Report Overview

Learn why dry wipes continue to dominate the market.

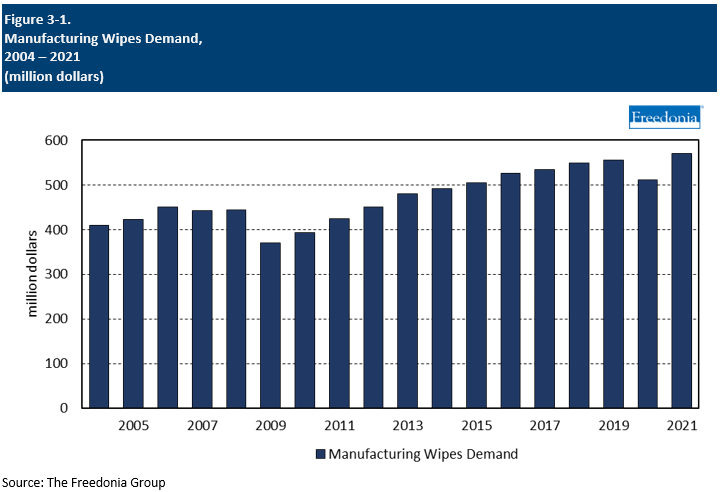

This Freedonia industry study analyzes the $570 million US manufacturing wipes industry. It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by application (general purpose, special purpose, surface application, cleanroom, printing, other), and type (wet, dry). The study also evaluates company market share and competitive analysis on industry competitors including 3M Company, Kimberly-Clark, and Nice-Pak.

This Freedonia industry study analyzes the $570 million US manufacturing wipes industry. It presents historical demand data (2011, 2016 and 2021) and forecasts (2026 and 2031) by application (general purpose, special purpose, surface application, cleanroom, printing, other), and type (wet, dry). The study also evaluates company market share and competitive analysis on industry competitors including 3M Company, Kimberly-Clark, and Nice-Pak.

Featuring 25 tables and 15 figures – available in Excel and Powerpoint! Learn More

Demand for manufacturing wipes is expected to advance 2.5% per year to $646 million in 2026, driven primarily by unit growth as prices moderate from inflation- and supply chain-related highs in 2021 and 2022. Unit growth will be supported by:

- consistent increases in manufacturing activity precipitated by industries returning to pre-pandemic levels of operation

- continued adoption of wipes - as manufacturers recognize their cost and performance benefits - within many industries

Dry Wipes Continue to Dominate the Market

Dry wipes have historically been more widely used in manufacturing settings due to their versatility and ability to be used in conjunction with solvents applied on site. This trend will continue despite improvements in wet wipe technology. Dry wipes are particularly favored in special purpose manufacturing applications, such as surface preparation and printing uses.

General Purpose Wipes Maintain Favorable Market Share

General purpose wipes accounted for 63% of manufacturing wipes sales in 2021, despite the continued popularity of specialty wipes. General purpose wipes are valuable as they can be used in a variety of industrial settings to cost effectively remove soils from manufactured products as well as from machinery, tools, and other equipment. Market growth going forward will be boosted by an acceleration in unit sales growth as US manufacturing activity continues to rebound. Additionally, general purpose wipes usage will benefit from the continued implementation of the EPA's Wiper Rule, which eases regulations surrounding their disposal.

Historical Market Trends

Sales of manufacturing wipes depend on a variety of market trends, as well as on macroeconomic and demographic factors. Manufacturing wipes markets primarily rely on economic growth, as it supports the revenues of businesses and other operations and can affect their investment in wipes over alternative products.

During the 2016-2018 period, the US experienced steady manufacturing growth. This trend is reflected by notable gains in both unit and value terms for manufacturing wipes, with most of the gains coming from general purpose wipes.

Overall, 2020 and 2021 were volatile years for the manufacturing wipes industry. General purpose and most special purpose wipes experienced diminished demand at the onset of the COVID-19 pandemic, but it rebounded in 2021. Industry demand for manufacturing wipes – most notably general purpose wipes – dropped the manufacturing wipes market nearly 8% from 2019 to 2020. Businesses had lesser need for manufacturing wipes as a whole during extended shutdowns, even as concerns over transmission of the virus supported demand for surface cleaning wipes.

Demand then rose as manufacturing rebounded in tandem with the economy in 2021 to erase losses. In addition, non-consumer outlets also increased their usage of wipes in disinfecting and cleaning operations.

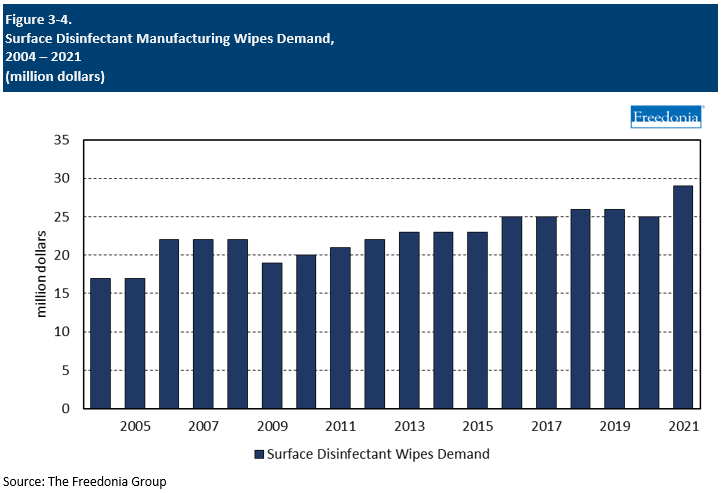

Surface Disinfectant Manufacturing Wipes

These wipes are well suited to industrial disinfectant applications. In high-traffic, industrial spaces, many of the same surfaces (e.g., doorknobs and handles, stairway handrails, or machinery) are touched. Thorough cleaning of these surfaces is likely to occur a limited number of times during the day, as it can disrupt the use of spaces and amenities. Making wipes available in manufacturing spaces encourages more regular use of disinfectants since it becomes incumbent on individuals to protect themselves from infection.

Unit sales gains will be supported by:

-

increasing awareness of the potential spread of disease through contact with communal surfaces and the ability of wipes to maintain sanitary conditions in high-traffic, public spaces

-

continued adoption of wipes in certain manufacturing settings, such as food processing spaces

-

growing manufacturing activity

However, growth will be limited by competition from disinfectant spray cleaners – including those wiped up with some sort of paper towel or cloth – and no-wipe spray cleaners based on their lower cost.

Competitive Products

In most applications, wipes compete against broad ranges of conventional cleaning applicators and chemicals. Competitive products include tissues, paper towels, washcloths, cotton balls, swabs, sponges, rental shop towels, woven fabrics, rags, and even consumers’ own hands. All of them can be used to apply, distribute, absorb, and dry a variety of fluids on skin, floors, furniture, glass, metal, hard surface counters, industrial machines, medical instruments, and other consumer and industrial market surfaces. Competition is based on the offsetting criteria of cost, performance, convenience, time and labor expenditures, disposability, and environmental impact.