are expected to capture a larger share by 2024. Countries with particularly ambitious EV adoption targets – such as those in Europe – are expected to decrease regulatory support for hybrid vehicles going forward because the internal combustion engines therein still contribute to greenhouse gas emissions. However, hybrid vehicles hold potential for growth globally; this is especially true of lower-income nations where infrastructure is, at least in the near term, expected to remain insufficient for large-scale EV adoption.

Due to the stronger growth outlook for EV production, the HEV sensor products that are expected to post the fastest gains are those that find particularly intensive use in EVs. Temperature and current sensors will account for an increased share of the market in 2026, while products used more intensively in hybrid vehicles – such as chemical property sensors and flow and level sensors – will post below average growth.

Strong Opportunities for Sensors in Value-Added Systems

While HEVs are expected to become increasingly cost-competitive going forward, these vehicles will continue to represent higher-end products on average. As a result, growth in deployment of HEVs will fuel increased sales of sensors used in value-added systems, which have relatively strong penetration in these vehicles. In particular, the increased prevalence and capabilities of advanced driver assistance systems (ADAS) will fuel demand growth for proximity and positioning sensors; imaging sensors will post even more rapid gains.

Historical Trends

The vast majority of HEV sensor sales are for OEM applications, especially given the relatively short period of time in which EVs have been in widespread use. As a result, demand is driven primarily by manufacturing trends.

Production of these vehicles is in turn impacted by a wide variety of economic factors, including consumer spending levels and investment in construction and manufacturing industries. Vehicle manufacturing can also be impacted by geopolitical events. For example, the global chip shortage that began during the COVID-19 pandemic has limited motor vehicle production, although HEVs have been less impacted than conventional motor vehicles.

While demand for HEV sensors in aftermarket applications is a small share of the total, this market will grow significantly over time as HEVs achieve more widespread adoption. Sales in these applications are impacted by consumer spending and long-term growth in the number of HEVs in use.

HEV sensor sales are also impacted by government regulations and technological developments. Many governments have established adoption targets and support schemes for HEVs, with these policies evolving over time as HEV technology develops.

Regional Trends

Demand by Region

Global demand for HEV sensors is forecast to increase 27% per year to $9.0 billion in 2026, just shy of tripling the 2022 level. All major motor vehicle producing regions will post rapid growth as market penetration of HEVs increases:

- Western Europe is expected to see the fastest growth, as the region’s ambitious environmental targets will lead to rapid adoption of sensor-intensive electric vehicles. Electrification trends will also contribute to strong gains in the EU countries of Eastern Europe.

- The Asia/Pacific region will remain the largest outlet for HEV sensors, accounting for 41% of global demand growth between 2021 and 2026. China will remain the world’s largest producer of electric motor vehicles, while manufacturing of these vehicles will advance rapidly in South Korea and Japan.

- In North America, the HEV sensor market is projected to remain smaller than that in Western Europe, reflecting relatively slow penetration of EVs in the US compared to other high-income nations.

- In the Africa/Mideast and Central and South American regions, the size of HEV sensor markets will continue to be limited by low levels of vehicle production.

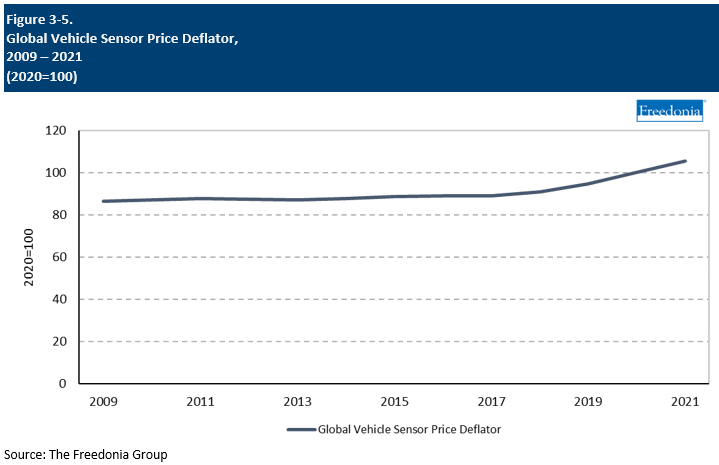

Pricing Patterns

Prices for HEV sensors are impacted by a variety of factors:

- costs of raw materials and components, such as semiconductors, resins, and metals

- labor and logistical costs

- government regulations

- innovations in production processes

In normal economic times, prices for HEV sensors have typically increased slower than inflation, reflecting improvements in production processes allowing for cost reductions. However, this has been tempered to an extent by the fact that savings from production improvements have often been used to enable production of higher performance sensors, rather than strictly being used to reduce costs.

Due to the importance of large, long-term supply contracts with vehicle OEMs, it can be difficult for HEV sensor producers to pass on costs to customers when raw materials prices rise. As a result, periods of increased costs for producers have often come at the expense of profit margins, rather than leading to immediate price increases.