Report Overview

Featuring 56 tables and 76 figures – now available in Excel and Powerpoint! Learn More

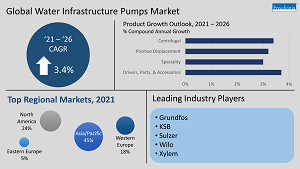

Global demand for pumps in the water infrastructure market is forecast to increase 3.4% per year to $13.5 billion in 2026, driven by ongoing investment in utilities infrastructure in industrializing countries. Recovery from the impact of the COVID-19 pandemic will also contribute to rising spending on new water utilities projects in higher-income countries.

Pandemic-Related Growth Continuing into 2022

While the water infrastructure pumps market contracted in 2020, losses were not as severe as in many other industries, due to the high levels of repair and replacement demand driving sales in the market and the critical need to maintain water utilities systems.

The industry posted a strong rebound in 2021 despite ongoing pandemic impacts, and continued recovery is expected going forward. Supply chain issues – including shortages of raw materials and electronic components – prevented many pumps producers from fully meeting new orders taken in 2021. While revenues from many of these sales could be realized in 2022, supply chain disruptions continue to pose an issue and could lead to further delays in deliveries.

Solar Water Pumps Hold Potential in Developing Countries

Sales of solar water pumps – which are used for agricultural and domestic water supply in off-grid rural areas – are rapidly increasing, with particularly strong potential in South Asia and sub-Saharan Africa. These regions possess abundant solar resources and have large populations living away from municipal water grids.

While these products are becoming more common, suppliers have struggled to deploy them as rapidly as called for by ambitious government targets. The high upfront costs of solar water pump systems represent a barrier to adoption, as the target markets for these products tend to be very price sensitive. However, the long-term cost savings associated with these products show a path to economic viability if effective financing strategies can be developed.

Desalination Market Expanding

Desalination systems are expected to be an increasingly important component of global water supply going forward, and sales of pumps to support these systems are projected to post strong growth. In recent history, this market has been primarily driven by Middle East countries, where oil wealth has allowed for high levels of investment in advanced systems to provide water to the arid region. However, desalination plants are increasingly being constructed worldwide, driven by both improving technology and concerns that climate change could contribute to increased issues with water scarcity. Going forward, the biggest potential for growth will occur in South Asia, most notably India, where the supply of potable water remains a concern.

North America: Water Infrastructure Pumps Market Size & Historical Trends

North America is defined as the United States, Mexico, and Canada.

Demand for water infrastructure pumps in North America totaled $2.7 billion in 2021. North America represents 24% of global sales and is the second largest regional market for water infrastructure pumps, behind the Asia/Pacific region.

The North American water infrastructure pumps market is dominated by the United States, which accounts for 85% of demand. Both the United States and Canada are characterized by technologically driven pump markets and a reliance on high quality pumps. In contrast, Mexico tends to use lower quality pumps and has low demand on a per capita basis.

North America: Demand by Country

Demand for water infrastructure pumps in North America is forecast to increase 1.9% per year to $3.1 billion in 2026. The pace of gains will be restrained by market maturity, although the region’s existing water infrastructure will continue to support repair and replacement sales.

The US is projected to account for 82% of regional sales growth between 2021 and 2026. The country has a complex and aging water system with extensive water treatment facilities. This infrastructure requires ongoing repair and upgrading, which sustains high levels of demand. A positive economic outlook in the country will support advancement of repairs and upgrades of water infrastructure pumps. The increasingly troublesome issue of clogged wastewater pipes will drive demand for grinders, shredders, and anti-clog pumps. In addition, the federal government passed the Infrastructure Investment and Jobs Act in 2021, which will support infrastructure upgrades.

Water infrastructure pump demand in Mexico will benefit from continued expansion of wastewater treatment and water infrastructure, particularly outside of major urban areas. Additionally, existing water infrastructure will generate ongoing demand for parts and repair.

North America: Demand by Product

Demand for water infrastructure pumps in North America is projected to increase 1.9% per year to $3.1 billion in 2026. Centrifugal pumps will remain the majority of demand and account for the majority of growth going forward. Pump drivers, parts, and accessories will also see solid growth, boosted by increasing use of anti-clog shredder and grinder accessories.