Report Overview

Understand market size and industry players

Understand the main types of packaging and demand trends

-

napkins

-

paper cups

-

paper plates

-

paper straws

This Freedonia industry study analyzes the $13.6 billion US paper disposable

packaging and serviceware market. It presents historical demand data (2012, 2017 and 2022) and forecasts (2027) by product (beverage packaging, serviceware, food cups, boxes and folding cartons, clamshells and two-piece containers, packaging bags and wraps, carryout bags, trays, and other food packaging) and market (limited-service restaurants, full-service restaurants, retail foodservice and non-commercial foodservice).

Featuring 83 tables and 20 figures – available in Excel and Powerpoint! Learn More

This report includes data from 2012-2027 in 5 year intervals and tables featuring year-by-year data for 2019-2026.

Demand for paper and paperboard single-use foodservice products is forecast to grow 3.3% annually to $16.0 billion in 2027. Demand in unit terms will grow as sustainability concerns increase, leading restaurants to move away from materials such as conventional plastic and foam and adopt paper and other biodegradable materials as a replacement. Additionally, demand in value terms will be supported by a shift toward higher value packaging, as more sustainable products that also feature a high performance level are higher priced than conventional paper packaging. Further gains will result from elevated levels of foodservice delivery and carryout/drive-thru revenues elevating paper disposables usage.

Paper-based disposables account for nearly half of the overall foodservice disposables market due to the ubiquity of napkins, paper cups, and paper bags at foodservice establishments. Paper’s natural high biodegradability levels and low cost has made it the preferred material to replace plastics in suitable applications in past years. However, paper faces a number of challenges in keeping its market share.

Paper Faces Competition from New Materials to Replace Plastic

Restaurants have felt increasing pressure to address concerns of excessive waste and lack of biodegradability in their disposable packaging. As sustainability concerns increase, other materials such as molded fiber and bioplastics are entering the market and competing with paper in acquiring demand share from plastic. In response, paper foodservice disposables suppliers are improving product aesthetics and performance, as well as increasing paper products’ environmental profile through replacing product coatings that hinder the eco-friendliness of their products.

Development of New Coatings to Increase Performance & Sustainability

An increased focus on biodegradability by end users has called into question the coatings used to improve paper performance in applications dealing with moisture and grease. Efforts from paper disposables suppliers to address this issue include the development of plant-based coatings as well as uncoated paper packaging that still offers high levels of grease resistance while maintaining high biodegradability levels.

Elevated Interest in Carryout & Drive-Thru Will Support Demand for Paper Disposables

Although a shift from dining on premises to takeout orders and delivery via digital apps had been occurring prior to 2020, the pandemic significantly accelerated this trend. This has had a varied impact on paper disposables, with products such as carryout bags and takeout containers benefiting the most. However, offering disposables such as napkins and straws upon request to limit waste creation is a growing practice that could restrain further expansion of paper disposables demand.

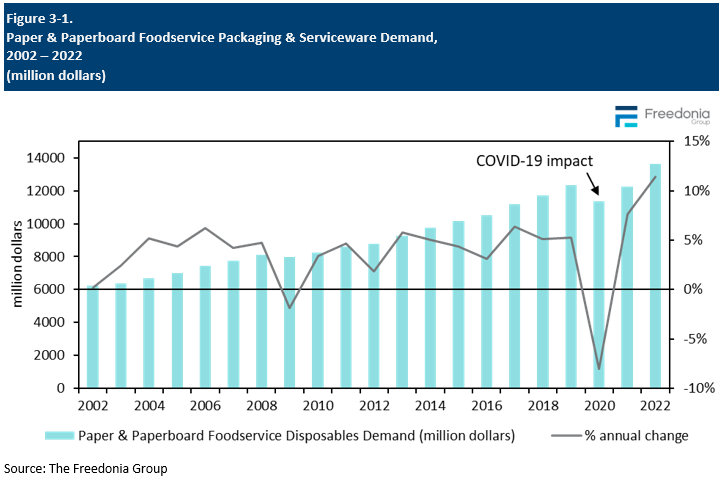

Historical Market Trends

At its broadest level, demand for single-use paper foodservice products is driven by trends in foodservice revenue, which is an indicator of the number of meals eaten away from home and the amount spent on those meals. Growth in foodservice activity in turn is dependent on a number of macroeconomic and demographic factors, including:

- trends in food consumption and the mix of food eaten at home versus away from home

- the health of the overall economy and levels of disposable income, which impact the ability of consumers to spend on more expensive restaurant meals (compared to home cooking)

- changes in the population mix, especially in terms of age cohorts (such as young adults) that are likely to eat out more often

- trends in consumer spending, including spending on travel and entertainment, which impact foodservice sales at hotels and sports and recreation venues

- student enrollment levels and trends in school lunch programs

Beyond these basic macroeconomic indicators, other factors that can impact the foodservice industry and demand for disposable products include:

- the mix of restaurants that are limited versus full-service, as limited service restaurants use a higher level and broader mix of disposables

- the share of total restaurant orders that are provided via drive-thru, curbside pickup, carryout, or delivery services

- the size and diversity of restaurant menus, as specific disposables are often used with specific menu items

- social factors such as health concerns, which not only influence the amount consumers eat out but the type of foods they purchase

- sustainability initiatives, which impact the overall level of disposables used as well as the types of products and materials used

- regulations, especially restrictions on specific materials or types of disposables

In addition, consumers are increasingly aware of the environmental impact of disposable packaging, and this has provided a distinct benefit for producers of paper products as major foodservice operations focus on improving their sustainability image.

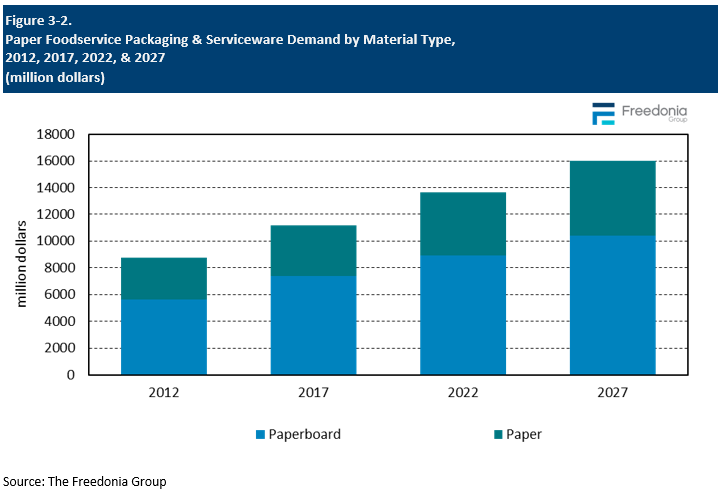

Demand by Material (Paper & Paperboard)

Paper and paperboard products account for nearly half of overall foodservice disposables demand and are gaining share from conventional plastic – their main competitor – due to growing preferences for materials that are perceived as environmentally friendly. However, in some applications paper products still need to address performance issues – particularly regarding high-moisture foods – and develop improved coatings that do not restrict recycling or product biodegradability.

Demand for paper and paperboard disposables is forecast to grow 3.3% annually to $16 billion in 2027. Products will lose demand share to other higher value materials increasingly penetrating the eco-friendly market – especially in applications where high quality is expected, as those are able to provide a better customer experience. However, new materials are still being implemented and have not yet reached economies of scale, meaning prices have yet to decline, allowing paper to compete as an inexpensive alternative.

Factors influencing overall demand include:

- Growth is expected due to a combination of convenience, cost-effectiveness, sustainability, and changing consumer behaviors.

- As more businesses look for ways to reduce their environmental impact and meet the demands of eco-conscious consumers, paper disposables are likely to become an increasingly popular option for the foodservice industry.

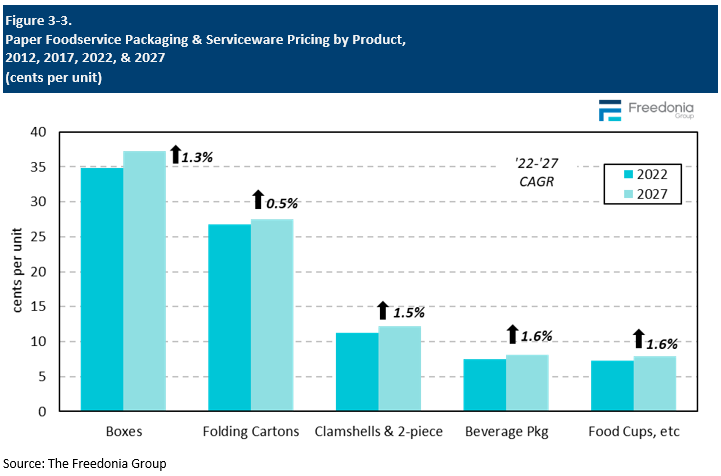

Pricing Trends

The foodservice disposables industry is competitive, and product pricing is a significant factor in customer purchasing decisions. Factors influencing prices for single-use foodservice products include:

- raw material and labor costs

- shipping and transportation costs

- supply and demand balances

- customization, design, and printing costs

- changes in the material mix for various products

- increasing participation in and corresponding competition from products made of newer and more innovative materials

- import competition

Raw material price fluctuations tend to have the greatest effect on pricing although product mix can also be important. Paper bag, paper cup, pizza box, and paperboard clamshell prices are linked to the price of bleached and unbleached kraft paper and paperboard, while napkin prices are tied to tissue paper prices.

Despite the significance of raw material costs as a base influence on disposables prices, pricing for single-use foodservice products does not always track raw material costs, as manufacturers tend to absorb raw material price increases as much as possible to maintain competitiveness. In addition, foodservice establishments can switch from one type of disposable to another if cost becomes an issue, limiting the ability of disposables producers to pass on increasing materials costs as well.