Report Overview

Highlights: Motorcycle Industry Statistics

A new motorcycle industry report from The Freedonia Group features a variety of insightful data points:

- Motorcycle market size and growth: Global demand for motorcycles in value terms is forecast to climb nearly 11% annually to $174 billion in 2027, more than double the 2017-2022 rate of growth.

- Regional insights: The Asia/Pacific region is expected to account for more than 75% of gains in the global motorcycles market.

- Use of motorcycles: The global usage of motorcycles is projected to increase by 4.1% annually, reaching nearly 1.5 billion units, mirroring the growth rate observed from 2022 to 2027.

New Global Motorcycle Industry Analysis

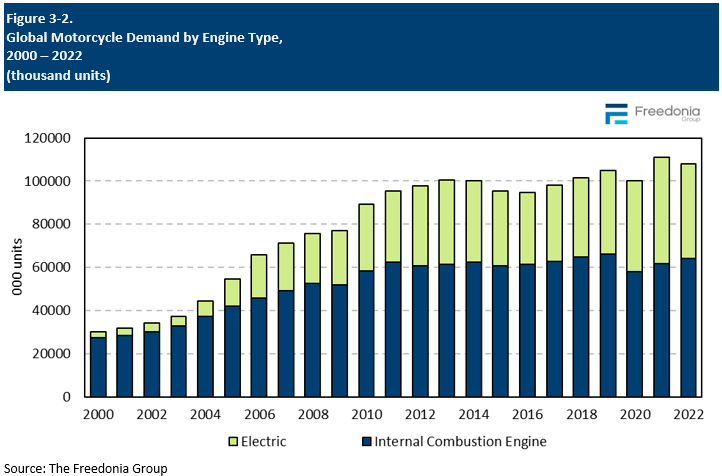

This Freedonia study analyzes the 108 million unit global motorcycle market. The study presents supply and demand figures for 2012, 2017, and 2022, and forecasts for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical motorcycle demand charts for the 2000-2022 period for all countries. Freedonia’s global motorcycle industry report also presents product demand by type data (ICE mopeds, scooters, and motorbikes; light ICE motorcycles; medium and heavy ICE motorcycles; e-bikes; and electric motorcycles, scooters, and mopeds) for 25 countries.

for 2027 and 2032. We also offer annual data for the 2019-2026 period and historical motorcycle demand charts for the 2000-2022 period for all countries. Freedonia’s global motorcycle industry report also presents product demand by type data (ICE mopeds, scooters, and motorbikes; light ICE motorcycles; medium and heavy ICE motorcycles; e-bikes; and electric motorcycles, scooters, and mopeds) for 25 countries.

Additionally, this study provides a competitive analysis of industry leaders and provides motorcycle market share for 27 leading manufacturers, such as Accell Group, Bajaj Auto, BMW Motorrad, Eicher Motors, Giant Manufacturing, Harley-Davidson, Hero MotoCorp, Honda, Italika, Jangsu Yadea, Kawasaki, Pierer Mobility, Merida, Piaggio, Suzuki, TVS Motor, and Yamaha. At the global level, the study also offers market share figures for ICE motorcycles, scooters, mopeds, and motorbikes; e-bikes; and electric motorcycles, scooters, mopeds, and motorbikes. It also presents regional market share motorcycles figures.

Featuring 288 tables and 146 figures – available in Excel and Powerpoint! Learn More

Global demand for motorcycles is forecast to expand 6.4% annually to 147 million units in 2027. The rate of growth will improve considerably over the previous five-year period as:

-

China recovers from low sales in 2022, due in part to the implementation of a stringent pandemic policy in that year

-

more stringent emission standards are implemented in some parts of the world and a general shift to electric-powered modes of transportation, boosting sales of e-bikes and other electric models

Asia/Pacific Motorcycle Market Growth

The immense Asia/Pacific market is projected to see significant demand growth, and will account for the vast majority of absolute gains through 2027:

-

Improving market conditions in China – which registered a double-digit drop in product sales in 2022 because of its strict Zero-COVID policy – will be a key driver of gains during the forecast period, especially for electric models.

-

Rising incomes in middle- and low-income countries such as India, Indonesia, Pakistan, and the Philippines will bolster sales of both new and replacement motorcycles.

-

Mature markets like Japan, South Korea, and Taiwan will expand at a solid rate during this time, largely driven by surging sales of electric models, as governments continue to promote the use of electric two-wheelers through subsidies and investments in charging infrastructure.

Rise of Electric Motorcycles and E-Bikes

Environmental concerns and wider availability will boost sales of e-bikes and other electric models. Through 2027, the e-bike segment will account for 23% of overall motorcycle market gains, while sales of electric motorcycles, scooters, mopeds, and other models climb nearly 11% per year:

-

E-bike sales will benefit from increasing consumer interest in these products as an alternative form of transportation, the rising sales of specialty models (e.g., e-cargo bikes), and the growing use of these machines for recreation (e.g., e-mountain bikes).

-

Electric motorcycle, scooter, and moped sales will benefit from a sharp increase in the number of companies offering these products, and many existing suppliers will invest in new production capacity, leading to the greater availability of these product types. Sales will also be encouraged by the shrinking performance gap between electric and ICE models.

Advances for all electric models will also be bolstered by government and industry initiatives aimed at reducing the environmental impact of transportation, ranging from subsidies to designation of new bicycle lanes.

Historical Motorcycle Market Trends

The immense global motorcycles market is affected by several related factors:

-

Two-wheelers are an essential mode of transportation in many parts of the world, and they are typically among the first to be adopted in developing nations.

-

Replacement product sales – which are highly cyclical – are the primary driver of growth in most mature markets and play a key role in numerous large, developing markets (e.g., China, India, and Indonesia).

-

The US, Japan, Taiwan, South Korea, and most West European nations have mature markets and large stocks of two-wheelers.

-

Motorcycles have a long lifespan.

Among the other factors that can have a positive or negative impact on the global motorcycle market’s growth cycles are:

-

economic conditions and level of international trade

-

changes in the value of a country’s currency

-

personal income and consumer spending trends

-

the increasing or decreasing availability of two-wheelers and changes in machine prices (e.g., high rates of inflation drove up prices in 2022)

-

the introduction of new motorcycles, scooters, mopeds, motorbikes, and e-bikes, which can spur both new and replacement machinery sales

-

the adoption of new emissions regulations for two-wheelers and technical and safety standards

-

the number of companies that manufacture and/or offer two-wheelers

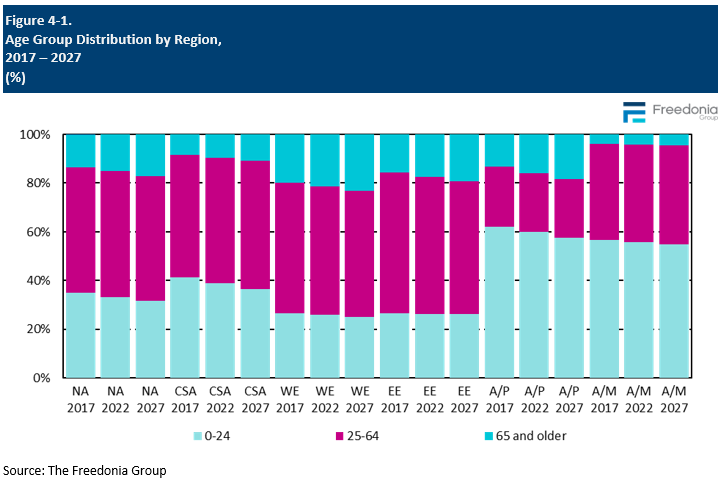

Demographic and economic factors also greatly affect levels of demand for motorcycles in all countries and regions, as do less quantifiable factors such as the presence of a motorcycling culture and consumer preferences. The size and growth of the market for motorcycles in each country is affected by:

-

population growth and changes in the age distribution of its population

-

competition from other forms of transportation (such as bicycles, light vehicles, and public rail and bus transport)

-

riding conditions (e.g., quality of road, rules enforcement)

-

legal and regulatory environment (licensing and down payment requirements)

-

popularity of motorsports, ranging from touring to racing to off-roading

Developing nations frequently see prolonged periods of growth as consumers increase their use of motorcycles and replace aging machines with more capable, higher priced models. Replacement sales are a smaller driver of gains in these markets because their stocks of two-wheelers are quite small and relatively new.

The electric motorcycle segment, which is still at an early stage of development, has seen a prolonged period of growth. This has helped to drive longer-term product sales growth. Government incentives have aided in the adoption of these models.

Motorcycles in Use by Engine Type & Region

Worldwide, there were more than 1.2 billion motorcycles (ICE two-wheelers, electric models, and e-bikes) in use in 2022. The regions with the largest stock of motorcycles in use are Asia/Pacific, Africa/Mideast, and Central & South America. Their prevalence is attributable to motorcycles providing an essential mode of transportation for a large portion of the population. Globally, the Asia/Pacific region had the largest motorcycle parc with 963 million units in 2022, representing 80% of the global total.

The number of motorcycles in use worldwide is forecast to climb 4.1% per year to nearly 1.5 billion units, matching the rate of growth from 2022-2027. The outlook through 2027 varies for ICE and electric models:

-

The global ICE motorcycle stock is forecast to expand 3.2% annually.

-

Worldwide, the electric motorcycle parc is expected to grow 6.5% per year.

While growth in ICE motorcycles sales will lag that of electric models, ICE models will remain the most widely used motorcycles in the world (69% of the stock in 2027) because of their popularity in both developing and mature markets:

-

Typically, ICE motorcycles offer superior performance (e.g., higher top speeds, faster acceleration) relative to electric models, making them popular for both transportation and recreational activities.

-

Many industrializing nations have underdeveloped electrical grids and few public charging stations, and do not subsidize the purchases of electric two-wheelers, limiting their appeal.

Multiple trends will cause the number of electric motorcycles, scooters, mopeds, and motorbikes, and e-bikes to increase between 2022 and 2027:

-

Government initiatives – ranging from subsidies to new charging infrastructure investments – will promote the use of electric models around the world.

-

Manufacturers will roll out a variety of new, innovative electric models that close the performance gap with ICE machines during the forecast period.

-

Industry groups around the world will promote the electrification of transportation.

-

Some ICE motorcycles will be converted into electric models (e.g., Indonesia has announced such plans).

Factors Impacting the Motorcycle Industry

Population Growth & Demographics

The relative age of a country’s population has a major influence on the use of motorcycles. Younger people worldwide are generally more eager to own and ride motorcycles, in part because they have fewer resources to buy light vehicles, are less averse to risk-taking, and more physically able to ride them than many older consumers. They are also more likely to use two-wheelers for recreation (e.g., racing, off-roading) and/or business. As a result, motorbikes, racing motorcycles, and e-mountain bikes, for instance, are more likely to be used by younger riders than premium touring ICE motorcycles.

While motorcycle riders are typically between the ages of 16 and 64, it is common for people in some parts of the world to continue to ride past that age. For example, a person is more likely to continue to ride into old age if the country has safe road conditions and enforces traffic laws, or if there are only limited public transportation options available. In developing areas, an older person is likely to be better positioned to afford a new two-wheeler or secure financing for a purchase. The rise of e-bikes – which have several advantages over conventional bicycles (e.g., ability to travel uphill more easily, extends riding range) can be partly attributed to the popularity of these machines with older riders.