Report Overview

Featuring 19 tables and 4 figures – now available in Excel and Powerpoint! Learn More

As more consumers interact with shipping boxes – most notably via online shopping – an analysis of consumer trends can give insight to marketing and product development opportunities.

This report contains analysis and data-driven discussions relating to shipping boxes, including a look at sustainability views and online shopping habits, behaviors, and attitudes.

This report includes analysis, data, trends, and customized cross tabs using two survey resources:

- data from The Freedonia Group’s proprietary national online survey conducted in April-May 2020, August 2020, November-December 2020, February-March 2021, June 2021, August-September 2021, October-November 2021, November-December 2021, February 2022, and May 2022

- data from syndicated national consumer survey results from MRI-Simmons Spring 2022 Report

Online Shopping Habits

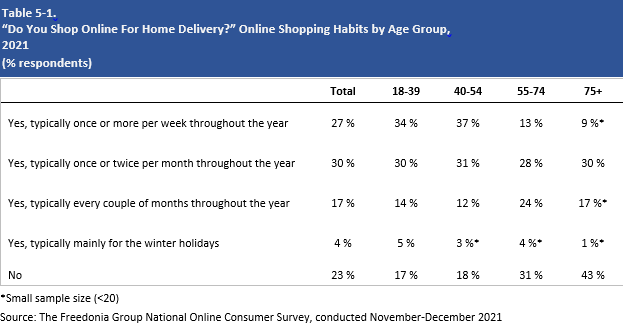

Online shopping is an activity that often involves the use of shipping boxes to get the goods to consumers’ homes. The frequency of online shopping, however, varies by demographic categories. Overall, the most frequent online shoppers are younger, urban, and higher income.

Consumers aged 18-54 are the most frequent online shoppers. 37% of those 40-54 and 34% of those 18-39 shop online at least once per week, and another 31% and 30%, respectively, shop online once or twice a month throughout the year. In contrast, 31% of those 55-74 and 43% of those over 75 reported not shopping online at all.

Corrugated Shipping Boxes

Corrugated boxes are made of containerboard, which consists of a corrugated medium between two or more linerboard faces.

Corrugated boxes are widely employed in virtually all areas of the economy because they are entrenched as the shipping container of choice in a number of markets. Their combination of low cost and excellent rigidity sustains their use with products that need protection, though they see some competition from flexible packaging in the shipping of textiles and nonfragile items.

Included within the scope of corrugated boxes for purposes of this report are:

- regular slotted containers

- full telescoping boxes (i.e., two-piece box sets that fit into one another)

- boxes with cut-outs for display purposes

- open-top tray-style boxes

- fold-over gift boxes

- bulk bins

- display-ready, or retail-ready boxes

- modular boxes

- standard boxes for shipping and e-commerce applications

- corrugated clamshells

Note: this category also includes solid fiber boxes, which are made from multiple layers of linerboard without corrugating material, and account for less than 1% of the total.

Suburban dwellers were somewhat less frequent in their online shopping habits, with 51% shopping online at least once or twice per month, including 22% that shop online at least weekly.

Rural consumers were least likely to report shopping online, with 32% saying they do not shop online, and only 45% reported shopping at least once or twice per month. Rural dwellers seem like they should be shopping online more often as selection of goods available locally tends to be more limited in rural areas. However, rural residents tend to be older, and older consumers shop online less frequently.

Factors Affecting Corrugated Shipping Box Sales

A number of factors impact demand for corrugated shipping boxes on a year-to-year basis, although general trends in manufacturing output, e-commerce, and product distribution play the greatest role. Corrugated boxes are widely used in the shipping and storage of a wide variety of goods, and – to a lesser extent – for product packaging. As a result, demand is especially reliant on business-to-business and business-to-consumer commerce. The entrenched position of these boxes as the shipping container of choice in most markets is due to their low cost and excellent protective performance, and the limited availability of alternatives.

Volume gains for corrugated shipping boxes have been limited by:

- source reduction involving using thinner or lighter weight board and eliminating unnecessary secondary packaging such as paperboard cartons

- right-sizing, or shipping items in boxes that are more dimensionally proportionate to their size

- optimization of shipping, or when multiple items are shipped in fewer boxes

- paper recycling levels, as recycled paper is a key raw material for box production

Trends in market value are determined primarily by annual changes in pricing and shifts in product mix in terms of size of boxes used and their performance or value-added features (such as coatings).

Unlike a number of other industries, the COVID-19 pandemic did not have a negative impact on corrugated and paperboard box demand. Demand in volume terms grew at the fastest rate of the decade in 2020, with gains supported in part by a jump in e-commerce, supported by stay-at-home orders during the first phase of the pandemic and a general reluctance by many shoppers to shop at brick-and-mortar stores, even for necessities including food and pharmaceuticals.

Cost-control pressures from high-volume customers will help restrain price growth. However, some price increases will be supported by the rising importance of innovative box designs and value-added features on boxes, such as superior graphics and printing, retail-ready designs, and those with unique shapes. This will lead to a larger presence for more expensive boxes, even for corrugated shipping applications.