Report Overview

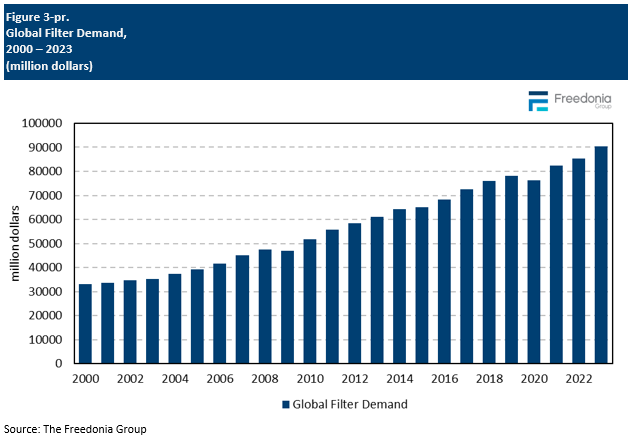

This Freedonia industry analyzes the $90 billion global market for filters. It presents historical supply and demand data (2013, 2018, and 2023) and forecasts (2028 and 2023), as well as annual data for the 2020-2027 period. Value demand by product data is shown for ICE filters (oil filters, air intake filters, fuel filters, cabin air filters, transmission filters, and all other ICE filters), fluid filters (fluid power filters, water treatment filters, and all other fluid filters), and air filters (panel and pocket filters, fabric air pollution filters, and all other air filters). The study also presents global filter demand by market (motor vehicles, motorcycles, other transportation equipment, manufacturing, consumer, utilities, off-road equipment, and all other markets). Data are provided in US dollars. The study also evaluates company market share and competitive analysis on industry competitors, including Atmus (formerly part of Cummins), Corning, Daikin, Danaher, Donaldson, Filtration Group, Mahle, MANN+HUMMEL, NGK Insulators, Parker-Hannifin, Tenecco, and 3M. It presents market share data for both the ICE filter market, and the air and fluid filter market.

This Freedonia industry analyzes the $90 billion global market for filters. It presents historical supply and demand data (2013, 2018, and 2023) and forecasts (2028 and 2023), as well as annual data for the 2020-2027 period. Value demand by product data is shown for ICE filters (oil filters, air intake filters, fuel filters, cabin air filters, transmission filters, and all other ICE filters), fluid filters (fluid power filters, water treatment filters, and all other fluid filters), and air filters (panel and pocket filters, fabric air pollution filters, and all other air filters). The study also presents global filter demand by market (motor vehicles, motorcycles, other transportation equipment, manufacturing, consumer, utilities, off-road equipment, and all other markets). Data are provided in US dollars. The study also evaluates company market share and competitive analysis on industry competitors, including Atmus (formerly part of Cummins), Corning, Daikin, Danaher, Donaldson, Filtration Group, Mahle, MANN+HUMMEL, NGK Insulators, Parker-Hannifin, Tenecco, and 3M. It presents market share data for both the ICE filter market, and the air and fluid filter market.

Featuring 268 tables and 158 figures – available in Excel and Powerpoint! Learn More

Global demand for filters is projected to expand 4.4% annually to $112 billion in 2028. In real terms, filter demand will improve significantly from its performance during the 2018-2023 period, when it was negatively affected by the pandemic’s impact on a variety of filter end users and the temporary implementation of China’s Zero-COVID policy, which adversely affected some of that country’s manufacturing industries.

Going forward, filter sales will be driven by:

-

improving conditions in the global motor vehicle industry, the single largest end use market for filters

-

concerns over air and water pollution, spurring greater investment in filtration devices among utilities, businesses, and consumers

In addition, market value will be boosted by increasing demand for advanced filtration technologies in mature markets – spurred on by the adoption of new regulations – and the ongoing transition to more advanced filter types in developing filter markets.

The Asia/Pacific Region to Account for More than Half of New Filter Demand

Between 2023 and 2028, Asia/Pacific is projected to account for 52% of global gains; with the two largest regional markets featuring favorable growth prospects:

-

Following its recovery in 2023 after a difficult 2022 that resulted from the country’s Zero-COVID policy, the immense Chinese filter market is expected to continue to grow at a healthy rate as key end-use markets perform well; consumer filters spending rises; and the Chinese government continues to strengthen environmental regulations.

-

Demand for filters is expected to accelerate in India, the region’s second largest market. In addition to strong economic and manufacturing growth, the country faces many environmental challenges, ranging from air pollution to water and soil contamination, which will drive demand for wide ranges of new and existing filtration technologies.

Electric Vehicles Offer Obstacle to Filter Sales Despite Increasing ICE Vehicle Production

Motor vehicles represent the largest global market for filters, and they are expected to account for more than 25% of absolute demand gains. From 2020 to 2022, motor vehicle production was negatively impacted by pandemic-related supply chain issues and a global chip shortage, with production finally reaching pre-pandemic levels in 2023. Going forward, the motor vehicle industry is expected to see its output steadily rise. This in turn will boost demand for internal combustion engine (ICE) filters. In addition, an increase in the global motor vehicle parc will support increased demand for replacement filters.

Despite the relative health of these underlying indicators, the ongoing shift to electric vehicles will continue to serve as a restraint against stronger growth in this market. While they do offer some opportunities for filter suppliers – specifically cabin air filters, which are generally larger in electric vehicles – the absence of fuel, air intake, and oil filters in these vehicles is a more significant impediment to sales.

Historical Market Trends

Filters are used in a wide range of industries that tend to be cyclical. These industries –including motor vehicles and other transportation equipment, industrial equipment, fluid treatment equipment, and pollution control systems – can be more sensitive to trends in the overall economy. However, the global filters market does not necessarily exhibit cyclicality itself, as two factors can mitigate the ups and downs of the marketplace:

-

To ensure the effective operation of motor vehicles, equipment, machinery, and other durable goods, filters must be replaced on a regular basis, sometimes several times each year. In general, filter purchases are not discretionary, except for some consumer air and water filters. As a result, filter purchases can be relatively steady even during periods of weak economic growth.

-

Developing markets that exhibit steady economic and industrial growth can also offset more mature markets where cyclicality may be the norm.

Filters sales can also be more affected by changes in environmental regulations and technology. For example, the phasing in of emissions standards for automotive engines has generated sustained demand for certain types of filters, such as diesel particulate filters (DPFs) and gasoline particulate filters (GPFs) in Europe, India, and China. In contrast, the development of electric automobiles, buses, two-wheelers, equipment, and machinery has been a restraining factor for filter use. Additionally, the ongoing adoption of longer lasting and more efficient filters has slowed replacement demand growth to some degree.

In general, the most important factors in determining the outlook for global filter demand on an annual basis are:

-

the outlook for the global economy and manufacturing activity

-

production and sales levels for motorized equipment like motor vehicles, motorcycles, transportation equipment such as boats, trains or aircraft, and off-road equipment

-

the base of industrial machinery and equipment in use worldwide

-

levels of water use and treatment activity in municipal, manufacturing, commercial and consumer markets

-

levels of electricity production and the types of fuels used by power plants

-

environmental regulations and government and industry standards regarding air and water pollution

-

new technology development impacting the types of engines, processes and fuels used by industry and transportation equipment

Pricing & Inflation

Like many industrial components, manufacturers’ level filter prices can vary dramatically depending on the product. In general, prices are based on a variety of characteristics, including:

Price is a dominant purchasing criterion for filters because these products are largely commodity items. Numerous strong competitors vie for a larger share of the market, so there is significant price competition to restrain price growth.

Filter prices also vary from country to country due to such factors as:

Filtration products are widely traded, and several major manufacturers have international production and marketing operations. As a result, prices (adjusted for relative currency fluctuations) tend to settle near a global standard for any given product type and level of quality, although variation remains in filter prices from area to area.

The introduction of new and innovative filtration products and improvements to the efficiency and durability of existing products provide opportunities for manufacturers to raise prices. In general, there is less pricing pressure among producers of specialty and custom filters since these products are designed for a specific application and often for a particular customer. Additionally, some segments of the filter market have relatively few suppliers, which increases the pricing power of manufacturers of these items. However, as higher-value niche products become more widely used, new firms are more likely to enter the market and exert downward pressure on prices.

Costs, such as for energy and raw materials, have increased over the past decade, making filtration products more expensive to manufacture and ship. In addition, trends toward higher-value or longer-lasting filters tend to correlate with the use of more expensive raw materials such as metal frames or higher-quality filter media.

Globally, filter prices are projected to grow 2.2% per year between 2023 and 2028, a slower pace than that of the inflation-fueled 2018-2023 period. Price increases will be supported by:

-

the development of more capable, higher-priced filtration products

-

rising input costs and elevated commodity prices

-

the adoption of more demanding air and water quality standards, emissions regulations, and technical product standards, leading to an ongoing shift to more advanced filters, especially in developing markets

Nonetheless, further price growth will be restrained by:

-

increasing filter manufacturing capabilities in developing nations with low production costs

-

the introduction of filters that have longer lifespans or can be cleaned

-

the rise of electric automobiles, buses, two-wheelers, and equipment

Global Manufacturing Outlook

The global manufacturing sector is a very important market for filters. A wide range of them are used by industrial enterprises around world. For example, some filters are needed during the production process, while others are needed to prevent the spread or infiltration of harmful by-products. OEM sales are important, but the aftermarket accounts for much of global filter demand in the manufacturing sector.

The use of industrial filters has grown rapidly across the Asia/Pacific region and many developing areas over the last decade. The adoption of new product standards and other regulations has encouraged a shift toward more advanced manufacturing filters.

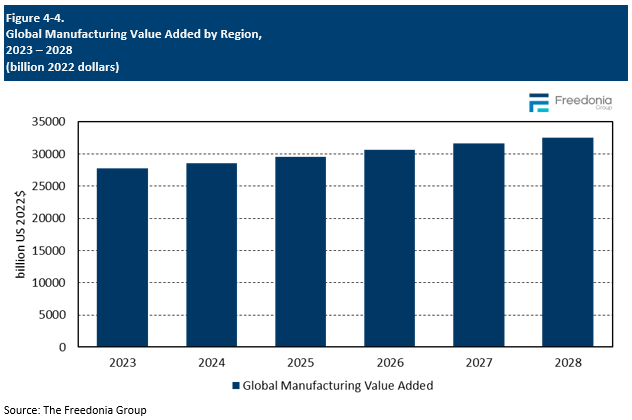

Through 2028, global manufacturing value added is projected to grow 3.2% annually to $32.6 trillion, a slight improvement over the 2018-2023 rate of growth. Nearly 70% of gains will be concentrated in the Asia/Pacific region. North America and Western Europe will account for 7% and 6% of growth during the forecast period, respectively.