Report Overview

Featuring 33 tables and 11 figures – available in Excel and Powerpoint! Learn More

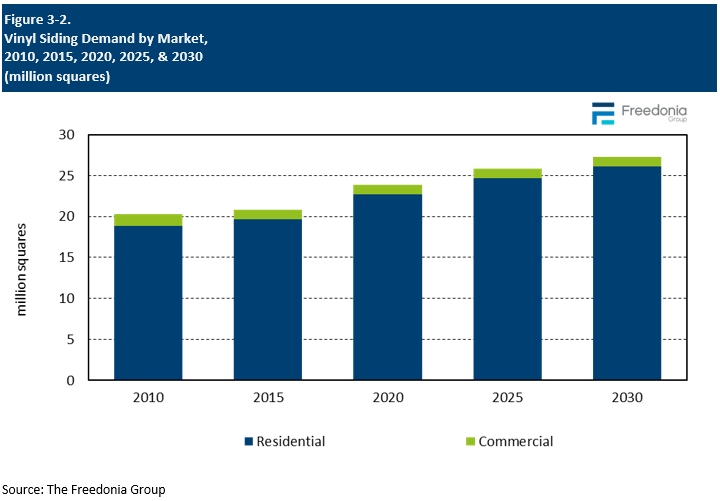

This study analyzes US demand for vinyl siding by market (residential and commercial), application (new and renovation). Residential coverage includes demand by housing type (single-family, multifamily, and manufactured housing.) Demand for siding is also broken out for US geographic regions and subregions. Historical data (2010, 2015, and 2020) and forecasts for 2025 and 2030 are presented for vinyl siding demand in current US dollars (including inflation) and in squares.

(single-family, multifamily, and manufactured housing.) Demand for siding is also broken out for US geographic regions and subregions. Historical data (2010, 2015, and 2020) and forecasts for 2025 and 2030 are presented for vinyl siding demand in current US dollars (including inflation) and in squares.

Demand for vinyl siding in the US is projected to increase 1.6% per year to 25.8 million squares in 2025, valued at $1.8 billion. Gains will be supported by an increase, primarily in the early part of the forecast period, in new housing construction and home renovation, which accounts for nearly all demand for vinyl siding. Demand will also be bolstered by the introduction of higher quality vinyl siding in new styles that mimic the look of more expensive materials but at a lower cost.

However, vinyl will continue to face significant competition from materials – most notably fiber cement – with greater durability that have distinctive aesthetics.

Product Improvements Allow Vinyl to Avert Further Share Losses & Remain Leading Material

Vinyl has long been the most commonly used siding material in the US, particularly in the Northeast and Midwest regions, and is expected to retain that leading position based mainly on its low cost and ready availability. However, other materials – primarily fiber cement – continue to erode the market base for vinyl siding, in part because many consumers are looking for ways to differentiate the appearance of their homes and to improve the curb appeal through installation of siding that looks more natural than vinyl.

In order to maintain relevance in the midst of these design trends, vinyl siding manufacturers continue to improve the appearance of these products. Additionally, they can benefit from marketing their products in new ways that appeal to design trends that call for unique aesthetics. For example, they can promote installation of vinyl products as vertical (rather than horizontal) panels to provide visual contrast and a more high-end look.

Residential Renovation Continues to Drive US Vinyl Siding Market

The residential renovation market accounted for 64% of vinyl siding demand in 2020 and is projected to remain the dominant market application through 2025. The renovation market is primarily supported by the large stock of vinyl siding in the US, as homeowners often replace old siding with the same material. In addition, vinyl siding is often in need of replacement more frequently than other, more durable siding materials.

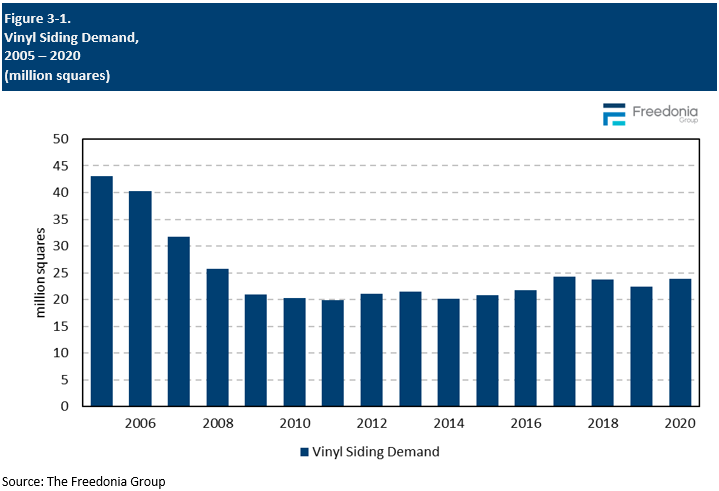

Historical Market Trends

Siding demand tends to follow trends in building construction activity, especially in the residential market. For instance, siding demand is strongly correlated with new home construction, as siding is included on virtually every new house, and siding is installed at the time of the home’s construction.

Demand for siding also follows trends in new commercial building, though not as closely as the residential trends, as there are some commercial buildings (warehouses and other industrial buildings, for instance) that use no siding products.

Siding demand is also impacted by trends in home renovation activity, as the residential re-siding market is the leading application for siding. While the siding on homes may require replacement due to age or storm damage, homeowners may also choose to upgrade the appearance of their homes by opting for higher quality siding products or move to products that have fewer maintenance requirements.

Similar to new construction activity, the trend is less profound in the commercial market, as renovation projects are more commonly focused on utility than on exterior aesthetics.

Other factors impacting the level, growth and value of siding demand each year include:

- trends in the average size and style of buildings being constructed

- the region where the siding is installed and its weather patterns

- improvements in product durability, which can lower replacement demand

- a shift in product mix toward more or less expensive siding materials

- the cost of raw materials, which can be volatile, which impacts siding pricing

Markets Overview

The residential market accounted for 95% of vinyl siding demand in 2020 and will account for the majority of demand gains through 2025. Replacement vinyl siding for single-family homes dominates the vinyl siding market:

- Ongoing home renovation activity will support gains, as many owners of homes that currently feature vinyl siding will continue to repair or renovate their homes using the same material.

- Vinyl siding demand will also be supported by an improvement in new residential construction in the first part of the forecast period.

In the commercial market, demand for vinyl siding is expected to remain at 1.2 million squares in 2025. While commercial building construction will support demand in renovation projects, continued preferences for competing materials that offer greater durability, such as fiber cement and concrete, will limit the size of the commercial vinyl siding market.

Pricing Trends

In this study, prices for vinyl siding materials are measured at the manufacturers’ level, so thus exclude any distributor or retail markups.

In general, the cost of raw materials is the key determinant of siding price levels. The cost of vinyl siding, which is manufactured from polyvinyl chloride (PVC), a petrochemical plastic resin, is affected by changes in the price of feedstocks such as crude petroleum or natural gas.

The average price of siding is also determined by its quality classification and changes in product mix. Performance factors are often key to this classification. For example, whether vinyl siding is classified as an economy, standard, or premium product depends on its rigidity, resistance to fading, thickness, and ease of installation.

Aesthetics can also play a role in product classification; premium vinyl siding is offered in more vibrant colors because it is made with specialty coatings and treatments that make it more expensive than standard grades.

In addition to increases in raw material and energy costs, growth in the average price per square of vinyl siding material will reflect efforts of manufacturers to create products with enhanced aesthetic and performance properties. For instance, vinyl siding manufacturers will make ongoing improvements to the durability and aesthetic appeal of their products.