Report Overview

The market for single-use and reusable bags has seen a lot of shifts over the past few years. Need a study that accurately assesses bag usage?

-

Gain insights into the popularity of single-use plastic bags and if reusable bags or bags made from other materials are gaining market share.

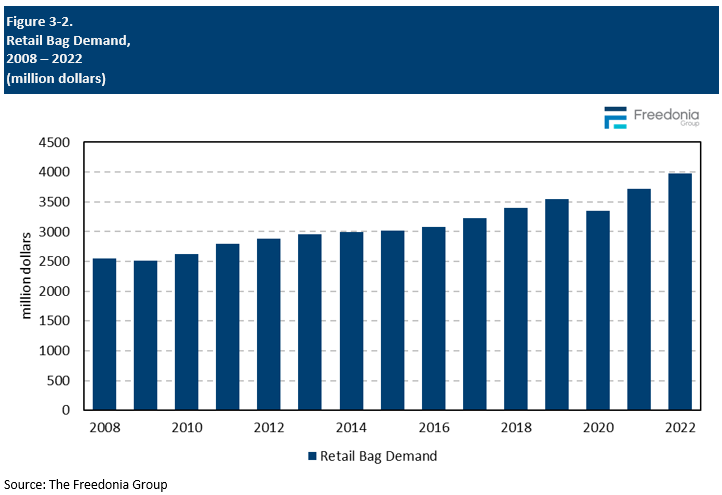

This Freedonia industry study analyzes the $4.5 billion US retail bag industry. It presents historical demand data (2012, 2017, and 2019 through 2022) and

forecasts (2023 through 2027 and 2032) by type (single-use and reusable), material (plastic, paper, and natural fabric) and market (grocery stores, foodservice, and other retail stores). The study also evaluates company market share and competitive analysis on key industry competitors including Novolex, Inteplast Group, Advance Polybag, International Paper, and Sigma Plastics Group.

Featuring 100 tables and 53 figures – available in Excel and Powerpoint! Learn More

Read the blog on Evolving Bag Policies

Demand for retail bags in the US is forecast to grow 2.5% per year to $4.5 billion in 2027, with regulations targeted at single-use products and growing environmental concerns among consumers leading to significant changes in industry composition and outlook:

-

Growth in market value will come almost entirely from a shift in the product mix toward higher-priced bags that meet regulatory requirements.

-

The number of bags used will stagnate, with strong growth in the foodservice market offsetting unit losses in grocery and other retail stores.

-

Strong growth in paper and heavier-gauge reusable plastic bags will somewhat offset losses in the single-use HDPE t-shirt bag segment.

New Retail Bag Regulations May be Slowing

In the past decade, 12 states and hundreds of municipalities in the US have passed retail bag regulations. These typically ban the distribution of single-use plastic bags, and they can also include fees for paper bags. Such regulations have impacted the retail bag market tremendously; consumers and producers alike face increasing uncertainty about the future of bag bans in the US, as well as which bags will be allowed in the future.

Many large markets (e.g., California, New York, Baltimore) have already enacted bans, while a steady contingent have passed bag ban preemption laws. This leaves a dwindling number of jurisdictions where new bag bans can be passed to further shakeup the retail bag market. However, there is potential for regulations to be revised or enhanced following controversy surrounding the efficacy of thickness-based bans; 2.25 mil bags, in particular, face growing scrutiny as a legitimate solution to curbing plastic waste.

Foodservice Trends will Act as a Boon to Retail Bag Use

Historically, the foodservice market has been a relatively minor component of bag demand compared to grocery and other retail stores. However, a strong increase in the popularity of takeout and delivery orders will continue to drive the use of retail bags at many foodservice establishments.

These trends are particularly evident in full-service and fast casual restaurants, which increasingly see takeout and delivery as an important revenue stream. Such establishments often use larger, higher-value bags compared to fast food restaurants, thereby supporting demand growth in both units and value.

Strong Demand for Paper Continues, Along with Growing Interest in High Gauge Plastic

Bans on thin, single-use plastic bags have caused a significant increase in demand for paper retail bags, especially where regulations have not included paper bag fees. Paper is now preferred in foodservice applications, as well as in key retail segments like apparel stores.

Additionally, many bans only pertain to single-use plastic bags that are thinner than 2.25 mil. This fact has generated significant demand for thicker bags in recent years, but it has also stirred controversy regarding the efficacy of bans from environmental and consumer behavior perspectives.

Historical Trends

Demand for retail bags depends primarily on trends in retail sales, particularly at establishments that sell smaller items. The outlook for retail sales, in turn, can be influenced by a variety of factors, both internal and external, that affect consumer behavior, economic conditions, and overall market dynamics, including:

-

the overall state of the economy, including factors like GDP growth, employment rates, inflation, and consumer confidence (during periods of economic expansion and low unemployment, consumers tend to have more disposable income and are more likely to spend on retail goods).

-

demographic factors such as population growth, age distribution, and changes in household composition can influence consumer preferences and spending patterns

-

consumer sentiment and confidence in the economy (high levels of confidence typically lead to increased consumer spending, while low confidence may result in reduced discretionary spending).

-

household income levels, which directly affect consumers' purchasing power (higher disposable income often leads to increased spending on retail products).

-

unemployment rates, which indicate the strength of the job market and impact consumer spending

Outside of overall retail sales levels, other key factors impacting retail bag demand include:

-

the share of retail sales held by e-commerce retailers, as merchandise purchased online does not require a retail bag

-

the share of retail sales held by club stores or discount stores that do not provide bags for customers or use alternatives for carrying merchandise such as boxes

-

regulations and changes in government policies, including bans, taxes, or other restrictions on the use of single-use bags

- consumer use of reusable bags, which limit unit demand for retail bags

Production Trends

Production of retail bags in the US is expected to increase 3.0% per year to $3.6 billion in 2027.

Most of the growth in production will come from paper bags, which have seen increased demand across all markets due to their perceived sustainability and the impact of plastic ban bans. As paper bag manufacturers seek to increase production capacity, more plastic bag manufacturers will continue to transition from low gauge HDPE bags to high gauge LDPE bags that better comply with single-use bag bans and restrictions.

The changing regulatory environment is having a significant impact on US producers:

-

To replace conventional, thin, HDPE t-shirt bags that have come under increasing regulatory scrutiny, polyethylene producers are quickly shifting production to bags that are 2.25 mil or thicker.

-

Paper producers have been operating near capacity, as they are less able to quickly ramp up production to meet new demand due to long lead times for equipment.

Regulatory uncertainty is making it difficult for both plastic and paper bag producers to plan future capacity needs. Regulations continue to evolve, varying by state and locality. Most producers feel they can accomplish what is needed but are looking for national standards to be put in place so they have a clearer understanding of future market movement before making any large investments.

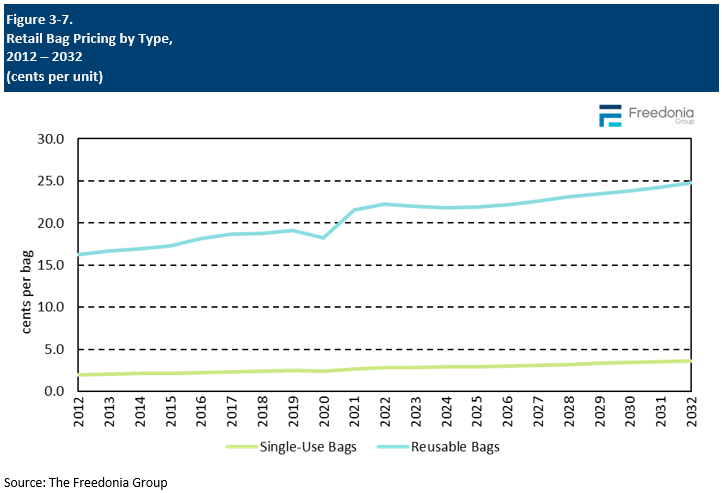

Pricing Patterns

The retail bag industry is competitive, and product pricing is a significant factor in customer purchasing decisions, especially among large foodservice chains and grocery stores which may use thousands of bags per day. Factors influencing average prices for retail bags include:

-

raw material and labor costs

-

shipping and transportation costs

-

supply and demand balances

-

customization, design, and printing costs

-

preference in bag size and the use of value added features such as coatings and handles

-

the prevalence of bag fees and taxes

Raw material price fluctuations tend to have the greatest effect on pricing although product mix can also be important:

-

The price of plastic bags is largely determined by the price of polyethylene resin, which, in turn, is affected by crude oil and natural gas prices.

- Paper bags are linked to the price of unbleached and bleached kraft paper.

Retail Sales Trends

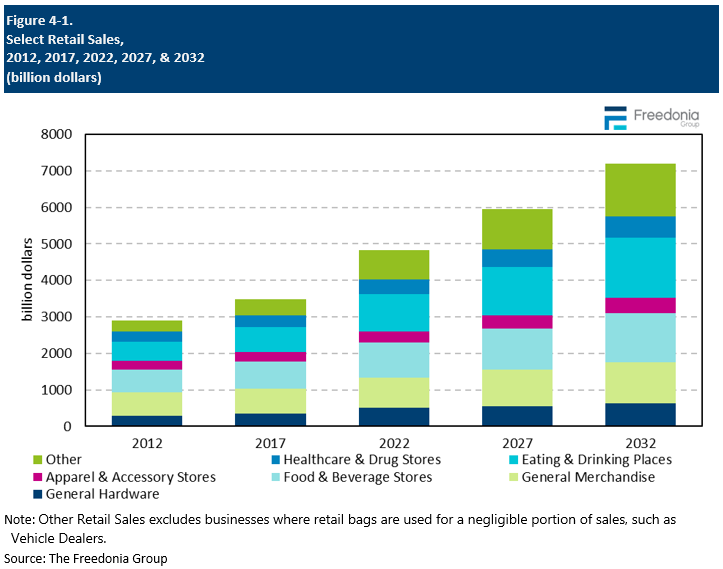

Demand for retail bags is driven both by the level of retail sales and growth trends in the different types of retail establishments.

Through 2027, retail sales are projected to increase at a more measured pace of 3.2% as inflation returns to historically normal levels. The strong growth of e-commerce relative to traditional retail stores will continue to be a major trend impacting retail bag demand, with the largest impact being felt in non-grocery retail stores.

Sales of nondurable goods, the primary uses of retail bags, will decelerate. Key trends will vary across the main markets.

-

Grocery stores, the largest market for retail bags, are expected to return to historically normal annual sales growth patterns following the strong pandemic-induced demand spike. Additionally, the growth of discount food stores and club stores will hinder retail bag demand as these establishments are less likely to offer free bags at checkout.

-

The quickest advances will be seen in eating and drinking places, as the demand for dining away from home continues to grow.

Other retail stores will provide a mixed bag of trends, with sales varying across the different segments.

-

Retail sales at healthcare and drug stores, a major market for single-use bags, will grow in correlation with the pharmaceutical industry’s outlook combined with an aging population.

-

Apparel and accessory stores will return to more moderate growth rates following volatility 2020 and 2021.

-

Some niche retail stores such as beauty stores will post strong growth.

- General hardware stores will post the weakest growth among the major retail sectors amid competition from large home improvement chains and online retailers.