Report Overview

Key developments include Ships in Own Container (SIOC) and eco-friendly packaging products.

This Freedonia industry study analyzes the e-commerce ready packaging industry and presents historical demand data for e-commerce packaging and e-commerce merchandise sales (2013, 2018, and 2023) and forecasts (2028 and 2033) by product type (boxes & mailers, protective packaging, and other) and market (computers, electronics & appliances; apparel & accessories; home furnishings; food & beverages; toys, games & sporting goods; health & beauty; and other). Annual historical data and forecasts for markets are also provided from 2013 to 2028. Data are given in dollar value.

Featuring 17 tables and 29 figures – available in Excel and Powerpoint! Learn More

E-commerce continues to have a profound impact on the packaging industry as companies adapt to the rapid shift from traditional retail models focused on brick-and-mortar stores and centralized distribution to one that includes online shopping and delivery direct to customer’s front doors. This shift toward home delivery is leading to significant changes in operations, infrastructure, and logistics at companies throughout the supply chain.

Retail e-commerce sales of merchandise are forecast to grow 8.9% per year to $1.4 trillion in 2028. This represents a slowdown from the high levels seen during the pandemic, but it is still well above growth in overall retail sales and most sectors of the US economy. However, the continued expansion of home delivery is having opposing impacts on the packaging industry and the types and amount of packaging used.

Sustainability Concerns Proliferate as Environmental Impact of E-Commerce Widens

The continuing robust growth of e-commerce has raised concerns about its environmental impact, particularly regarding carbon emissions from transportation and the large amount of packaging waste generated. Consumer product manufacturers, retailers, and parcel shipping companies are all looking for more sustainable practices that optimize packing and delivery, reduce the amount of shipping materials used, and include the development new eco-friendly and delivery-compatible options.

Demand for traditional e-commerce related packaging – primarily shipping boxes, mailers and associated protective packaging materials – is forecast to grow 6.4% per year to $8.5 billion in 2028, lagging growth in e-commerce sales due to continued efforts to reduce the use of excess shipping materials.

Ships in Own Container (SIOC or SIPP) Driven by Environmental Concerns & Cost Savings

E-commerce ready packaging is a new movement in the packaging industry focused on addressing the sustainability and cost issues associated with growth in direct-to-consumer shipping. These new programs focus on two key areas of development:

-

Ships in Own Container (SIOC) packaging

-

improving sustainability, efficiency, cost, and supply chain optimizations

Demand for e-commerce ready packaging is being driven by leading global e-commerce giants such as Amazon and Alibaba, who are using their influence to push suppliers to meet their standards.

The shipment of SIOC packages will continue to see double-digit growth over the next decade, reaching 6 billion units in 2028. While a small share of packages have historically been shipped in their own packaging, efforts to reduce packaging waste and improve profitability will continue to drive this shift away from traditional shipping materials.

Factors Impacting Packaging Demand

Demand for e-commerce ready packaging is impacted by a variety of factors, including:

- the outlook for US retail sales, which is, in turn, dependent on growth in the overall economy and consumer income levels

- the popularity of shopping online and the number of such orders placed each year

- the types of products purchased online and their relevant packaging requirements

- the level of concern regarding packaging waste, as well as efforts to reduce generation thereof and improve recycling rates

- key retailers instituting policy changes regarding the amount and types of packaging used

While the shift toward online shopping was well underway by 2020, the pandemic significantly accelerated it; there were sharp spikes in online purchasing in 2020 and 2021. Since then, some consumers have started to return to their pre-pandemic habits and preferences, resulting in a drop from the unusually high levels of online shopping.

On the other hand, there are customers that have continued to rely on online shopping; their behaviors will have an important effect on the need for e-commerce ready packaging. Factors that are driving consumers to remain online shoppers include:

-

continuing closures of brick-and-mortar retail stores, which can significantly limit the availability of items that would have been purchased at those stores

-

ability of online retailers to offer lower prices due to their reduced overhead costs, which will lure in budget-conscious shoppers

-

availability of a wide variety of specialty or unique items available online and the greater number of products offered in every merchandise category compared to physical retail stores, which are limited by space constraints

However, there are reasons for shoppers to return to brick-and-mortar stores, including:

-

the desire to support local businesses

-

the difficulty of dealing with numerous shipping boxes and packaging waste

-

a preference for picking out items in person, especially in terms of appearance or other quality concerns

-

the difficulty or cost in returning items that are not wanted

-

concerns about the environmental impact of excess packaging and the sharp increase in trucks on the road needed to deliver packages to customer’s locations, which result in increased emissions and traffic noise

Annual Parcel Shipping Trends

The US parcel shipping industry is substantial, with 21.5 billion packages shipped in 2023 alone. The parcel shipping industry experienced mostly healthy gains over the preceding decades, driven by the rise of e-commerce as a share of overall retail sales. In 2020 and 2021, the industry registered strong double-digit growth because many consumers relied on e-commerce during the pandemic. Since 2021, though, industry growth has fallen from those unusually elevated levels, as most carriers saw weak to declining growth through 2023.

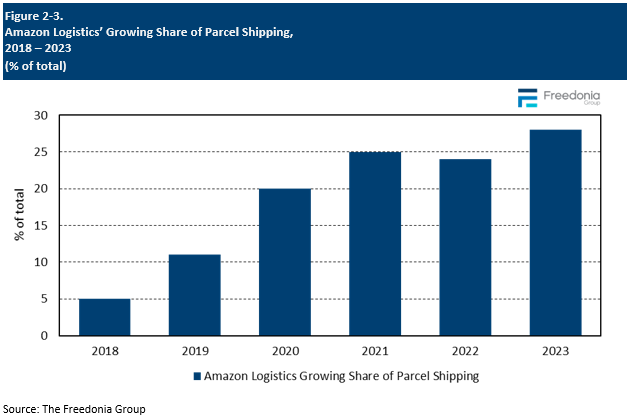

The parcel shipping industry is extremely concentrated, historically dominated by three key players – the United States Postal Service (USPS), United Parcel Service (UPS), and FedEx – which collectively accounted for over 90% parcel deliveries in the US in 2013. However, Amazon has become a major player in the parcel shipping industry in recent years, increasingly using its in-house Amazon Logistics service and local couriers for last-mile delivery. In 2022, Amazon began delivering parcels for other sellers through its Buy with Prime program.

According to their own estimate, Amazon will soon overtake USPS – the current leader by shipping volume – to become the new frontrunner in US parcel delivery. It has already surpassed FedEx and UPS and now controls about 28% of the market.

Together, USPS, Amazon Logistics, UPS, and FedEx delivered about 96% of US packages by volume in 2023. Other significant industry players (accounting for most remaining parcels shipped) include DHL, Kuehne+Nagel, and a variety of small regional companies.

Amount Spent Shopping Online

E-commerce companies cater to a diverse audience, from tech-savvy Gen Zers and millennials (who prioritize convenience and speed) to Gen Xers and baby boomers (who value reliability and customer service). Pre-Boomers, or the Silent Generation, tend to prefer in-person shopping, but younger members of this cohort are shopping online more often.

Twenty-seven percent of respondents across all generations had spent $1000 or more on the internet in the preceding six months, indicating that a notable portion of shoppers are comfortable making substantial purchases online. This behavior cuts across most generational lines; regardless of age, consumers are increasingly finding value in the convenience, variety, and competitive pricing that are frequently available through online platforms.

Such a trend could reflect broader shifts in retail, where e-commerce is becoming a more integral part of everyday shopping habits. This change is being driven by factors like enhanced digital literacy, trust in online payment systems, and the evolving logistics of home delivery.