Report Overview

Foodservice is markedly different than before the pandemic. Learn more about changes.

-

Kinds of packaging used

-

Sustainability conversions

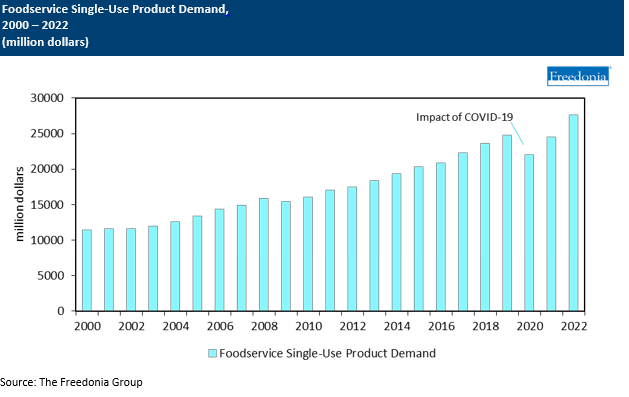

The US market for foodservice packaging and serviceware continues to face unprecedented disruption, with the lingering impact of the COVID-19 pandemic, sustainability initiatives, and longer running market trends all combining to escalate changes in market size, product formats, and materials.

Demand for foodservice single-use products is forecast to grow 3.8% annually to $33.2 billion in 2027. However, this growth rate hides several opposing underlying trends:

- Growth in individual product prices will moderate – or even decline – from inflation-driven highs in 2021 and 2022, but this will be offset by a shift in the product mix toward higher value materials and packaging formats.

- Real growth will be supported by continued recovery in the restaurant industry and key noncommercial foodservice markets such as sports and entertainment venues and catering. Demand will be further boosted by the popularity of takeout and delivery, especially from full-service establishments that have historically not been large users of disposables.

- Growth in units will be restrained by sustainability-driven efforts to reduce or eliminate excess packaging and serviceware use.

Featuring 196 tables and 69 figures – available in Excel and Powerpoint! Learn More

Sustainability Drives Market Value Growth & Materials Evolution But Limits Unit Gains

The foodservice industry historically considered the environmental impact of its packaging use, but cost and performance often were more important factors in purchasing decisions.

However, over the past decade sustainability has become the leading factor for choosing single-use products, especially for high-profile national chains. This has resulted in:

- a strong push toward using higher priced alternatives – such as paper, molded fiber, and bioplastics – to conventional plastics

- efforts to eliminate certain types of disposables altogether, including small plastics (such as straws and stirrers) and products made from plastic foam

Search for the Perfect Material Continues; All Materials Have Pros & Cons

Foodservice companies and their suppliers continue to search for the ideal packaging material, a product that offers good sustainability and performance at a low price. While conventional plastics continue to dominate sales due to their low cost and good performance (and a growing focus on recycled content), the fastest industry growth is expected in newer materials such as molded sugarcane and PHA bioplastics. These new materials offer good performance, sustainability, and increasingly competitive pricing.

Carryout & Off-Premises Dining Continues at High Levels

Limited service restaurants have long had a strong takeout business, but over the past decade there has been a marked shift in focus for all restaurants – including full-service establishments – to off-premise sales, either through drive-thru, curbside, or delivery operations. Shifts away from dining inside restaurants are significantly expanding the number of disposables needed per order, leading to the development of improved products designed to deliver food safely while retaining its quality and presentation.

Historical Market Trends

At its broadest level, demand for single-use foodservice products is driven by trends in foodservice revenue, which is an indicator of the number of meals eaten away from home and the amount spent on those meals. Growth in foodservice activity in turn is dependent on a number of macroeconomic and demographic factors including:

- Trends in food consumption and the mix of food eaten at home versus away from home

- The health of the overall economy and levels of disposable income, which impact the ability of consumers to spend on more expensive restaurant meals (compared to home cooking)

- Changes in the population mix, especially in terms of age cohorts (such as young adults) that are likely to eat out more often

- Trends in consumer spending, including spending on travel and entertainment, which impact foodservice sales at hotels and sports and recreation venues

- Student enrollment levels and trends in school lunch programs

Beyond these basic macroeconomic indicators, other factors that can impact the foodservice industry and demand for disposable products include:

- the mix of restaurants that are limited versus full-service, as limited service restaurants use a higher level and broader mix of disposables

- the share of total restaurant orders that are provided via drive-thru, curbside pickup, carryout, or delivery services

- the size and diversity of restaurant menus, as specific disposables are often used with specific menu items

- social factors such as health concerns, which not only influence the amount consumers eat out but the type of foods they purchase

- sustainability initiatives, which impact the overall level of disposables used as well as the types of products and materials used

- regulations, especially restrictions on specific materials or types of disposables

Product Focus

Prior to 2020, foodservice revenues experienced healthy growth in market value in the range of around 3-6% per year, reflecting a combination of rising menu prices, a general shift toward out-of-home dining – particularly among younger people at fast casual restaurants and coffee shops – and the increasing incidence of limited service restaurants bolstering their menus by offering more premium and novelty options.

In 2020, overall foodservice revenues fell sharply, with full-service restaurants experiencing the largest declines due to their smaller focus on drive-thru and carryout services. Revenues for QSRs were impacted less, as demand shifted from in-restaurant dining to drive-thru and curbside pick-up and was further supported by the increased popularity and support of mobile ordering apps.

In response to the pandemic, restaurants in many parts of the country closed their dining rooms and offered takeout and delivery options only. This particularly impacted full-service restaurants, for which takeout or delivery had been a small portion of their business.

To date, restaurant revenues have mostly returned to pre-pandemic levels, although a significant part of recent revenue gains has been due to heightened inflation during 2021 and 2022 and not real volume recovery. The channels through which these revenues come has shifted somewhat, with both limited- and full service restaurants owing a larger portion of their revenue to delivery and takeout orders compared to historical levels.

Study Description

This study examines the US market for foodservice disposable packaging, defined as packaging used by foodservice locations to serve and package food, and meant to be disposed of. Serviceware – such as dinnerware, cutlery, straws, and napkins – is also covered. Historical data are provided for 2012, 2017, and 2022, with forecasts through 2027. Annual data is provided for 2018-2026. Also provided is an analysis of key industry players.

Single-Use Products Overview

Single-use disposable foodservice products is forecast to rise 3.8% per year to $33.2 billion in 2027, with the fastest growth expected for products where sustainability is driving demand toward higher-value formats or where high levels of carryout and delivery activity are changing the product mix.

Factors driving overall advances include:

- a return to growth in the number of meals prepared or eaten away from home, after a brief disruption in 2020

- an expansion of takeout, curbside pickup, and delivery (which require greater use of disposables) facilitated by third-party websites and apps, particularly in restaurants that traditionally only offered dine-in options

- changing eating habits, including snacking throughout the day and eating on-the-go, which benefit foodservice sales made not only at restaurants but also at retail establishments, especially convenience stores and grocery stores

- foodservice markets converting to higher value products with either better performance or an improved environmental profile