Amazon vs. the Pet Products Competition

by Sarah Schmidt

September 11, 2017

Amazon in the Pet Products industry

E-commerce giant Amazon is shaping consumer pet products purchasing trends that are shifting purchasing channels (online, in-store, and multi-channel) and preferences according to major retailers and retailer channels. In its new report, U.S. Pet Market Focus: The Amazon Pet Food and Supplies Shopper, Packaged Facts examines Amazon cross-usage among major pet players, its growing on purchasing preferences, and pet spending allocation by purchase channel.

Online pet product sales are at a tipping point: Packaged Facts estimates online pet product sales accounting for approximately of the total U.S. pet products market. Among the fastest-growing online retail categories, pet products experienced significant growth over two years in the percentage of adults purchasing online pet products in the past three months. And Amazon is leading the way: Amazon pet product sales reached $2 billion in 2016, up 40% from 2015.

Gauging the Amazon Threat

In terms of breadth of reach, supermarkets continue to claim the largest number of pet shoppers. Pet owners are still exercising purchase channel choice and, during 2011-17, tended to purchase from more retailers and channels. While the average number of purchase channels has increased, pet owner retailer/channel loyalty remains high. The emotional attachment of pet owners to their pets provides a wealth of opportunity for market participants to establish higher-touch relationships.

Online pet product and supply purchasing is building from a small base, and is not yet a significant primary or exclusive means of pet product shopping. While online pet sales are gaining traction, only a very small segment of pet owners exclusively buy products online, making the gambit of an online-only channel unrealistic. However, the success of Chewy.com and the growing role online pet subscription services play predicates multi-channel shopping within the online category.

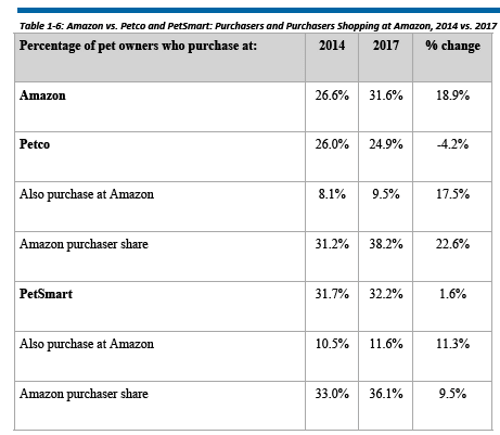

Amazon’s purchase usage penetration among pet owners has grown 19% to 31.6% in just three years. At the same time, the share of pet owners purchasing from Petco and PetSmart who also shop Amazon has grown. This does not mean Petco and PetSmart shoppers purchase pet products from Amazon, but it does put this population at risk, vulnerable to the powerful Amazon Prime loyalty proposition that, while wildly successful, has lacked actual face time with customers that remains important in building consumer relationships.

Pet marketers looking to identify likely Amazon pet shoppers should look to age -- like other online pet shoppers, the Amazon purchaser is more likely to:

- Be aged 25-34, indexing at 127, suggesting overlap with online pet products purchasers, who index at 146

- Have $150K+ in HH income and reside in heavily urban counties

Amazon's Approach to Pet Products

True to its ethos, Amazon offers countless pet products and supplies, including more than 384,000 dog products, some two-thirds of which are offered through Amazon Prime. Some 7.4% (~29,000) of Amazon’s dog products qualify for one-day shipping, while another 1.3% (~5,000) of them qualify for subscribe & save. Amazon is framing its pet products to maximize interest and usage of its Prime membership services.

Packaged Facts’ results suggest that Amazon’s subscription programs are helping the company pivot more deeply into consumer packaged goods and, by helping it capture repeat purchases, creating a stickier customer who may be more apt to shop Amazon for other needs.

Amazon also has key pet product trends covered. As of July 2017, Amazon offers more than 10,500 “all-natural” pet products for dogs alone, by keyword search. Products range from dry and wet dog food to health supplies and herbal supplements. Regarding Amazon’s 10,200+ dog food products, more than 1,750 are categorized as grain-free. There are even 61 results for “ancestral.”

Amazon Fresh, the company’s online food/grocery platform, offers 1,250 purchase choices in the dog category alone. Because Amazon Fresh requires an Amazon Prime membership, the product serves a cross-marketing gambit as well. This cross-selling is intended to help Amazon build interest among pet supply shoppers in Amazon Fresh groceries. In the bargain, Amazon satisfies two needs together that were once distinct – and two needs that competitors such as Petco, PetSmart, and other pet-centric retailers cannot replicate.

Visit Amazon Strategies and the Amazon Shopper for more coverage of Amazon consumer usage and engagement trends and related consumer usage and engagement strategies,

Discover more information about the market for pet products in our collection of pet products & services research reports.

Have unique research needs?

Freedonia Custom Research listens intently to your needs and objectives. Then we work diligently to define and deliver a service to meet them.Subscribe to Our Blog

Stay up to date with the latest information about new market research and news in areas relevant to your business from our analysts and team members.Packaged Facts Blog Subscription

Provide the following details to subscribe.