Report Overview

Featuring 94 tables and 43 figures – now available in Excel and Powerpoint! Learn More

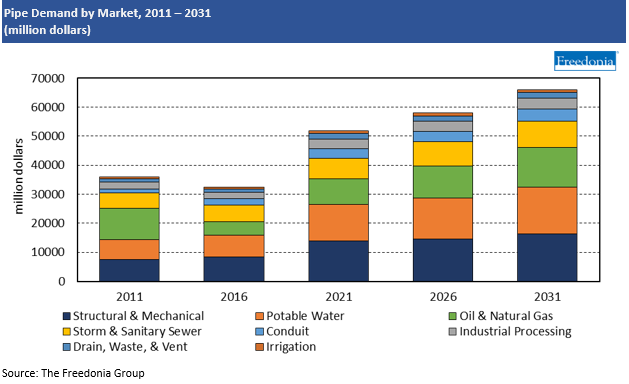

Through 2026, demand for pipe products in the US is forecast to increase 2.2% per year to $57.9 billion, equivalent to 12.9 billion linear feet. Growth in value terms is projected to decelerate significantly due mostly to the expectation that average prices of plastic and metal pipe will moderate going forward. However, volume gains will be driven by:

- a rebound in oil and gas drilling activity

- increasing water and sewer construction

- healthy growth in transportation equipment manufacturing

- rising production of air conditioners and refrigerators, particularly larger and higher end models that require more tubing

Major Spike in PVC, Steel, & Copper Prices in 2021 Leads to Record Year in Value Terms

In 2021, average prices of PVC, steel, and copper pipe spiked 38%, 48%, and 49%, respectively. The significant increase in prices was due to a number of factors including:

- major increases in raw material prices, as inflation reaches the highest levels in the US in over 40 years

- significant supply chain issues and shortages

These price increases led to a massive spike in value demand in 2021 that was boosted by a return to growth in pipe usage. In linear feet terms, demand accelerated from a nearly flat 2020, as the oil and gas drilling, industrial processing, and structural and mechanical markets rebounded due to rising gas prices and increasing durable goods production.

Oil & Gas Market Rebound to Support Growth

The oil and gas market is expected to be the fastest growing pipe market, supported by a significant rebound in the number of wells drilled in the US as oil and natural gas prices increase from very low levels in 2020 and early 2021. Oil and gas drilling activity has increased significantly in 2022, as international production has not been able to keep up with demand and sanctions against Russia have limited the supply of available oil, causing prices to increase at a rapid pace.

HDPE & PEX Continue to Gain Market Share

Demand for HDPE and PEX pipe is expected to grow rapidly due to a number of performance advantages enabled by the flexibility of these materials. HDPE will find the greatest sales opportunities in the storm and sanitary sewer market, while PEX will continue to gain share in potable water distribution:

Pricing Patterns

Pipe prices are affected primarily by raw material costs, but are also a function of pipe diameter and thickness. As a result, the price per foot can be markedly different from the price per pound for a given pipe material depending on the diameter of pipe used:

The size of the US pipe industry skyrocketed in value terms in 2021, primarily due to spikes in the costs of many raw materials integral to production. Some of the largest of these price increases were seen in PVC, steel, and copper pipe. In 2021, average prices of PVC, steel, and copper pipe increased 38%, 48%, and 49%, respectively:

Through 2026, the average price for pipe measured in dollars per linear foot is forecast to decrease slightly, as pricing for metal pipe and some types of plastic pipe are expected to return closer to their historical averages following a major spike in 2021.

Metal pipe price growth will also be checked by the efforts of domestic manufacturers to absorb price increases to maintain market share in the face of strong competition from less costly plastic pipe. In addition, virgin copper and ductile iron price hikes will continue to be tempered by competition from scrap.

- HDPE’s flexibility makes it well suited for trenchless installation methods such as slip lining and horizontal directional drilling.

- PEX’s flexibility also facilitates installation in the water distribution market, as it can be bent around obstacles and cut easily.

- The four pipe materials with the lowest per pound cost – concrete, clay, ductile iron, and steel – have the highest per foot costs, simply because they tend to be produced in larger diameters.

- Conversely, copper and other nonferrous pipe is mostly used in small diameters, so it has higher per pound costs but lower per foot costs.

- PVC price increases were fueled by a residential construction spending boom, as PVC is used in a wide variety of home construction products. Winter storms hitting a major PVC resin supplier in February 2021 further exacerbated shortages and pushed prices upward.

- Spiking copper pipe prices were caused by a general increase in demand for copper, as well as other factors such as tariffs and the lingering impact of mining closures related to the pandemic.

- The spike in steel prices were caused by the lingering effects of the tariffs imposed on steel during the Trump administration, as well as pent-up demand in the manufacturing sector following the COVID-19 lockdowns.